Fund and Share Account

Invest around the world, your way

Access global markets and trade UK and overseas shares

No annual investment limits

Free to hold shares, ETFs, investment trusts, bonds and more

Before you invest: investing for 5+ years increases your chances of positive returns compared to cash savings. But investments rise and fall in value, so you could get back less than you put in. You’re responsible for your investment decisions.

Before you invest: investing for 5+ years increases your chances of positive returns compared to cash savings. But investments rise and fall in value, so you could get back less than you put in. You’re responsible for your investment decisions.

What is a Fund and Share Account?

A refreshingly simple investment account helping you build your own investment portfolio and invest in what you want, when you want.

Trade UK and Overseas shares

Access global markets and trade in what you want, when you want.

No investment limits

There's no annual limit to what you can invest. You can start big or small.

Free to hold shares

No account charge to hold shares, ETFs, investment trusts, Venture Capital Trusts, gilts and bonds. Dealing charges apply. View account charges.

Why choose the HL Fund and Share Account?

HL offers simplicity, flexibility, and expert guidance to help you invest for your future.

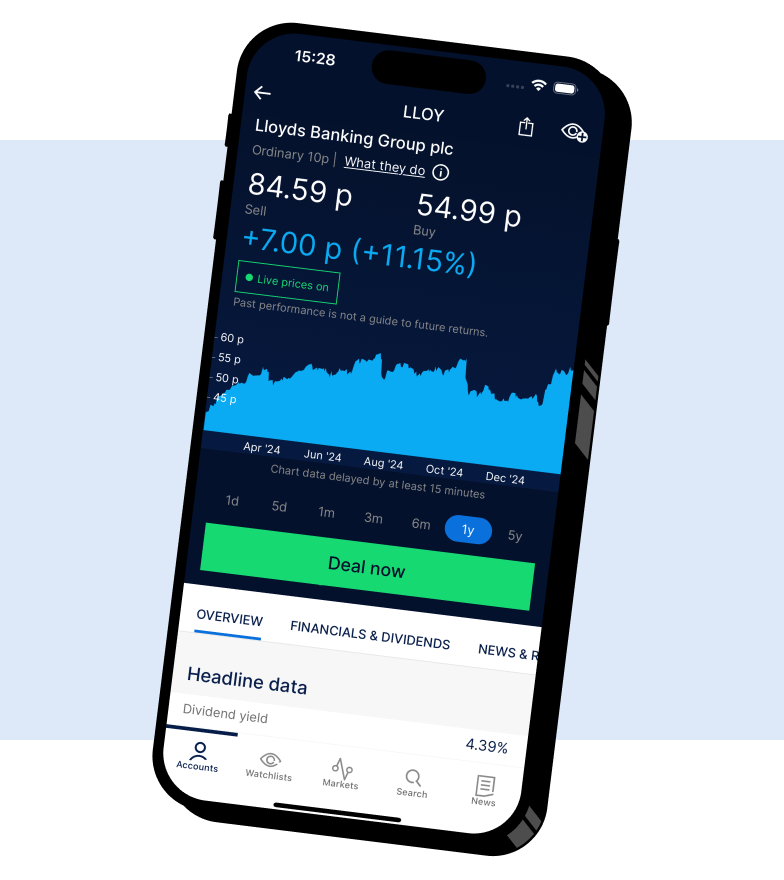

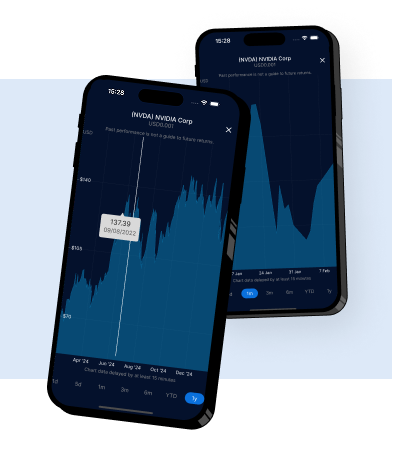

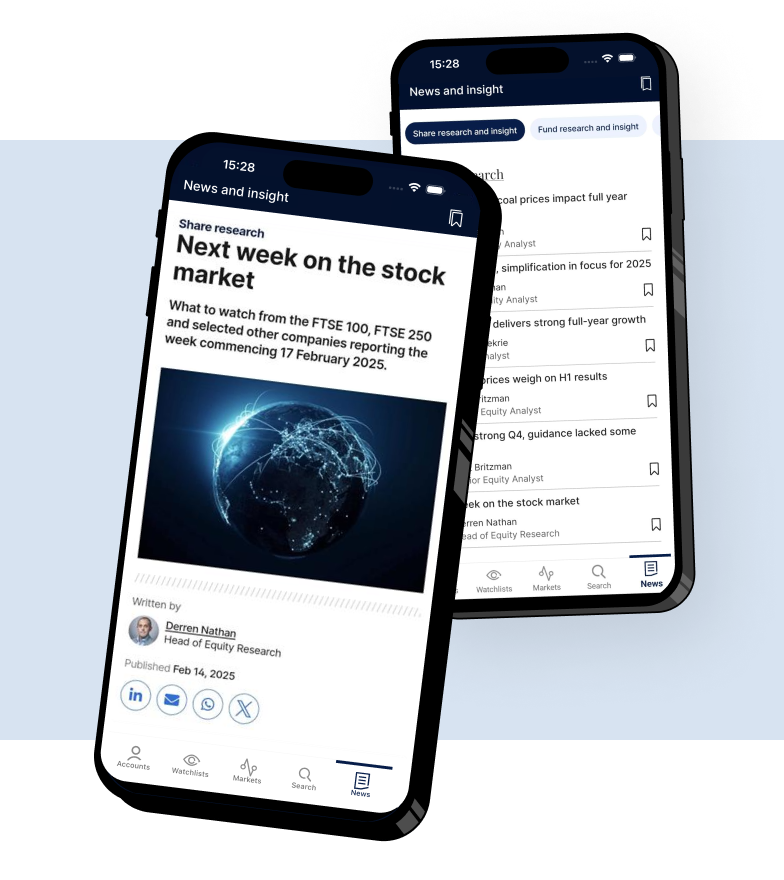

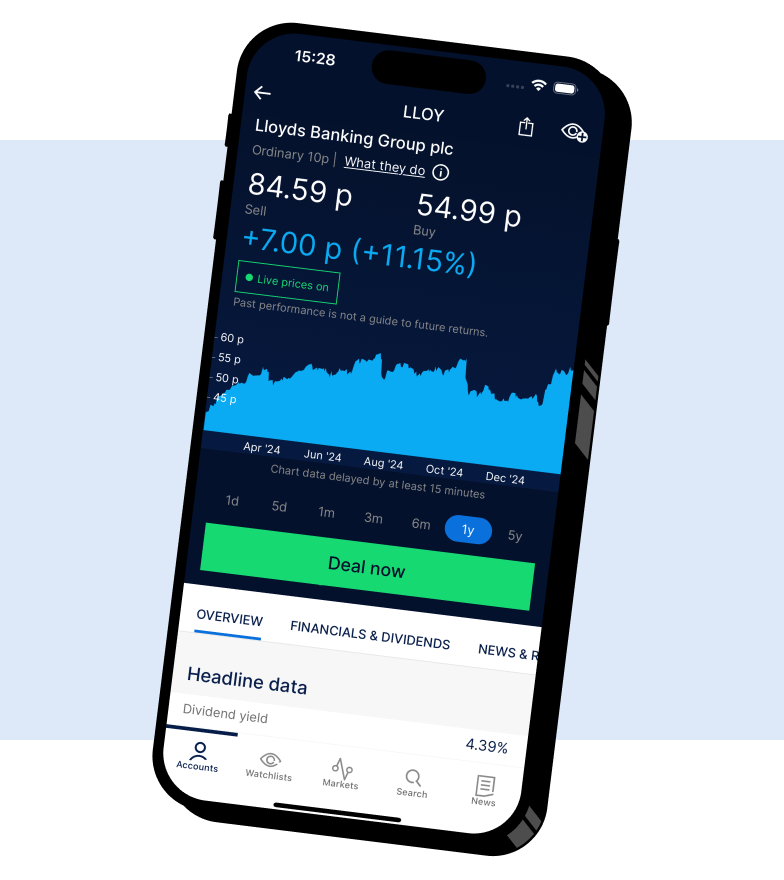

Live share prices, research and insight

Huge investment choice with the UK's largest retail stockbroker

Speak to our UK-based helpdesk if you have any questions

Free to hold shares, ETFs, and more

Get started in minutes

Open a free HL Fund and Share Account today. You can start investing from just £100 as a lump sum or £25 if you invest monthly, with no limits on how much you can invest - so you have the flexibility to start small, with the potential to go as big as you like.

