As the United States hurtles towards polling day, the frontrunners are battling for workers’ votes in America’s industrial heartland.

President Biden has pledged to triple some of the tariffs on foreign industrial metals imposed by his predecessor Donald Trump. Both candidates are now preaching a protectionist agenda, but these measures have the potential to do more harm than good to both the US and global economy.

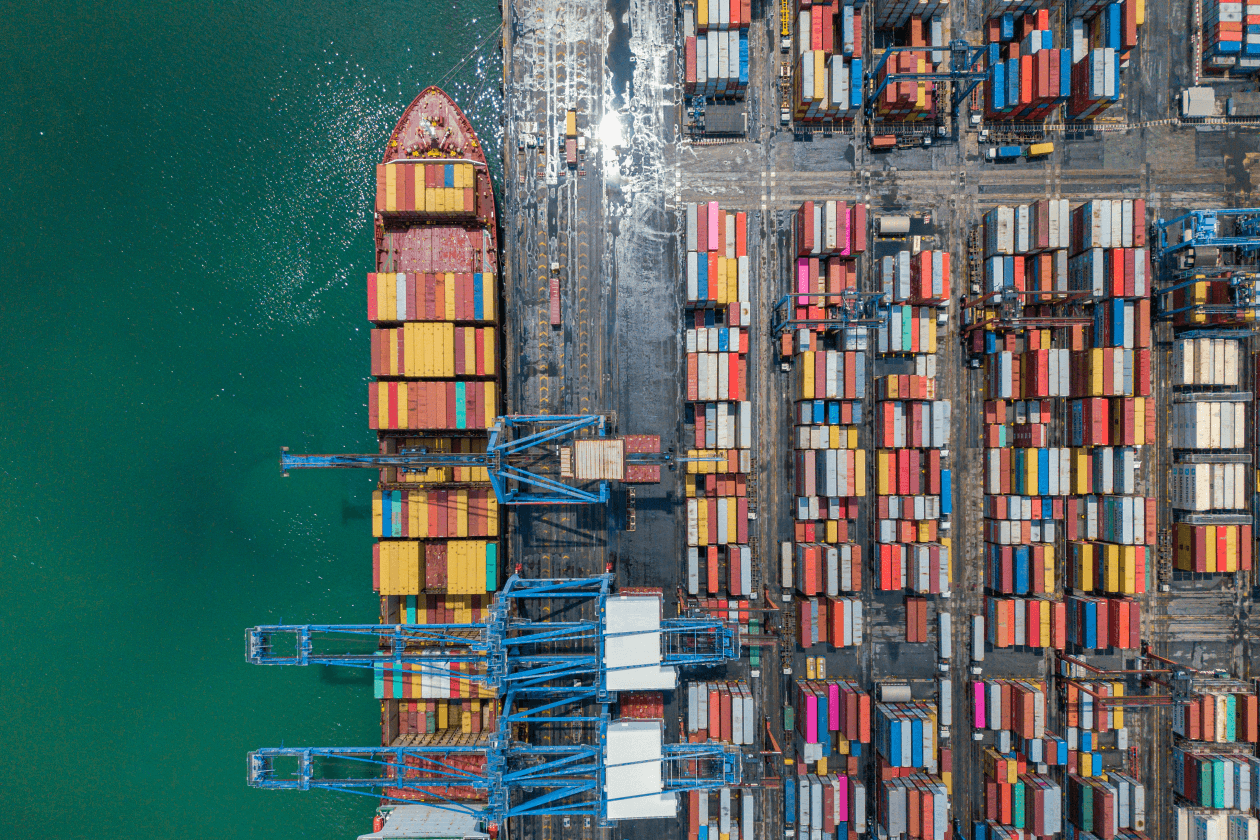

Evolution of world trade, 1950-2022 values ($bn)

International trade hasn’t gone into reverse but the rate of growth has slowed dramatically in the last decade with trade in goods and services up around 0.2% in 2023 We’ve seen reluctance for countries to sign new trade agreements, and a surge in restrictions and subsidies.

The US-China trade war has been the frontline of the crackdown on the free movement of goods and services. The value of trade between the US and China has undoubtedly trended downwards in recent years. However, it’s still close to historic highs, with US Exports to China being the biggest sufferer.

Other nations like Mexico and Taiwan have benefitted from the fall out. It’s a complex picture and we think there will be plenty more twists and turns.

Here are three share ideas we think are well placed to navigate the fast-changing patterns in global trade and hopefully benefit.

This article isn’t personal advice. If you’re not sure an investment is right for you, seek advice. Investments and any income from them rise and fall in value, so you could get back less than you invest. Past performance isn’t a guide to the future.

Investing in an individual company isn’t right for everyone because if that company fails, you could lose your whole investment. If you cannot afford this, investing in a single company might not be right for you. You should make sure you understand the companies you’re investing in and their specific risks. You should also make sure any shares you own are part of a diversified portfolio.

