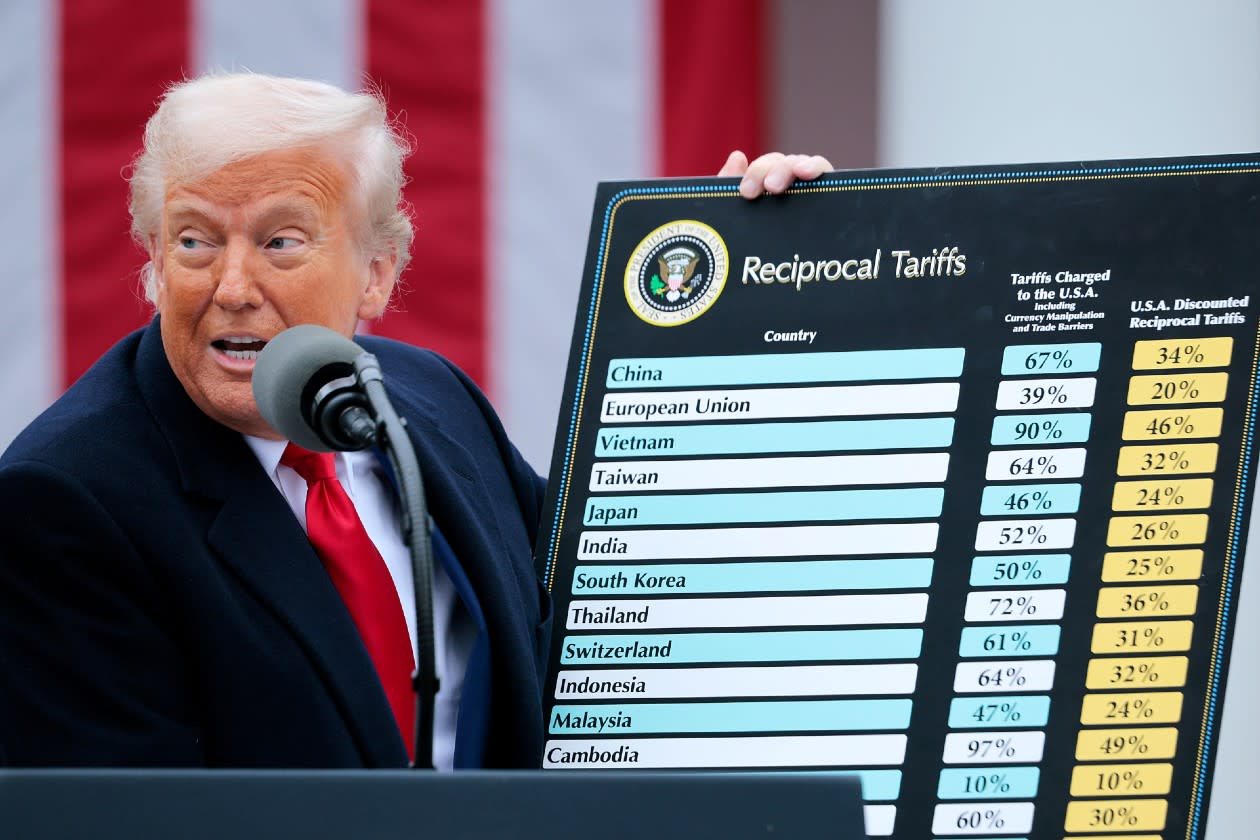

In early April, Donald Trump sent a shockwave through global stock markets, announcing sweeping tariffs on US imports from 9 April.

His attempts to rewrite the dynamics of global trade sent stock markets into a tailspin.

To dial down the temperature and allow time for negotiations, the US administration announced a 90-day pause on the imposition of punitive tariff rates, with a 10% ‘baseline’ tariff applying in most cases in the meantime.

However, this week the 90-day pause ends.

Here’s what could come next and how investors can prepare.

This article isn’t personal advice. If you're not sure if a course of action is right for you, ask for financial advice. Remember, all investments can rise and fall in value, so you could get back less than you invest. Past performance also isn’t a guide to the future.

How do tariffs work and why did Trump bring them in?

