1. Subject to these terms and conditions, if you register for our Transfers Cashback Offer (Nov 23 – Feb 24) and

apply to transfer an existing pension, ISA or general investment account from another platform between 16

November

2023 and 29 February 2024 inclusive (the “Offer Period”), you will receive a cash amount after the transfer is

complete, depending on the amount you transfer (the “Offer”). The Offer is funded by us, and the cashback will

not

come from your own cash or investments.

2. You must register for the Offer to qualify. You can do this by completing the online cashback registration

form,

the postal cashback registration form or by asking us via secure message (using your online account) or by

telephone

to register you manually. If you do not register for the offer, no cashback will be paid.

3. If you register for the Offer and we receive your qualifying transfer application(s) within the Offer Period,

even

if the transfer itself isn’t completed until after the Offer closes, you will still qualify.

4. The cashback payment will be paid into your Loyalty Bonus Account which is separate from your other HL

Account(s).

You will receive the cashback payment within 8 weeks from the date that your last qualifying transfer completes.

The

payment date will be determined by us. The cash can be kept in your Loyalty Bonus Account for fee collection,

withdrawn or moved into another of your HL accounts. If moved into an ISA or SIPP, it will count towards your

annual

allowance.

5. We ask you keep your HL account(s) for at least one year from the date that the last qualifying transfer

completes. Please feel free to switch between investments and in or out of cash within your account, but if you

decide to transfer any portion of your receiving account away or close your account within 12 months of the date

your last qualifying transfer completes, then we reserve the right to reclaim the cashback paid. If cash is to

be

reclaimed, then you will be notified, and the cash will be taken within 7 days of the account closure or

transfer

out.

6. It isn’t possible to combine the value of transfers into accounts with different client numbers for the

purpose of

this Offer. The maximum amount of cashback you can receive under this Offer across all pensions, ISA or general

investment account transfers is £4,500.

7. If you register for the Offer and apply to transfer existing pensions within the Offer Period with a total

value of at least £10,000 from other providers to our platform into your HL Self-Invested Personal Pension or

Drawdown Pension, you will receive a cash amount between £100 and £3,500.

8. The total value of your cashback will be based on the cumulative total value of qualifying pension transfers

made within the Offer Period. The value of the cashback paid will be determined in accordance with the tiers

identified in the table accompanying these terms and conditions.

9. If you need more time to decide whether you want to transfer to us, please complete the online extension form and we will extend the pension deadline for you by six

months. Alternatively, call our Helpdesk on 0117 980 9926 or send a secure message through your online account.

10. The following are excluded from the Offer: (1) the transfer of a Junior SIPP, Junior ISA, Child Trust Fund,

Lifetime ISA or defined benefit/final salary pension; (2) new money cash subscriptions into any existing HL

Account;

(3) the lodgement of certificated shares; (4) movements of investments or cash already held on the HL platform,

including switches or transfers between or within existing HL accounts or income and interest received on any

assets

held in those accounts; (5) transfers to the HL Cash ISA.

11. We reserve the right to remove or suspend the Offer if necessary, including for legal or regulatory reasons

or

otherwise, by posting a notice on our website. If the Offer closes early, all qualifying applications already

received at the time of the posting of the notice will still be accepted.

12. We also reserve the right to determine how the cashback payment is calculated. Therefore, if you are not sure

how

your transfers will be treated under the terms of this Offer, please contact us before you apply to transfer. By

registering for the Offer and submitting a qualifying application within the Offer Period, you agree to be bound

by

the terms of this Offer.

13. These terms are governed by the laws of England and Wales and subject to the exclusive jurisdiction of the

courts

of England and Wales.

14. This Offer is provided by Hargreaves Lansdown Asset Management Limited, which is a limited company registered

in

England & Wales with the company number 01896481, whose registered office is 1 College Square South, Anchor

Road,

Bristol, BS1 5HL. References in these terms and conditions to “our”, “us” or “we” are to Hargreaves Lansdown

Asset

Management Limited.