Remember, before you can trade US or Canadian shares, you need to complete and return a W-8BEN form – this entitles you to save tax on any dividends. Tax rules can change and benefits depend on personal circumstances.

3 share ideas

DR Horton – looking inwards

House builders sell all of their product at the point of manufacture and from that point of view can be seen as relatively insulated from any escalation in protectionism.

Stubbornly high mortgage rates have been keeping a lid on sales levels of existing houses in the United States. Mortgage rates in the US tend to be fixed for a longer period than in the UK – typically 30 years. This means potential sellers are keen to hold onto lower rates on their existing loans, keeping their houses off the market, and pushing prices higher.

This supply pressure is a positive for the new build market.

DR Horton is one of the nation’s leading housebuilders. It comes with a strong growth record, and despite a challenging American housing market, it has continued to grow sales, earnings and market share so far in 2024.

The wide spread of price points helps target a broad customer base, from first-time buyers all the way through to the luxury end of the market. Its strong financial position leaves it well placed to cope with changes in market conditions.

The valuation, which sits just below the long-run average doesn’t look too demanding. However further protectionism might not be entirely good news. If it goes too far, macroeconomic uncertainty and inflation in raw material prices could still impact input costs as well as demand.

Cameco – pivotal energy supplies

With little sign that the recent geopolitical tensions are going to ease any time soon, governments around the world are increasing their focus on energy security. That and the threat of climate change have seen a drive to reduce how much we rely on fossil fuels.

Nuclear energy is being increasingly viewed as part of the solution. We think this market is primed to grow from here. Not only because of the helpful megatrend of cleaner energy solutions, but because there’s limited uranium supply at a time when demand is increasing.

There’s also a push to reduce reliance on Russian energy supplies, and for now, Russia remains the world’s largest supplier of enriched Uranium.

Cameco is well-placed to benefit from these market dynamics. It has several approved and built assets in less volatile regions ready to fire up. Almost 90% of uranium consumption is in countries with little-to-no primary production and Cameco has controlling ownership of one of the world’s largest high-grade uranium reserves.

The group’s revenue jumped over a third to $2.6bn in 2023, partly because of rising uranium prices and volumes. Operating profit margins are in the region of 15%, and these are expected to more than double in the coming years.

The outlook for Uranium looks positive, but there can be no guarantee that supportive political attitudes and strong pricing will continue.

Cameco’s merits haven’t gone unnoticed by the market and the valuation now sits well above the long-term average. That’s been supported by a surge in the uranium price, but remember commodity prices can be volatile, which increases the risks of ups and downs. And while there have been great improvements in nuclear safety standards in recent years, any major incidents would be negative for investor sentiment.

Intel – putting down the chips

While the US has been a key driver of innovation in the semiconductor market, the manufacture of these products remains dominated by Asian nations.

Intel has been one of the highest-profile beneficiaries of US industrial policy. It’s been awarded up to $19.5bn of government funding under the CHIPS Act, to boost the production of semiconductors on US soil.

They’ve been out of favour with investors lately, with near-term challenges in some of Intel’s non-core businesses. While its valuation is above the long-term average, it trails a lot of the competition.

As Intel scales up and offers its facilities to other chip designers, it could offer opportunity for investors. Intel target those experiencing booming demand for the high-end processors required to drive advances in artificial intelligence (AI). Combined with a shortage of supply and daunting barriers to entry, the space certainly has its attractions.

One sign of the company’s ambition is the early adoption of the latest generation of semiconductor manufacturing equipment to challenge the market leaders’ technical advantage. The orders are rolling in. By 2030, Intel expects to be the world’s second-largest contract manufacturer of semiconductors with an underlying operating margin of 30%.

But there’s lots of execution risk. Its foundry (chip factories) division’s a relatively small part of the business and is currently heavily loss-making. There’s no guarantee that state support will enable Intel to compete effectively. Analysts are pinning this year’s modest sales growth expectations on a sales recovery for the PC chips for which Intel is best known.

Meanwhile, investments in AI capabilities have been dampening profits. A decent recovery is forecast for this year, but margins are still looking thin. There’s pressure for Intel to stem the losses in its foundries and drive a strong performance from AI chips.

Another risk to be mindful of is the potential for further trade restrictions to China, the company’s largest market. This means there could be more volatility ahead.

This article is original Hargreaves Lansdown content, published by Hargreaves Lansdown. It was correct as at the date of publication, and our views may have changed since then. Unless otherwise stated, estimates, including prospective yields, are a consensus of analyst forecasts provided by Refinitiv. These estimates are not a reliable indicator of future performance. Yields are variable and not guaranteed. Investments rise and fall in value so investors could make a loss.

This article is not advice or a recommendation to buy, sell or hold any investment. No view is given on the present or future value or price of any investment, and investors should form their own view on any proposed investment. This article has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is considered a marketing communication. Non-independent research is not subject to FCA rules prohibiting dealing ahead of research, however HL has put controls in place (including dealing restrictions, physical and information barriers) to manage potential conflicts of interest presented by such dealing. Please see our full non-independent research disclosure for more information.