Junior ISA

Give your child a head start

Invest for your child’s future with the UK’s best value Junior Stocks and Shares ISA

Before you invest in a Junior ISA: investing for 5+ years increases your chances of positive returns compared to cash savings. But investments rise and fall in value, so your child could get back less than you put in. You’re responsible for your investment decisions. Tax benefits depend on circumstances and rules can change.

Before you invest in a Junior ISA: investing for 5+ years increases your chances of positive returns compared to cash savings. But investments rise and fall in value, so your child could get back less than you put in. You’re responsible for your investment decisions. Tax benefits depend on circumstances and rules can change.

What is a Junior ISA?

A Junior Stocks and Shares ISA is an account that lets you invest for your child’s future, free from UK tax.

Build a nest egg

Give your child a head start on adult life.

Boost potential returns

Investments should provide higher returns than cash over the long term.

Save tax

Invest up to £9,000 each tax year, free from UK income and capital gains tax.

Why choose the HL Junior ISA?

Open a Junior Stocks and Shares ISA with the UK’s #1 investment and savings platform.

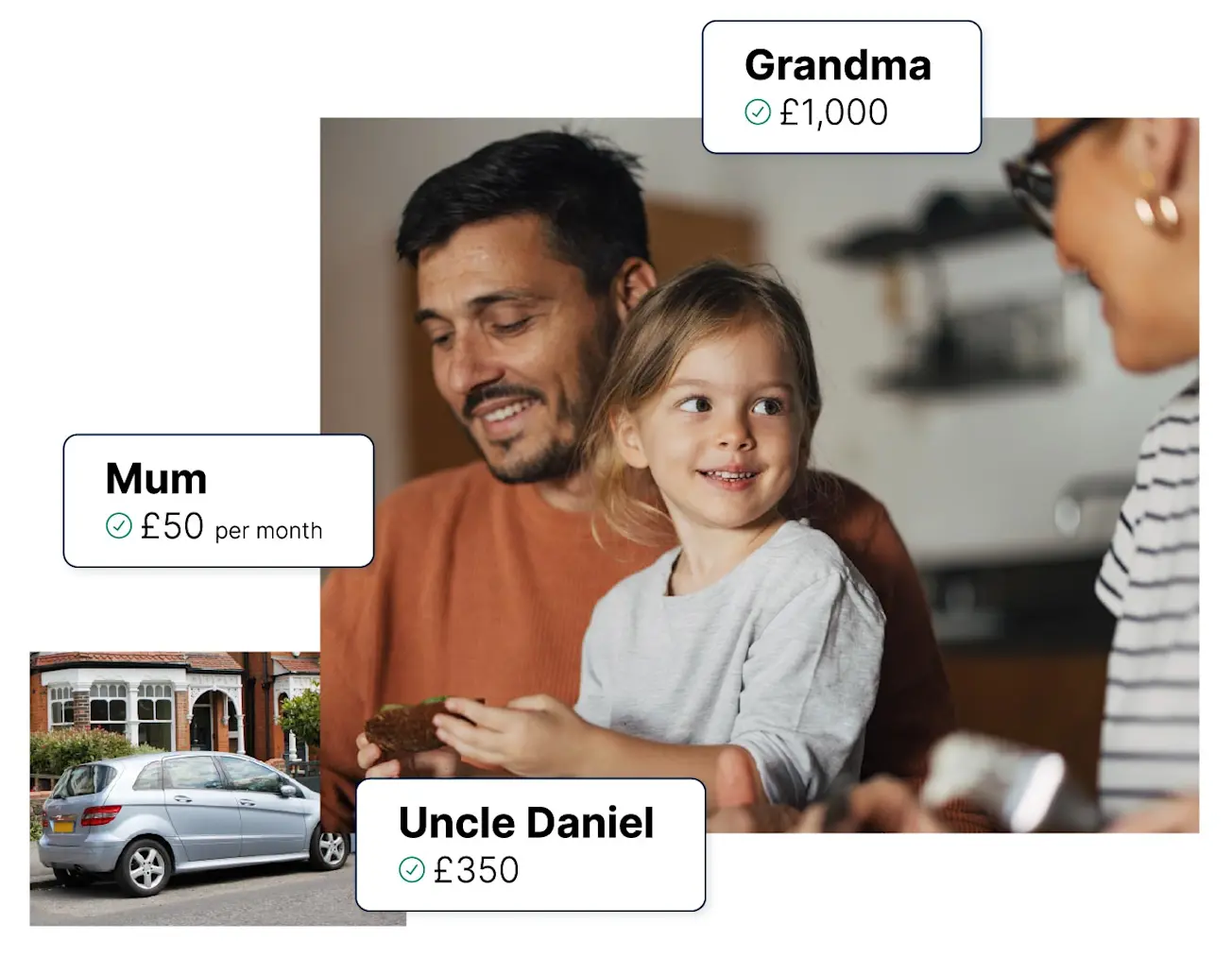

Let friends and family chip in

Pick your own investments or choose from ready-made options

Speak to our UK-based helpdesk if you have any questions

Manage everything in one place by linking Junior ISAs to your own HL account

Junior ISA charges

0%

With the HL Junior ISA, kids go free.

