Identity Fraud

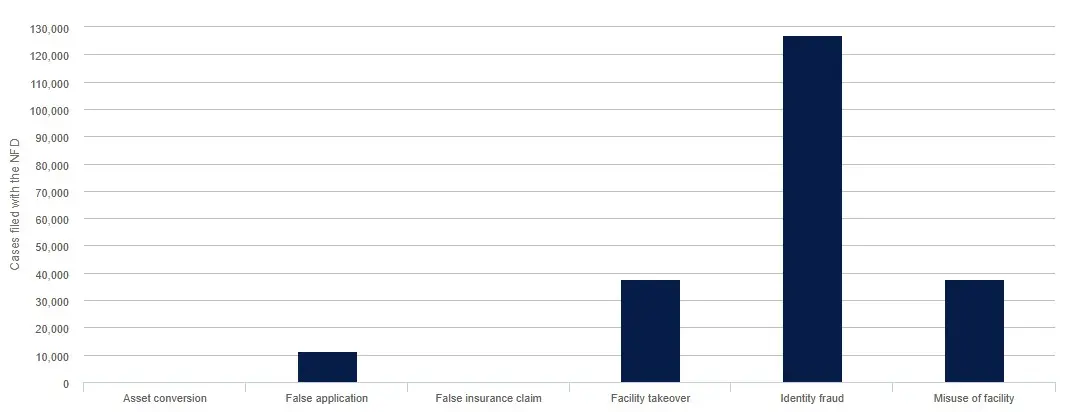

As of April 2023, identity fraud is almost 70% of fraud cases filed in the National Fraud Database.

Your personal information is valuable. With it, a scammer can take out lines of credit, access your accounts and open new ones all in your name.

In lots of cases, all fraudsters need is your full name, date of birth and address. They can get this information in a variety of ways, like taking documents from your rubbish or contacting you pretending to be a legitimate organisation and asking for your details.

Remember, keep your identity and personal information safe and secure.

Security concerns

Have a question or wish to report fraudulent activity? Please call us on:

0117 900 9000

Mon - Fri: 08:00 - 17:00

Sat: 09:30 - 12:30

or you can email us at any time.

Cases filed to the National Fraud Database (NFD) between January and June 2024

How can you spot identity theft?

There’s a lot of signs that mean you could be a victim of identity theft.

Here’s a few to watch out for:

Important documents recently going missing (like a passport, driving licence, National Insurance card)

Mail you’re expecting from a bank or official body hasn’t arrived

Any unfamiliar transactions on your bank accounts

Receiving bills or statements from accounts you haven’t opened

Solicitors or debt collectors contact you about loans you haven’t applied for

How to protect yourself from identity theft

Store your important documents safely

Shred or destroy old documents containing any personal information

Monitor your accounts and credit reports for any unfamiliar activity

When you move house, let all the relevant companies/providers/platforms that hold your information know

What should you do if you have been a victim of identity theft?

If you think your details are at risk or already exposed, there are steps you can take.

You can regularly get copies of your personal credit file from a credit reference agency. If there are checks from financial organisations that you don’t recognise, applications might have been made using your details. The agencies might also offer a protective registration service to alert you when your details are used to apply for financial products – there will likely be a fee for this.

Keep an eye on your post – a lot of organisations send out welcome letters which should alert you if anything unexpected is happening. If you think your post is being intercepted, contact Royal Mail. If you are an existing Hargreaves Lansdown client and experience problems with your post from us, please let us know.

If your personal details have been used for fraudulent purposes (for example to open an account in your name), report it to Action Fraud if you’re in England, Wales or Northern Ireland. If you’re in Scotland, report it to the police. You should also contact the company who received the application directly and inform them of the situation.

Specific threats

Hargreaves Lansdown never cold call investors offering investment opportunities.

Investment scams often involve high-pressure selling tactics in order to get investors to purchase investments that are either worthless or non-existent. The initial contact usually starts with a telephone call that comes from out of the blue, and fraudsters will often purport to be calling from well-established, regulated firms in order to appear legitimate. The FCA refer to these as ‘clone’ firms.

Hargreaves Lansdown will never:

Call you out of the blue to promote an investment or offer you money in exchange for your shares.

Ask you to send application forms by email. You can apply online via our website or by telephone by calling 0117 900 9000, and if you want to send a cheque please send your application by post to our registered address: Hargreaves Lansdown, One College Square South, Anchor Road, Bristol, BS1 5HL.

