- The fund harnesses the experience of four talented managers, who each specialise in a different area of the UK market

- Performance has been mixed over the past year but long-term returns remain impressive

- The fund remains one of our favourite ways to access a broad spectrum of UK companies

Our view

The Franklin UK Managers’ Focus Fund draws on the expertise of four experienced fund managers. Each manager has a specific focus on large, medium-sized or higher-risk smaller companies and their best ideas are blended together to form a high-conviction and concentrated portfolio. We like this approach as it means each investment has a material impact on performance, however it does increase risk.

Our analysis shows this approach has added considerable value over time, although there is no guarantee this will continue in future. This fund remains one of our favourite ways to gain exposure to a diverse cross-section of UK businesses and we have faith in the managers to generate good long-term performance. The fund continues to feature on the Wealth 150+ list of our favourite funds across the major sectors.

Performance

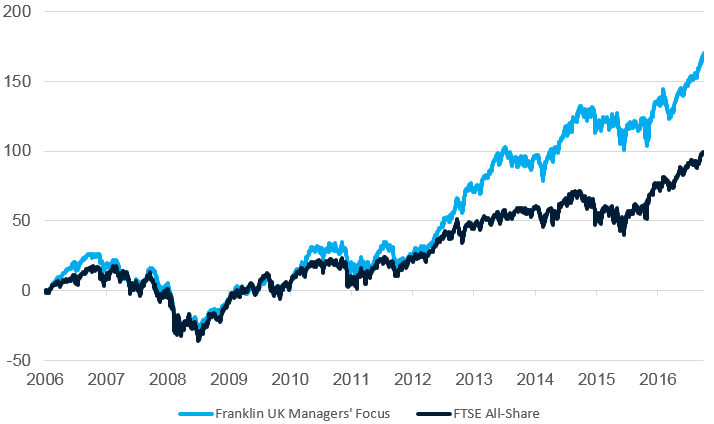

The fund’s managers have an exceptional long-term track record. Since launch in September 2006, the fund has returned 170.2%*, compared with 98.9%* for the FTSE All-Share, although this is no guide to the future. Much of this outperformance can be attributed to the managers’ ability to add value through strong stock selection.

| Annual Percentage Growth | |||||

|---|---|---|---|---|---|

| May 12 -

May 13 |

May 13 -

May 14 |

May 14 -

May 15 |

May 15 -

May 16 |

May 16 -

May 17 |

|

| Franklin UK Managers’ Focus | 36.9 | 19.6 | 19.2 | -4.0 | 21.0 |

| FTSE All-Share | 30.1 | 8.9 | 7.5 | -6.3 | 24.5 |

Past performance is not a guide to the future. Source: *Lipper IM to 31/05/2017.

The fund delivered an attractive return over the past year, although it underperformed the broader UK market. A bias towards small and medium-sized companies, which tend to be more domestically-orientated than their larger counterparts, proved painful in the wake of the UK’s vote to leave the European Union. Exposure to retailers such as Dixons Carphone and Topps Tiles also detracted from returns due to concerns over a slowdown in consumer spending.

The fund has since performed well and outperformed its benchmark although this should not be seen as a guide to future returns. Positive contributors to performance include adhesives manufacturer Scapa Group, which has benefited from stronger profit growth and the successful integration of a recently acquired company which specialises in consumer wound care products.

Franklin UK Managers' Focus vs FTSE All-Share (%)

Past performance is not a guide to the future. Source: Lipper IM to 31/05/2017.

Recent trades

The managers have recently taken profits from a number of the fund’s stronger-performing investments and some have been sold from the portfolio. Proceeds were reinvested into new companies, which offer attractive value and are highlighted in the table below.

| Bought | Sold | |

|---|---|---|

| Laird: The managers took the opportunity to invest in the electronics and technology company on account of its share price weakness and more attractive valuation following the UK’s vote to leave the EU. | Micro Focus International: The software firm’s shares were sold after performing well following a successful acquisition of Hewlett Packard’s software business and subsequent promotion to the FTSE 100 index. | |

| Bunzl: A multinational distribution and outsourcing company which, according to the managers, benefits from a competitive market position, an internationally diversified income stream and pricing power (the ability to raise prices in line with inflation without affecting demand for its services). | Unite Group: Shares in the student accommodation provider performed well and were sold once they became less attractively-valued. |

Find out more about this fund including how to invest

Please read the key features/key investor information document in addition to the information above.

Want our latest research sent direct to your inbox?

Our expert research team provide regular updates on a wide range of funds.