The Invesco Perpetual Japan Fund has been removed from the Wealth 150 list of our favourite funds across the major sectors.

The fund is managed by Paul Chesson, an experienced fund manager with a 20 year track record of investing in Japan. While the manager has outperformed the Japanese stock market over a long period of time, performance has been volatile. He has delivered some strong performance over short periods, such as in 2009, but this has often been followed with longer periods of more lacklustre performance against the stock market.

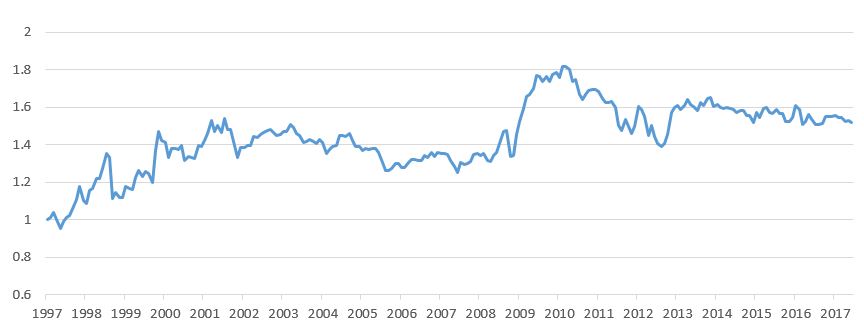

This is demonstrated in the chart below – when the line is rising the fund is outperforming the FTSE Japan Index, and when it is falling it is underperforming. Furthermore, we feel the manager’s stock selection– a key factor we analyse when assessing a fund manager’s ability – has been variable and added little value in recent years.

Find out more about Paul Chesson’s investment approach

Paul Chesson's track record against the FTSE Japan Index

Past performance is not a guide to the future. Source: Lipper IM to 31/07/2017

The chart initially shows Paul Chesson’s performance managing Invesco Japanese Equity Core, followed by his time running Invesco Perpetual Japan from February 2000.

| Annual Percentage Growth | |||||

|---|---|---|---|---|---|

| July 12 -

July 13 |

July 13 -

July 14 |

July 14 -

July 15 |

July 15 -

July 16 |

July 16 -

July 17 | |

| Invesco Perpetual Japan | 43.9 | -1.2 | 16.8 | 11.2 | 15.4 |

| FTSE Japan | 30.2 | -0.6 | 18.3 | 14.1 | 16.1 |

| IA Japan | 30.7 | -1.5 | 16.4 | 14.3 | 17.5 |

Past performance is not a guide to future returns. Source Lipper IM to 31/07/2017.

Overall, we do not feel investors have been sufficiently compensated for the risks taken. The Wealth 150 is reserved for managers in which we have the highest conviction. In our view, there are other talented fund managers in the Japan sector who have demonstrated more consistent performance and a greater ability to add value through their stock-picking over a prolonged period. Furthermore, investors are able to access these managers at a lower ongoing fund charge, which can make a real difference to performance over the long term. Our favourites feature on the Wealth 150+.

Please read the key features/key investor information document in addition to the information above.

Want our latest research sent direct to your inbox?

Our expert research team provide regular updates on a wide range of funds.