HL Special Situations

Our favourite funds from across the world focused on delivering capital growth

Important - The value of this fund and the income from it can still fall, so you could get back less than you invested, especially over the short term. If you are unsure of the suitability of any investment for your circumstances please contact us for advice. Tax rules can change and benefits depend on individual circumstances.

Why invest?

This fund focuses on managers who have shown excellent stock-picking skill, regardless of what areas they specialise in. Our analysis identifies managers with the potential to deliver better returns for investors over the long term. Investors could use this fund to form the equity part of a diversified investment portfolio.

Many of the managers we think are the best stock-pickers focus on smaller and mid-sized companies, which makes the fund a medium to high-risk option. Your money will be invested in shares, and as with most investments, you should plan to hold this fund for at least five years. If you're unsure whether investing is right for you, find out whether you should save or invest.

You’ll get:

A globally diversified portfolio, invested with some of the world's most skilful fund managers.

Some investments in higher-risk small and medium-sized companies.

Some investments in higher-risk emerging markets.

This fund has a holding in Hargreaves Lansdown plc through the underlying funds. This is outside of HL’s control.

Invest NowKey Investor InformationFund prospectus View fund factsheet

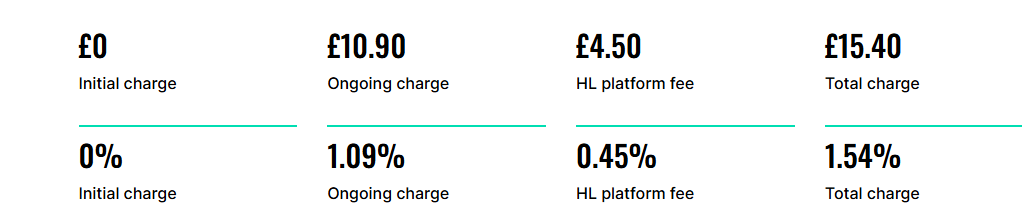

Costs

Data correct as at 24 May 2024.

Yearly charge based on an example £1,000 investment:

The ongoing charge is taken directly from the fund. This covers the management of the fund and all expenses other than transactional fees which are charged on top of this, these costs are incurred by all funds when shares are bought or sold and are reflected in the fund’s price.

The HL platform fee is our charge for looking after your investments which won't be over 0.45% per year. Both of these charges will be payable if you want to hold the fund with HL, amounting to a maximum of just 1.54% in total per year. The above example assumes no growth.

This fund is managed by Hargreaves Lansdown Fund Managers Ltd, part of the Hargreaves Lansdown Group. If you invest, HL will receive the fund's management charge, as well as the platform fee.

See how the costs will affect your investment in detailView HL’s chargesInvest Now

Building out your portfolio?

If you’re comfortable building out your own portfolio and would like HL’s dedicated team of fund managers to look after more of your investments, consider HL's Portfolio Building Block funds:

They can be used to build a portfolio or add to an existing one

They provide a simple way to diversify across sectors

Over 400,000 investors already trust HL's expert fund management teams with more than £10bn of their money