- Managers are more cautious in their outlook for the UK economy

- Exposure to larger companies, which could fare better in a weaker economic environment, has increased

- Companies reliant on government and consumer spending have been avoided

Our view

Majedie’s investment boutique is home to an experienced and stable UK equity fund management team who have worked together for many years. The team is incentivised to perform well as they often invest their own money alongside their investors and have bonuses linked to the fund’s returns.

Chris Reid and Yuri Khodjamirian, managers of the Majedie UK Income Fund, have added considerable value through picking companies that have gone on to perform well, according to our analysis. They continue to benefit from the support of the wider team and we are confident in their ability to add value for investors. The fund remains on the Wealth 150 list of our favourite funds across the major sectors.

As is often the case with an income fund, charges are taken from capital which can increase the yield, but reduce the capacity for capital growth. The fund is also relatively concentrated, which means each investment can have a greater impact on total returns, although this is a higher risk approach.

Performance

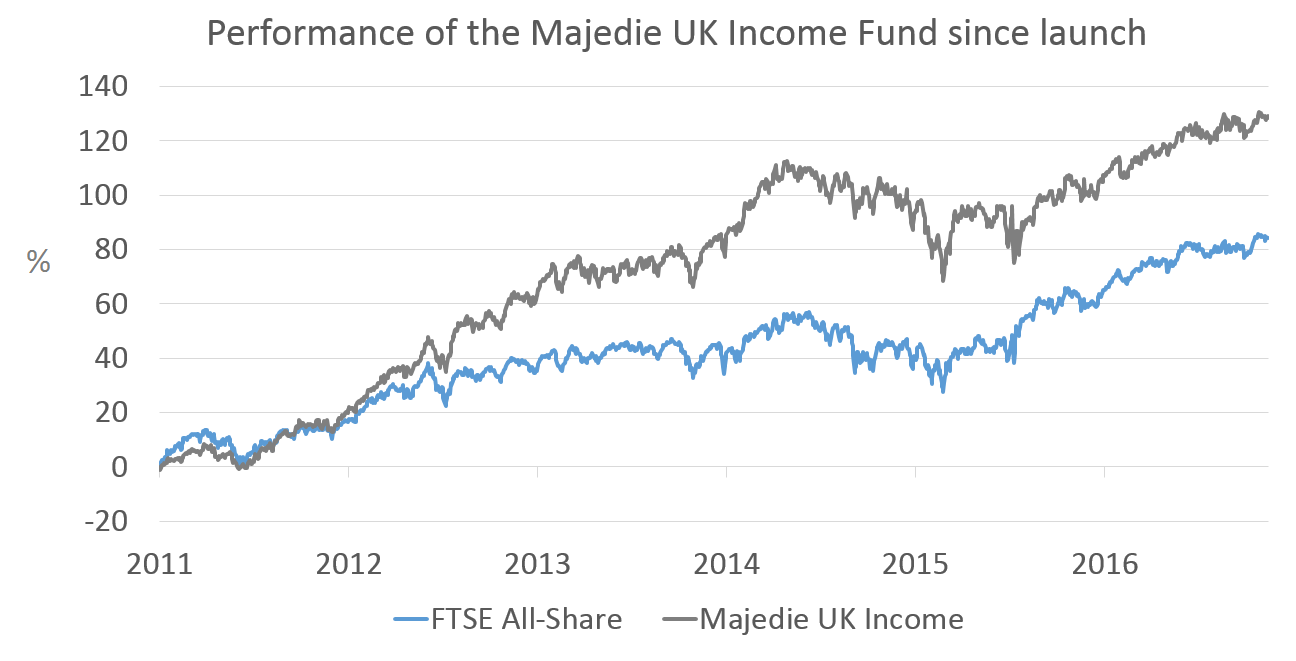

Over the longer term a bias to higher-risk small and medium-sized companies has aided returns, as has the managers’ good stock selection. Despite a year of weaker performance from September 2015, when larger companies outperformed their smaller counterparts, the fund has comfortably outperformed the FTSE All Share Index since launch in September 2012. Investors at inception have enjoyed returns of 129.4%* compared with 84.4% for the index over the same period. Past performance should not be seen as a guide to future returns.

Past performance is not a guide to future returns. Source: Lipper IM* to 31/10/17

| Annual Percentage Growth | |||||

|---|---|---|---|---|---|

| Oct 12 -

Oct 13 |

Oct 13 -

Oct 14 |

Oct 14 -

Oct 15 |

Oct 15 -

Oct 16 |

Oct 16 -

Oct 17 | |

| Majedie UK Income Fund | 41.07 | 9.55 | 12.23 | 1.20 | 12.96 |

| FTSE All-Share | 22.76 | 1.03 | 2.99 | 12.22 | 13.39 |

Portfolio Positioning

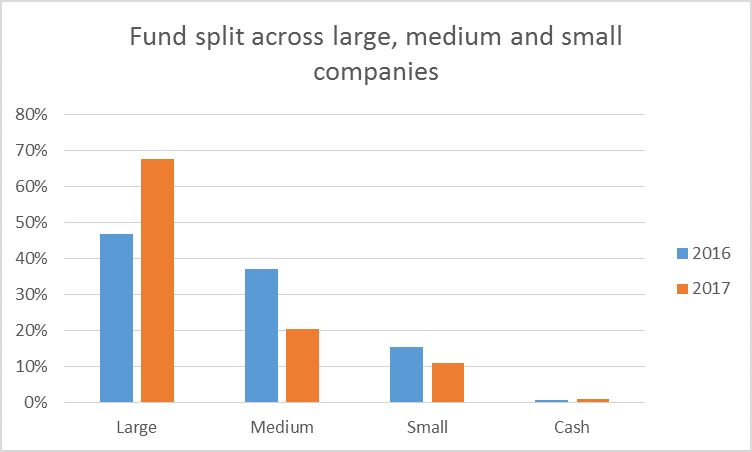

The managers have become more cautious in their outlook for the UK economy and have made a number of changes to the portfolio since the UK’s decision to leave the European Union last June.

Exposure to medium-sized companies, which have tended to fare best in a strong economic environment, has been reduced. Marks & Spencer, for example, was sold from the portfolio in an effort to avoid companies reliant on consumer spending. Concern over its dividend prospects was also a contributing factor to the sale as the new Chairman is expected to initiate a restructure. The managers used the proceeds to increase exposure to larger companies, which could prove more resilient if markets weaken.

Source: Fundslibrary to 30/09/17

New larger company investments include Vodafone and a number of utility companies, with exposure to the latter now accounting for almost 7.7% of the fund, up from 1.9% prior to the referendum. Exposure to oil & gas has also more than doubled over the same period, predominantly through increased investment in BP and Royal Dutch Shell.

The managers have also added to an investment in HSBC. The global bank is more conservative than many of its peers and has always held a large amount of cash on deposit. Low interest rates have therefore negatively affected the business as it has earnt little to no return on the cash it holds. With three US interest rate rises behind us, and the potential for more on the horizon, the outlook for the business is improved. This, coupled with cost cutting and a successful expansion into Asia, means the bank presents an attractive investment opportunity, according to the managers.

Find out more about this fund including how to invest

Please read the key features/key investor information document in addition to the information above.

Want our latest research sent direct to your inbox?

Our expert research team provide regular updates on a wide range of funds.