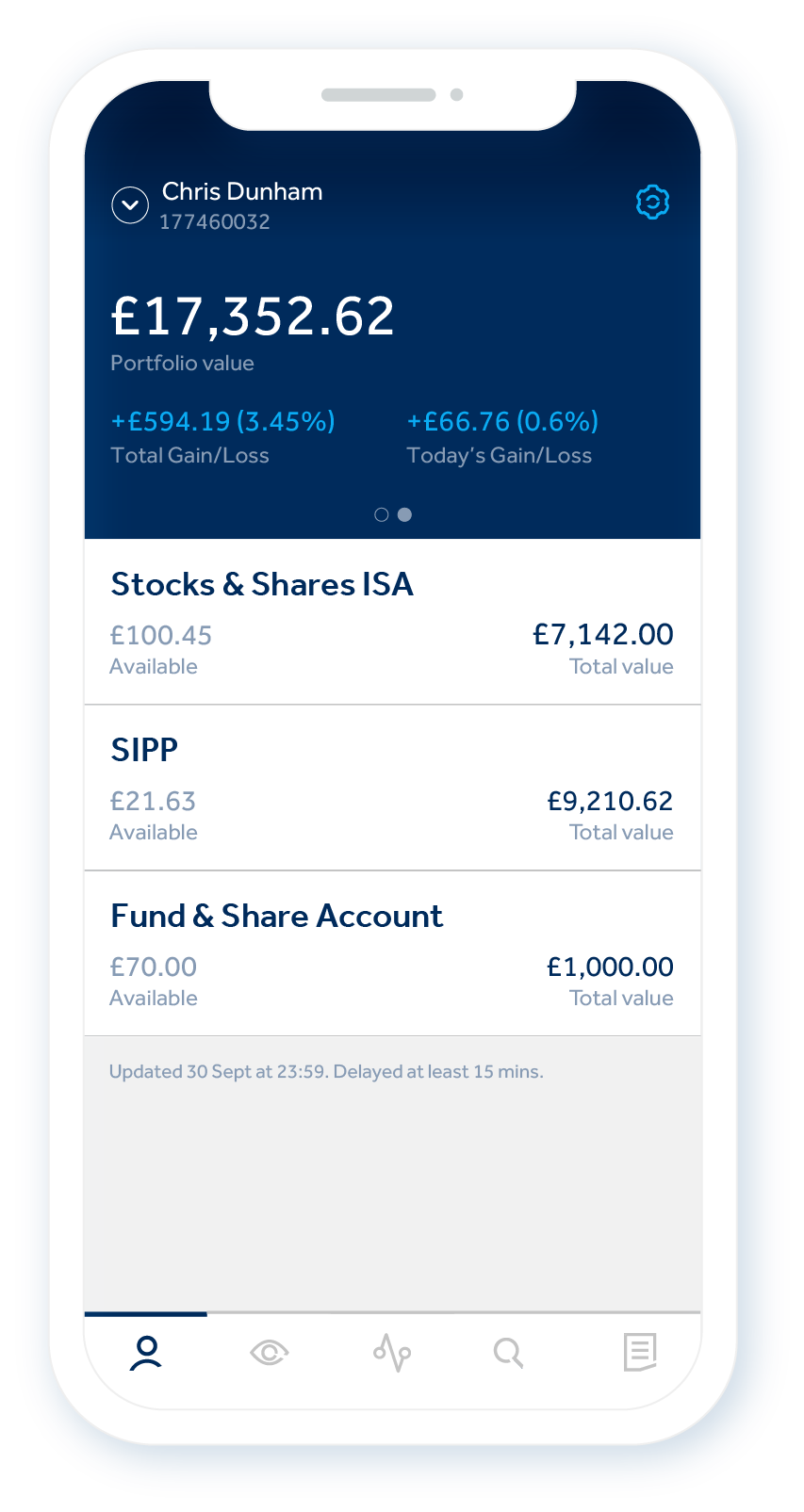

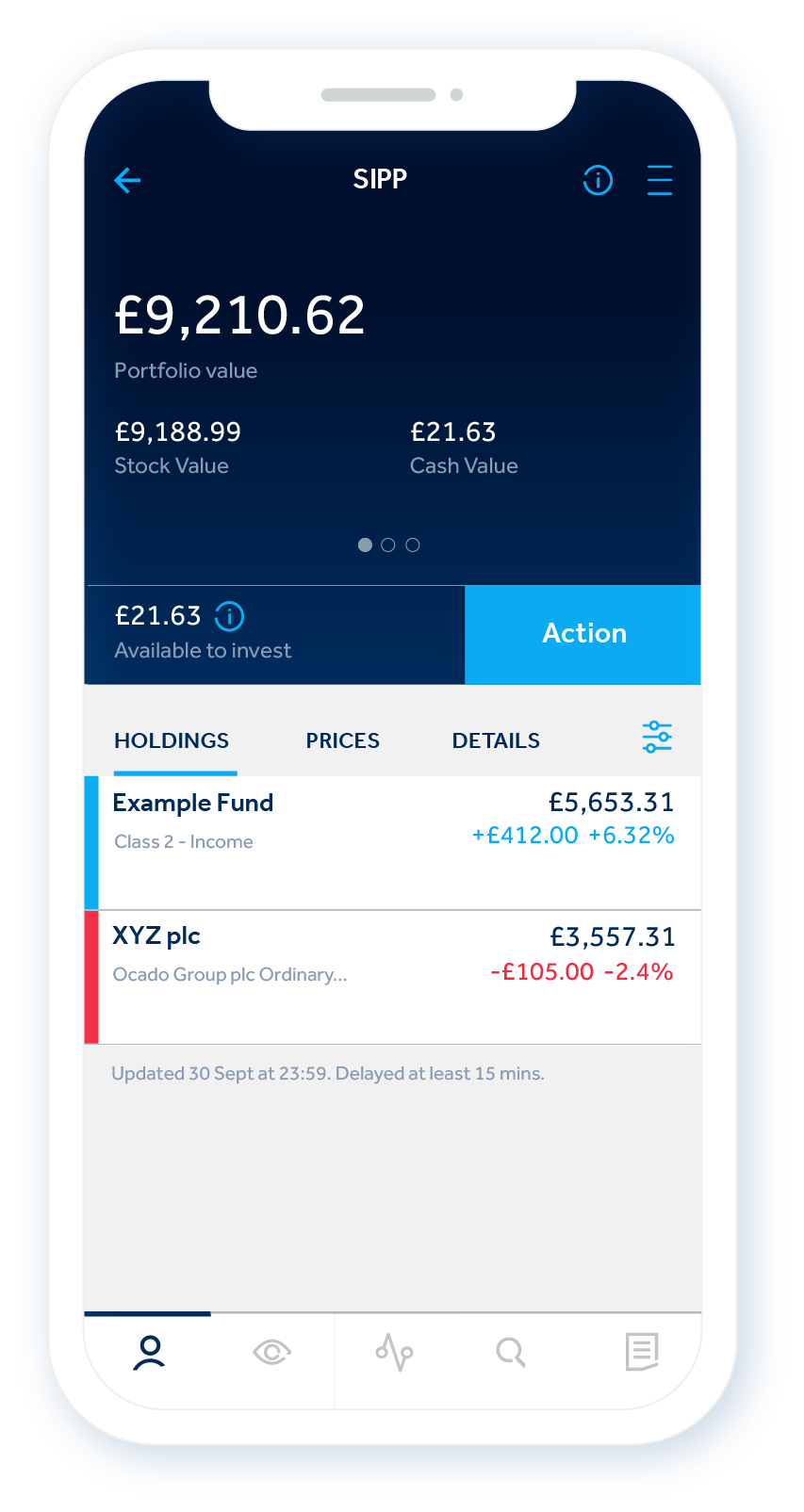

Switch your pension on

Helping people save and invest for over 40 years

Trusted by 1.9 million clients

We’re a financially secure company, authorised by the Financial Conduct Authority. And have won over 200 awards.

Expert knowledge and guidance

Get the latest investment news, research and insight. Plus tools to help you make decisions with confidence.

Ongoing support

Help from our UK-based client support team. Or personal financial advice from our highly qualified experts.