Discuss detailed information regarding an application or transaction with you by unsecure email.

Ask you to send money via bank transfer to a bank account, an overseas bank account or a currency exchange provider.

If you believe that you have received a cold call from anyone purporting to work for Hargreaves Lansdown, please contact our Investment Helpdesk on 0117 900 9000.

How to protect yourself:

Reject cold calls.

Always do your own research.

Remember, if something sounds too good to be true it most likely is.

If you are in any doubt, put down the phone and call us on 0117 900 9000.

What are clone firm investment scams?

Clone firm investment scams are financial operations which involve fraudsters using literature and websites that mirror the details of authorised firms, like pension providers or investment platforms.

They’ll try to convince you that they work for a genuine company and use high-pressure selling tactics to get you to buy ‘investments'. These ‘investments’ are worthless and often aren’t even offered by the company they’re pretending to be.

5 tips to help spot them

1. A seemingly genuine call to promote an investment – Scammers might call you promoting an investment or offer you money in exchange for your shares. We’d never do this.

2. Asking to send application forms by email – Scammers often ask you to send applications by unsecure email. Where possible, we’ll ask you to complete an application on our website, over the phone or by post. If you need to send an application by email, protect the attachment with a password and let us know what the password is separately.

3. Trying to discuss your personal information by unsecure email – If we need to talk to you about your HL account, we’ll contact you by secure message, which is sent to your online account.

4. Offering to invest in a product the genuine company doesn’t offer – HL will never call you to promote a particular investment or product. Scams on social media and search engines have become more popular with fraudsters recently.

5. Insisting you send money via bank transfer – Scammers often ask for money to be sent electronically to a bank account, overseas bank account or a currency exchange provider. The quickest and safest way to send us money is usually by debit card via our website or by calling us, but if you need to send us a bank transfer, you can contact us securely to verify the correct details before you make a payment.

For lots of fraudsters, this is a full-time job. They have the time and expertise to try and build a relationship with you. These scammers are extremely persistent and their aim is simple – to take your money. Remember, if it seems too good to be true, it probably is.

Protecting yourself from scams

Check the firm contacting you is FCA-authorised

The FCA authorises almost all financial services companies in the UK. If they’re not authorised, it could be a scam. You can check the Financial Services Register to see if a company or individual is authorised or registered. If you’re contacted by a company you’re not familiar with, you should always check the register before you act.

Check the company contacting you is genuine

To make sure you’re being contacted by a genuine company, you should call their switchboard number which you can find on the FCA Register. If they phone you, it’s usually best to end the call, check the register and then call the company back on the number found on the FCA website.

If you can’t find any contact details on the FCA Register or if the firm claims they’re out of date, check by calling the consumer helpline on 0800 111 6768.

If you’re dealing with an overseas company, you should check with the regulator in that country and also check the scam warnings from foreign regulators.

Remember, phone numbers displayed on incoming calls are easily spoofed by fraudsters to make it appear they’re calling from the expected location or company. If you don’t feel comfortable then it’s completely acceptable to stop, think and check before taking any action.

Check the FCA Warning List

Use the FCA Warning List to see if the company is known to be operating without the FCA’s permission.

Even if a firm isn’t on the FCA Warning List, it might still be a scam – scammers will change names and details all the time.

Reject unexpected investment offers whether made online, on social media or over the phone. Be wary even if you made the first contact.

What to do if you think you’ve been scammed

Call your bank straight away – they’ll be able to help you with the next steps.

If you’ve been defrauded or experienced cybercrime you should report it to Action Fraud either online or by calling 0300 123 2040.

If you've started a pension transfer and now suspect a scam, call your pension provider straight away. They might be able to stop it.

You should also report what’s happened to the FCA either online or by calling 0800 111 6768.

If you’ve noticed any suspicious activity on your HL account or think your account might’ve been compromised, then please contact our Online Support team on 0117 980 9984 as soon as possible.

Help with the emotional impact of fraud

If you do fall victim to fraud, this can have a huge emotional impact as well as being financially crippling. Victims can often feel embarrassed and don’t want to tell people what’s happened, even though they’re not to blame.

If you need to talk to someone about how you’re feeling, you can contact Victim Support either online or via their support line on 0808 168 9111. You can also contact Samaritans at any time of the day or night on 116 123.