The UK's #1 Investment and Savings Platform

Helping people save and invest for 45 years

Below are extracts from the Boring Money Market Monitor Q3 2025 report. These support the claim of Hargreaves Lansdown being the UK’s #1 investment and savings platform, when compared against platforms offering savings and investments to private clients.

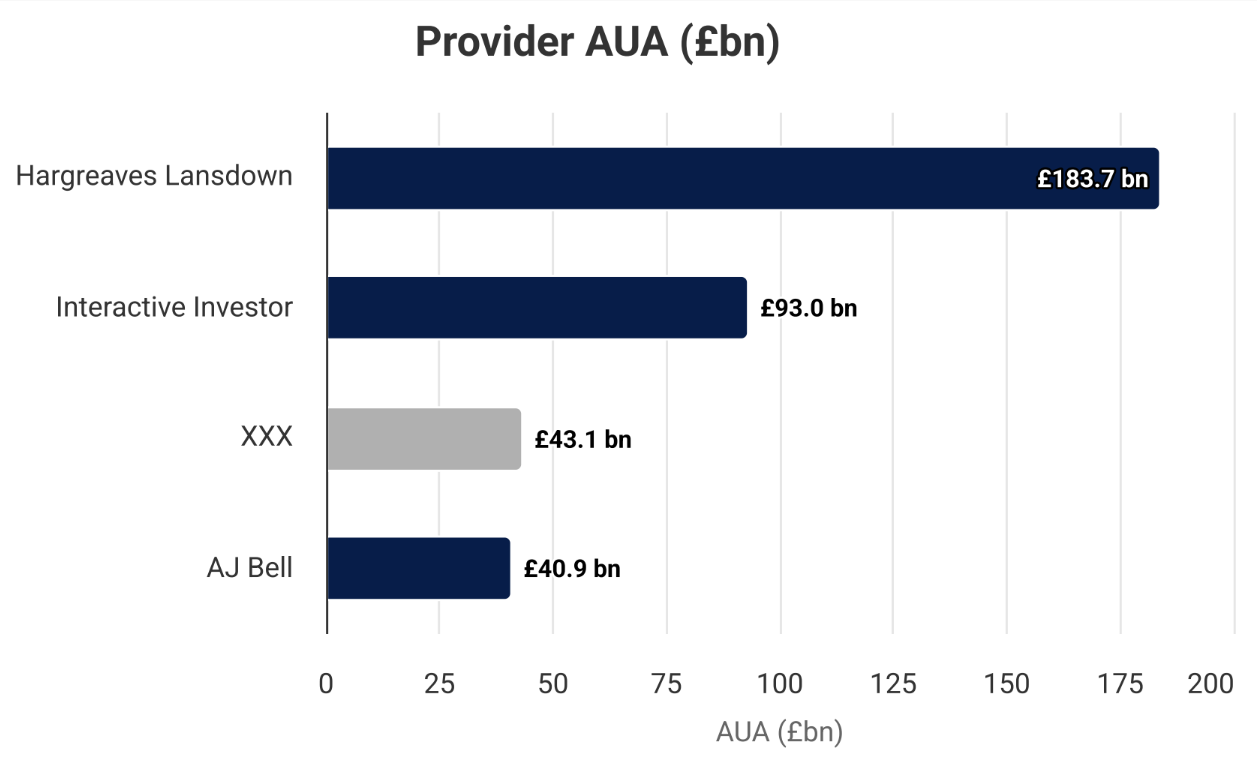

The Boring Money report shows Hargreaves Lansdown as the UK’s #1 Direct to Client Platform for total assets under administration (AUA) as at quarter 3 2025.

Hargreaves Lansdown has also recently been awarded Best App, Best Buy ISA, Best Buy JISA, Best Buy LISA, Best Buy Pension, Best for Customer Service, Best for Investment Research and Best for Investment Trusts. We were also highly commended in The Paul Bradshaw Innovation award (Boring Money Best Buys 2026).

Looking after the most amount of money

Value of assets under administration and market share as at Q3 2025*

Source: Boring Money Market Monitor Q3 2025

*Certain brand names omitted which do not publicly disclose AUA. Full report can be purchased at Market Monitor | Boring Money Business.

D2C market share by provider

| Provider | D2C market share by AUA |

|---|---|

| Hargreaves Lansdown | 33.6% |

| Interactive Investor | 17.0% |

| XXXXX | 7.9% |

| AJ Bell | 7.5% |

Source: Data supplied and aggregated by 20+ D2C investment platforms, and 5+ years of consumer research and market sizing conducted by Boring Money