Improving your cash strategy

Don't miss out on better cash returns

Important information - Active Savings helps you make your own decisions and is not personal advice. Fixed term products generally only allow access to funds at maturity. Inflation reduces the future spending power of money.

Everyone needs cash

Yet many of us neglect our cash savings.

If that sounds familiar you're not alone.

Holding the right amount of cash is key. You'll need some set aside for emergencies, but you might also be saving for a goal or event such as a new car or a wedding. Or, you might just want to keep some cash aside ready for when the right investment opportunity comes along.

Make it go further

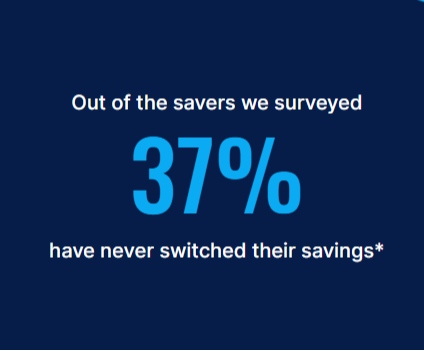

Many are missing out on higher rates. According to our research 37% of all savers we surveyed have never switched their savings. Almost half don't even know what rate they're getting*.

An effective cash strategy can boost your returns and help you reach your goals sooner.

*HL Survey, September 2020, 2,001 nationally representative respondents.

Building a savings portfolio

Start by thinking about your short, medium and longer-term goals.

This will help you decide how to spread your money to ensure you earn the best return possible, while having access when you need it.

Short term - cash for emergencies

Financial planners generally suggest keeping between three to six months’ worth of income in easily accessible cash, in case of an emergency like a leaky roof or losing your job.

If you’re in retirement, you might want to have more as your income may be lower so it may take longer to build your savings back up.

Keeping this pot of cash in an easy access account gives you the freedom to withdraw whenever you need.

Easy access rates are variable. While instant access accounts allow you to instantly withdraw your money at any time, with Active Savings withdrawals usually take up to one working day.

How hard can it be?

Building an effective strategy can be a hassle. To chase good rates you'd need to save with several different banks.

That's more paperwork, more passwords to remember and more accounts to manage.

And not everyone has the time.

We can help

That's why we launched Active Savings

It lets you pick and mix a range of savings products from multiple banks and building societies, through the convenience of one online account.

And once you're set up there are no forms or paperwork to fill in when moving money around. So you can manage your cash all in one place, with just a few clicks.

Getting started only takes a few minutes.

This website is issued by Hargreaves Lansdown Asset Management Limited (company number 1896481), which is authorised and regulated by the Financial Conduct Authority with firm reference 115248.

The Active Savings service is provided by Hargreaves Lansdown Savings Limited (company number 8355960). Hargreaves Lansdown Savings Limited is authorised and regulated by the Financial Conduct Authority (firm reference number 915119). Hargreaves Lansdown Savings Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 with firm reference 901007 for the issuing of electronic money.