Updated HL charges

The best service. The best information. Now even better value.

From 1 March 2026, the amount you pay to invest with us will change.

We're introducing these changes to provide even more clients with better value for money.

Read on to find out what’s changing and why we’re making these changes now.

Investing for 5+ years increases your chances of positive returns compared to cash savings. But investments rise and fall in value, so you could get back less than you put in. This isn’t personal advice. If you’re not sure what’s right for you, ask for financial advice.

Investing for 5+ years increases your chances of positive returns compared to cash savings. But investments rise and fall in value, so you could get back less than you put in. This isn’t personal advice. If you’re not sure what’s right for you, ask for financial advice.

Why the change?

We’re making these changes to reflect the evolving needs and behaviours of our clients. Almost 45 years ago, Hargreaves Lansdown was founded to give the best information and the best service, at the best value. These principles remain at the heart of our business.

Better value

Most clients will pay less, or about the same as before.

Continuous improvement

We’ll continue to invest in our products and services.

Transparent pricing

You can see the main changes below or view a comparison of all charges in detail.

What’s changing?

0.35%

Account charges are ongoing charges based on a percentage of the value of your investments. We are reducing our annual account charges from 0.45% to 0.35% on Stocks and Shares ISA and SIPP accounts. For Fund and Share Accounts, we’re reducing account charges for holding funds, from 0.45% to 0.35%, and introducing a charge of 0.35% to hold shares.

We are introducing new account charge limits for shares (includes investment trusts, exchange traded funds (ETFs) and bonds). You will never pay more than £150 per year in account charges for holding shares in each of our SIPP, Stocks and Shares ISA or Fund and Share Account.

£6.95

Dealing charges are what you pay each time you buy or sell an investment.

We are reducing the amount you pay to buy or sell shares with us, from £11.95 to £6.95 per online trade. This dealing charge reduces to £3.95 if you’ve placed more than 20 trades in the previous month. Other charges, such as government taxes and updated overseas foreign exchange charges (FX), may apply.

We’re introducing a charge of £1.95 per trade to buy or sell funds online.

To learn more, view our full list of charges or try our comparison calculator.

Deal for free when you invest regularly by Direct Debit

Dealing charges don’t apply when you buy investments through Regular Investing or elect for dividend reinvestment.

When you choose to invest regularly via Direct Debit, you simply choose a fixed monthly amount you’d like to invest into a particular fund, share, ETF or other investment. We then automatically place your trades each month, for free.

Other charges, such as government taxes and overseas foreign exchange charges (FX), may apply.

Ongoing value, every day

New, lowest ever cost Ready-Made Pension Plan

200+

awards for service and research

£56mn

saved in fund discounts

Kids go free with the HL Junior ISA

What happens next?

The changes will automatically be applied to your investments and accounts from 1 March 2026.

If you’d like to get a feel for what the changes mean for you, try our handy calculator. You can put in your own figures and adjust investment options.

FAQs

If you need more help understanding these changes or how they affect you, contact us.

If you're an HL client you'll have received an email with a summary of the changes. You can also use our calculator to understand how changing what you hold or trade could impact what you pay in future.

Need more support? Get in touch – we’ll be happy to help.

Account charges are collected at the start of the month after they occur. For instance, account charges related to March 2026 will be collected on 1 April 2026.

Dealing charges are taken immediately.

To check charges on our website:

1. Log in online to see your accounts.

2. Select the account you want to view.

3. Select the ‘Account administration’ tab.

4. Under Account administration tariff, select ‘View history of fees charged’.

5. Check the Total outstanding balance to see what fees are due.

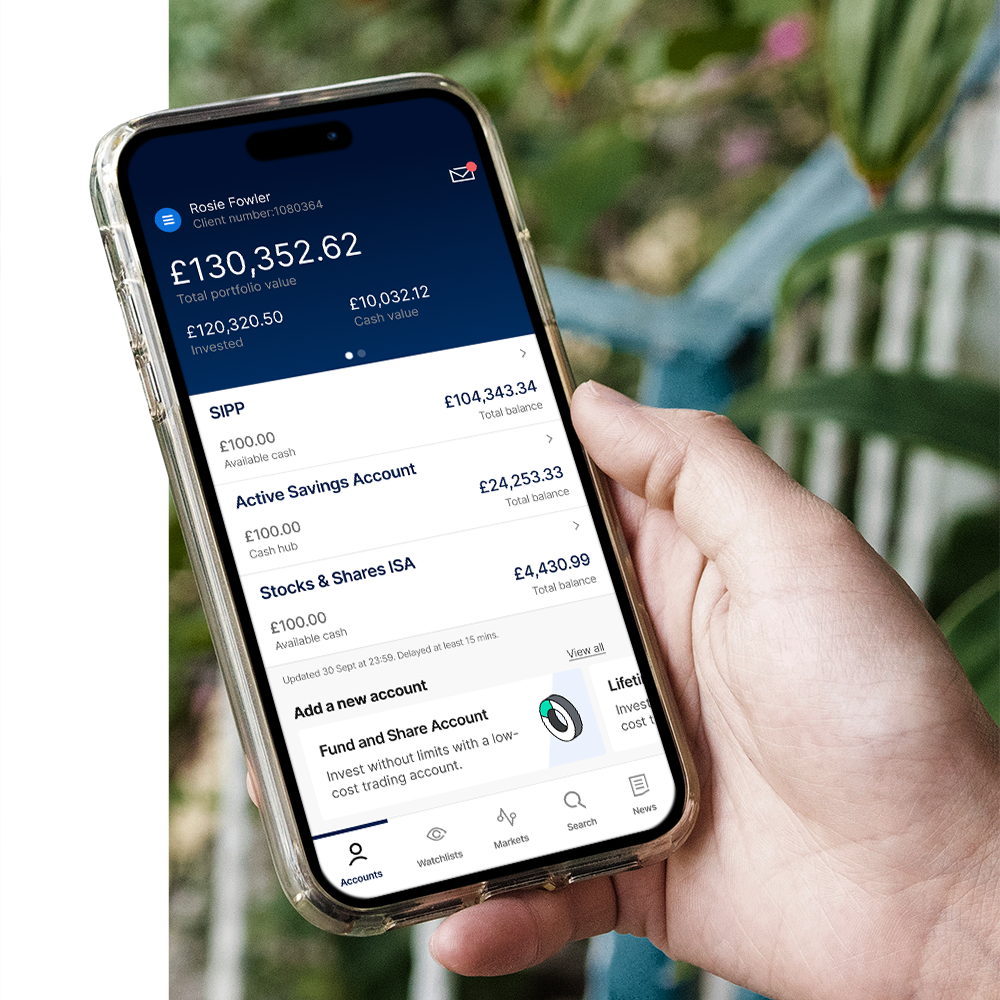

To check charges on our mobile app:

1. Select ‘Accounts’ in the bottom left corner.

2. Log in using the verification method you have set up.

3. Select the account you want to view.

4. Select the menu in the top right corner.

5. Select ‘Fee history’.

6. Check the Total outstanding balance to see what fees are due.

Let us know what you want to transfer. We’ll take care of the rest.

You can also contact us if you have any questions about transferring.

Our current charges remain in place until 11:59pm on Saturday 28 February 2026.

Here’s how charges will work for instructions placed before this time but executed afterwards:

Share trades (including stop-loss and limit orders)

If you place an instruction before midnight on 28 February but it executes on or after 1 March 2026, the new, lower share dealing charges will apply.

Online fund trades (including fund switches)

If you submit an online fund instruction before midnight on 28 February, no dealing charges will apply – even if the trade executes after 1 March.

Postal fund dealing

Instructions must reach us by Friday 27 February 2026 for no dealing charges to apply. Postal instructions received after 27 February will be processed on Monday 2 March, and the new fund dealing charges will apply.

We've won over 200 awards for our services