If you don't want to invest new money, you can transfer investments from another provider to HL.

Is the Fund and Share Account right for me?

Consider investing in a Fund and Share Account if:

You have already used or do not want to use your ISA allowances

You're clear on the differences between saving and investing and you have cash savings to cover emergencies

You understand the value of your investments will rise and fall, so you could get back less than you invest

You're happy to invest for the long term - we suggest at least five years

You're comfortable choosing your own investments and you're happy to check in to make sure they're continuing to meet your objectives

This isn't personal advice. If you're not sure what's right for you, ask for financial advice.

Fund and Share Account charges

0.35%

Free to open, with an account charge of no more than 0.35% for holding investments.

The investments you choose may have their own ongoing charges, and dealing charges apply for one-off trades.

Experts in the industry

Insights and tips from our team of analysts and experts.

Service and Security

Enjoy peace of mind. We've been helping clients save and invest securely for over 40 years.

Award-winning service

Over 200 awards, including 'Best for Investment Research' and 'Best for Customer Service' for 2025.

Flexible investing.

Built for you.

Free to all HL clients, live share prices are available on the HL website and HL mobile app.

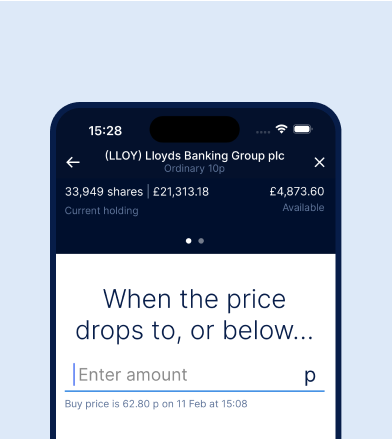

Help protect your portfolio with stop losses and help meet your price target in a volatile market at no extra charge.

Keep track of existing and potential investments all in one place.

Spot trends and opportunities with a range of technical analysis and comparison tools. You can even add your own purchases to track profit and losses.

Market updates three times a day and free weekly emails containing our experts' latest views and opinions on shares and more.

Open an HL Fund and Share Account

Join the UK's #1 investment and savings platform today.

Investing essentials

Learn more about investing and get inspired with our investment ideas.

FAQs

Common questions about a Fund and Share Account.

To open a Fund and Share Account online, you’ll need to be over 18, live in the UK and a UK resident for tax purposes. If you’re not, please contact us so we can check if you’re eligible to open an account.

You should also be:

Comfortable choosing your own investments

Confident making long-term investment decisions

Free from significant debt (other than a mortgage)

Clear on our charges and how you’ll be affected by tax

If you’re not sure which investments are right for you, please ask us about financial advice.

No, you can open a Fund and Share Account without adding any money. When you’re ready to invest, top up from as little as £1 or by setting up a Direct Debit from £25 per month.

Yes, you can transfer the following into a Fund and Share Account:

Funds

UK and overseas shares

Corporate and government bonds

Exchange Traded Funds (ETFs)

Investment trusts

If you're already a client, you may be able to transfer online. Otherwise, it takes five minutes to download and fill in a form.

It's free to transfer to us, but some companies may charge exit fees. It's a good idea to check whether yours does before transferring.

It may be possible to request a partial transfer of your investment account to HL instead of transferring your account in full. However, not all providers can facilitate a partial transfer so we’d recommend checking with your current provider first.

A partial transfer can only be requested over the phone or via a transfer form and cover letter in the post. There are specific regulations regarding this so please call our transfer helpdesk on 0117 906 7816 if you need any help.

We've won over 200 awards for our services