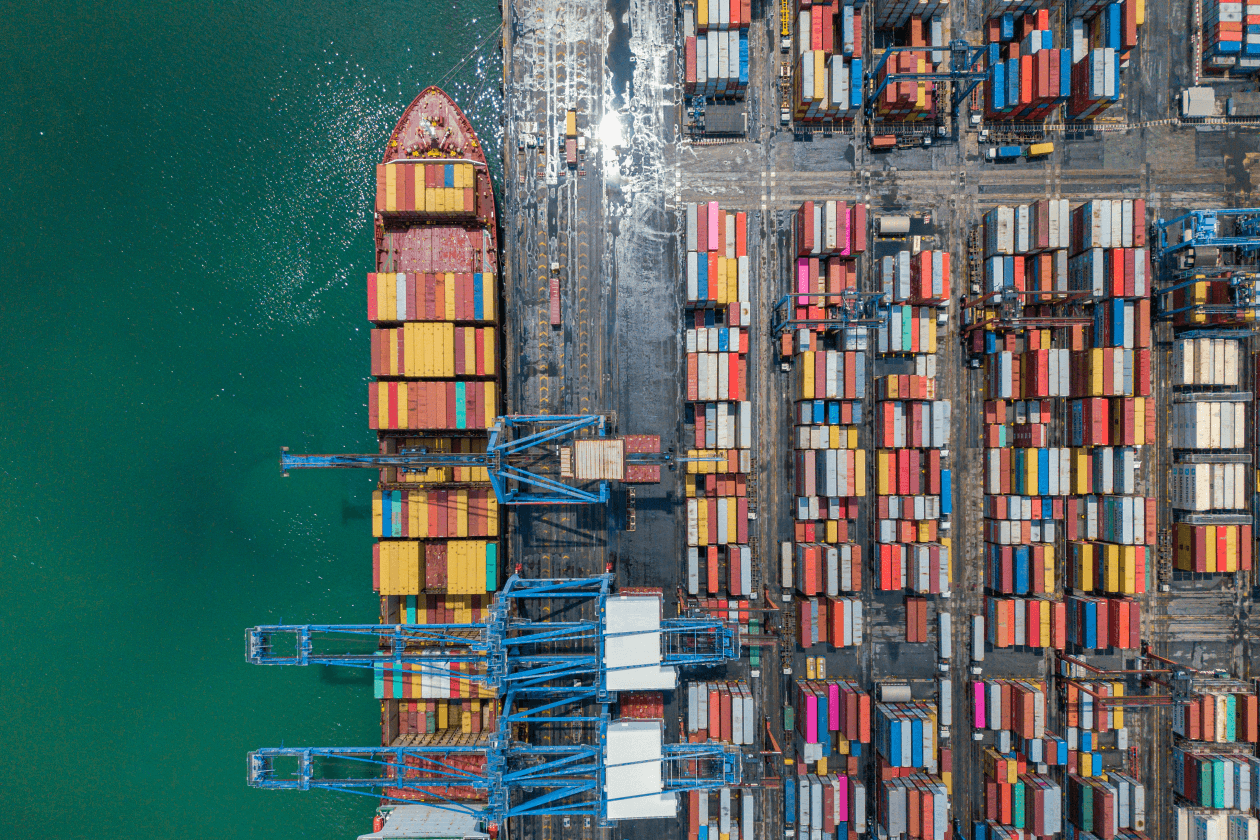

Commodities are the raw ingredients that grease the global economy. With international trade flows under pressure, it’s been difficult for operators within the sector and for the service providers that support them.

However, with global trade talks progressing and deals being struck, a change in fortunes could be on the cards.

Here are three share ideas that could prosper if stability emerges around the rules governing imports and export agreements between nations.

This article isn’t personal advice. If you’re not sure an investment is right for you, seek advice. Investments and any income from them will rise and fall in value, so you could get back less than you invest. Remember, yields are variable, and no returns are ever guaranteed. Ratios also shouldn’t be looked at on their own.

Investing in an individual company isn’t right for everyone because if that company fails, you could lose your whole investment. If you cannot afford this, investing in a single company might not be right for you. You should make sure you understand the companies you’re investing in and their specific risks. You should also make sure any shares you own are part of a diversified portfolio.

Croda

Croda develops and supplies ingredients for industrial applications, the life sciences, and consumer care brands.

So far, the prospect of a reset to global trading rules hasn’t derailed the company’s strategic progress.

The local manufacturing and procurement model should offer some protection from tariffs, and the group intends to apply a surcharge to clients to cover any incremental costs.