You won’t pay online dealing or account charges. This means more of what you pay in can benefit your child.

Depending on the investments you choose, other charges could still apply.

Trusted by 2 million

Our clients trust us with over £172bn of their savings and investments.

Over 40 years

We've been helping people to save and invest for a better future since 1981.

Award-winning service

Over 200 awards, including 'Best Buy Junior ISA' and 'Best for Customer Service' 2025

Is a Junior ISA right for you and your child?

Parents or legal guardians can open a Junior ISA and manage the account. Once set up, grandparents, family and friends can add money.

Consider investing in a Junior Stocks and Shares ISA if:

You're comfortable with the fact that withdrawals cannot be made until the child turns 18 and that anything paid into a Junior ISA belongs to the child.

You're clear on the differences between saving and investing and you have your own cash savings to cover emergencies.

You understand the value of your investments will rise and fall, so your child could get back less than you invest.

You're comfortable choosing investments for your child and happy to check in to make sure they're continuing to meet your objectives.

This isn’t personal advice. If you’re not sure what’s right for you or your child, ask for financial advice.

Should you save or invest for your child?

Children have time on their side when it comes to money. Anything you save or invest for them should have more time to grow.

This means investing is often your best option. While it's important to remember that you could get back less than you invest, cash isn't a risk-free option over the long term.

This is because inflation erodes the spending power of cash over time. Investments, on the other hand, offer the potential for inflation-beating returns.

Open or top up a Junior Stocks and Shares ISA from £100 lump sum, or £25 a month.

Transfer an existing Junior ISA

Transfer to HL today for more investment choice, and greater control of a child’s future. Join thousands who’ve already made the switch.

It's free to transfer to us, but check for loss of benefits, guarantees, and any exit fees before you transfer.

Junior ISA investment options

Pick your own investments

Your child, your choice

Choose from funds, UK and overseas shares, investment trusts, bonds, exchange-traded funds (ETFs) and more.

Leave it to our experts

Ready-made investments

All-in-one investment options, created by our team of experts.

Hear why Jack chose the HL Junior ISA for his children

HL client, Jack, shares what he loves about the HL Junior ISA.

Hear why he invests for his children and how he hopes their savings could support them in the future.

HL client, Jack, shares his experience of investing for his children. Hear what he thinks about the UK’s best value Junior Stocks and Shares ISA

Join the UK's #1 investment and savings platform

Open or top up a Junior ISA from £100 lump sum, or £25 a month.

FAQs

Common questions about Junior ISAs.

Junior ISAs can only be opened by a parent or legal guardian of the child. Once set up, parents, grandparents, friends and family can all pay in – up to the annual limit each tax year (currently £9,000).

Hargreaves Lansdown won’t obtain consent from the registered contact before accepting subscriptions to a Junior ISA. Payments will remain as cash in the account, pending an investment instruction from the registered contact – the parent or legal guardian.

Although grandparents can’t open a Junior ISA for a child, they are able to open a bare trust account on their behalf.

If your child was born between 1 September 2002 and 2 January 2011, they automatically received £50 or more from the government in a Child Trust Fund when they were born. The Child Trust Fund scheme is now closed, but you can transfer your child’s Child Trust Fund to an HL Junior Stocks and Shares ISA.

When your child turns 18, their HL Junior ISA will be converted into an HL Stocks and Shares ISA.

The child will gain full access to their investments and savings. They can continue to invest, or withdraw their money in part or in full.

A Junior ISA is an Individual Savings Account (ISA) for children under 18. There are two types of Junior ISA.

A Junior Cash ISA lets you save cash for your child. Junior Stocks and Shares ISAs let you invest for your child. Like all ISAs, money in a Junior ISA is free from UK income and capital gains tax. Tax benefits depend on circumstances and rules can change.

Your child can have one or both types of Junior ISA, but not more than one of each type with different providers. Your child is the only person who can withdraw money from their Junior ISA, after they turn 18.

We offer a Junior Stocks and Shares ISA, which we’ll convert to a Stocks and Shares ISA for your child when they turn 18.

Investing could help give the young ones in your life a head start on university fees, their first home or a future nest egg.

Once you’ve opened a Junior ISA as the parent or legal guardian of a child, you can decide where to invest.

With HL, you have the same breadth of investment choice as an equivalent adult ISA, such as an HL Stocks and Shares ISA.

Choose from ready-made options, funds, UK and overseas shares, investment trusts, bonds, exchange-traded funds (ETFs) and more.

You can add money to existing investments over time, set up a Direct Debit to invest automatically each month, or buy and sell investments as you choose.

See Junior ISA investment ideas

Read more about the differences between saving and investing

Junior ISA essentials

Read more about Junior Stocks and Shares ISAs.

We've won over 200 awards for our services