Tariffs are taxes paid by importers, with the revenue going straight to the government. Tariffs often lead to higher prices, unless the costs are absorbed by the importer.

Trump’s tariff policy is intended to address what he views as an unfair global trading system.

By making foreign goods more expensive, his goal is to boost the competitiveness of domestic alternatives, supporting US industry and raising tax revenue in the process.

However, there’s a problem – tariffs often trigger retaliation.

A tit-for-tat increase between the US and China escalated, with US tariffs on China reaching 145%, and China responding with 125% tariffs.

As in this case, tariff measures can spill over into a broader trade war, with other measures like quotas, export controls and non-tariff barriers being imposed.

The EU and others had also planned retaliatory measures against the US too.

How did stock markets react to Trump’s tariffs?

Stock markets tumbled off the back of Trump’s ‘Liberation Day’ announcement.

Since the announcement of tariffs and the subsequent pause though, markets have steadily recovered.

In fact, all major markets ended June higher than they were on 2 April.

The end of the 90-day tariff pause – what could happen next?

The 90-day pause ends on 9 July. As things stand, that would mean the imposition of heavy tariffs by the US on many of its major trading partners.

Progress has been made towards resolving some of the most critical disputes.

Following talks in Geneva and London, the US and China recently signed a trade deal which will see trade restrictions eased by both parties, in addition to temporarily stopping further tariff measures.

The UK government secured a trade deal too, although they were spared from punitive tariffs initially, so this was less significant for investors.

But progress elsewhere is more elusive.

Talks with key players including the EU, Japan, and South Korea are ongoing.

At the time of writing, markets are predicting a 39% probability of the US and the EU reaching a deal before the deadline, which highlights the scale of the challenge.

However, we could see several possible outcomes.

Will Trump extend the 90-day tariff pause?

David Smith, co-manager of the HL Managed and HL Income Funds, believes that an extension of the 90-day pause is the most likely, although uncertainty remains elevated.

In this event, markets avoid another shock to the system, and Donald Trump doesn’t have to back down.

This would buy time for negotiations to continue, allowing trade tension to diffuse.

The market reaction would probably be muted in this event – a continuation of the status quo.

Could Trump cancel the tariffs before the deadline?

There’s an outside chance that Trump could cancel tariffs before the deadline, declaring them a success for opening the dialogue with trading partners and securing better access for US firms abroad.

This would be a major boon to markets.

But turning off the tariff revenue taps seems an unlikely move considering that stock markets appear unphased and the US economy is so far resilient to the 10% tariff rate which is currently in force.

He could elect to retain the 10% blanket rate, and cancel additional tariffs, but this feels premature as negotiations are ongoing.

What else could happen?

It's possible that we go off the cliff edge, and reciprocal tariffs come into force.

In this event, significant market volatility can’t be ruled out.

We expect that pressure from financial markets – and the painful experience of the April fallout – make this less likely.

How can investors prepare?

If Trump’s second term has taught us anything, it’s to expect the unexpected.

Markets are adapting to his particular style of leadership and looking through the noisy politics – investors should too.

Positioning your portfolio for a certain outcome is a risky move.

We think it’s a better idea to stay focused on the long-term, staying diversified, with exposure across regions, sectors, and asset classes.

Investment ideas to help

Our ready-made investments are designed to help you navigate stock market uncertainty.

David Smith and the team manage a range of portfolios tailored to different levels of risk.

Simply choose the investment that best aligns with your goals and leave the rest to our expert managers to handle the investment decisions. All you’ll need to do is check in on them from time to time to make sure they’re still right for you.

You only need to pick one of these funds to have a diversified investment portfolio, but you can also use them to build a portfolio.

The Ready-Made investments are run by Hargreaves Lansdown Fund Managers Ltd., part of the Hargreaves Lansdown Group.

Pay no ongoing charge to hold shares, ETFs, gilts, bonds and more in an HL Fund and Share Account

Open an account in minutes, then add money later

Choose where and how much you want to invest – without limits

Depending where you invest, other charges could apply. See full account charges.

Article image credit: Chip Somodevilla / Getty Images.