We also support the increasing focus on New and Protected Products, now at 35% of sales. This facilitates research and development-based relationships with local and regional customers. These more specialised end products can grow quicker, and it also makes it harder for clients to switch suppliers.

If discussions between nations limit the scope of tariffs, Croda should still benefit from the long-term growth drivers. Growing demand for more sustainable cosmetics, flavours and fragrances all play well to Croda’s strengths.

However, we see consumer care products as the most sensitive to changes in trade rules.

Croda is also well known for providing delivery systems for mRNA-based medicines like Pfizer’s COVID-19 vaccine.

This year, it expects clinical trial usage to drive growth in these products.

Key medical approvals could see a step up, but that’s not something Croda can control.

Croda’s recovery from earlier cyclical challenges is moving in the right direction, but given how rapidly global trade policy is evolving, further obstacles for Croda’s customers and the company’s prospects can’t be ruled out.

Shell

In common with its rivals, Shell’s having to grapple with the steep fall in oil prices that followed Donald Trump’s ‘Liberation Day’. But Shell’s financial profile is among the most robust in the sector.

A strong balance sheet and a renewed efficiency drive underpins an increase in targeted returns to shareholders of 40-50% of operating cash flow over the cycle. That should allow for annual dividend increases of 4% and continued share buybacks of around $3.5bn per quarter, as long as oil prices remain above $60 per barrel.

It’s also well placed to fund investment in replacing oil reserves and low-carbon fuel initiatives. That supports targeted oil and gas production increases of 1% per annum out to 2030, although maintenance at producing wells is set to hamper output in the short term.

Shell’s targeting annual growth of 4-5% in sales of liquified natural gas over the same timeframe. That’s a fuel that could benefit from growth drivers like the push for energy independence, rising usage in heavy-duty transport, and waning popularity of coal in power generation.

Shell’s fortunes are linked to commodity prices, which adds an element of risk.

But if progress on trade talks leads to an improvement in the economic outlook, and with it energy demand, then the company and investors should see the benefit.

UPS

UPS doesn’t make or sell finished products or commodities, but as the world’s largest parcel delivery service, it’s highly sensitive to disruption in the flow of goods across borders. So, expected weakness of US imports from China is weighing on the outlook.

That uncertainty is reflected in a valuation that sits some way below the long-run average.

However, UPS is using technology to provide importers transparency on charges in a time of great complexity and we think this can help the company sharpen its competitive edge.

Cost savings are another key initiative with some $3.5bn of efficiencies expected for this year alone. It’s not simply a matter of cutting the workforce, but also the introduction of more automation, which should mean that customers don’t see a deterioration in service levels.

This should support expanding margins and UPS’s ability to sustain its 6.8% dividend yield. However, there can be no guarantees, especially when trading conditions are challenging.

The cost reductions go hand in hand with its plan to reduce dependency on low-returning fulfilment services for Amazon, which are a big part of the business.

UPS is also focused on replacing some of that work with higher-quality activities and, to that end, has been acquiring companies in the healthcare logistics space. The complex nature of deliveries in this specialist area allows it to earn higher margins than the wider business.

There’s no doubt UPS is pursuing some ambitious strategic goals. If it achieves them, investor sentiment will likely improve. But the combination of execution risk and macroeconomic uncertainty means there could be a bumpy road ahead.

This article is original Hargreaves Lansdown content, published by Hargreaves Lansdown. It was correct as at the date of publication, and our views may have changed since then. Unless otherwise stated estimates, including prospective yields, are a consensus of analyst forecasts provided by LSEG. These estimates are not a reliable indicator of future performance. Past performance is not a guide to the future. Investments rise and fall in value so investors could make a loss. Yields are variable and not guaranteed.

This article is not advice or a recommendation to buy, sell or hold any investment. No view is given on the present or future value or price of any investment, and investors should form their own view on any proposed investment. This article has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is considered a marketing communication. Non-independent research is not subject to FCA rules prohibiting dealing ahead of research, however HL has put controls in place (including dealing restrictions, physical and information barriers) to manage potential conflicts of interest presented by such dealing. Please see our full non-independent research disclosure for more information.

Open a new HL Stocks and Shares ISA or SIPP today and enjoy 40% off your account charge

Open your ISA or SIPP and add at least £10,000 (including cash and/or transfers) by 30 June 2025

The 40% discount applies between 1 July and 31 December 2025

If you're transferring, your reduced charge will start once your transfer completes, and continue until 31 December 2025

Need more time to apply to transfer? Contact our Helpdesk.

Important: This offer reduces the HL account charge. Our standard account charge is no more than 0.45% a year. Other investment charges may still apply. Buying and selling funds is free. Share and ETF dealing charges apply. See the full ISA offer terms and SIPP offer terms.