Important - The value of this fund and the income from it can still fall, so you could get back less than you invested, especially over the short term. If you are unsure of the suitability of any investment for your circumstances please contact us for advice. Tax rules can change and benefits depend on individual circumstances.

Why invest?

This fund aims to provide a sustainable monthly income - with the potential for future income growth - by investing in global equities and bonds. It’s designed for investors who want to leave the asset allocation and manager selection to experts. It could be a core holding or used to diversify an income-focused portfolio.

At least 60% of your money will be invested in global bonds which provide interest income and reduce risk. The rest of your money is typically invested in global equities for their dividend income and the opportunity for future income growth.

Overall, the fund is a low to moderate-risk option. As with most investments, you should plan to hold it for at least five years. If you're unsure whether investing is right for you, find out whether you should save or invest.

You’ll get a mix of:

Investment grade and higher-risk high yield corporate bonds, as well as government bonds, from around the world.

Shares of companies both in and outside the UK that have a history of paying consistent, generous dividends (not a guide to future income).

Invest NowKey Investor Information Fund prospectus View fund factsheet

Costs

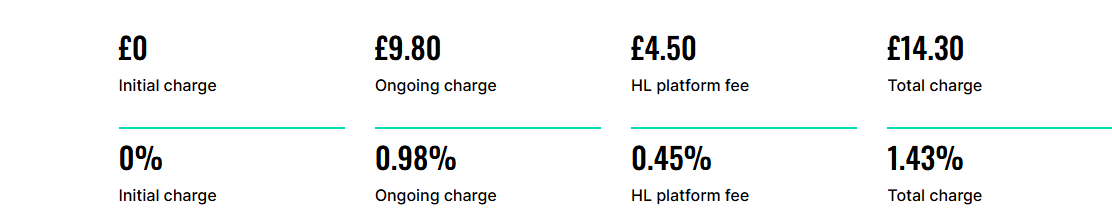

Data correct as at 1 October 2024.

Yearly charge based on an example £1,000 investment:

The ongoing charge is taken directly from the fund. This covers the management of the fund and all expenses other than transactional fees which are charged on top of this, these costs are incurred by all funds when shares are bought or sold and are reflected in the fund’s price.

The HL platform fee is our charge for looking after your investments which won't be over 0.45% per year. Both of these charges will be payable if you want to hold the fund with HL, amounting to a maximum of just 1.43% in total per year. The above example assumes no growth.

This fund is managed by Hargreaves Lansdown Fund Managers Ltd, part of the Hargreaves Lansdown Group. If you invest, HL will receive the fund's management charge, as well as the platform fee.

See how the costs will affect your investment in detailView HL’s chargesInvest Now

Building out your portfolio?

If you’re comfortable building out your own portfolio and would like HL’s dedicated team of fund managers to look after more of your investments, consider HL's Portfolio Building Block funds:

They can be used to build a portfolio or add to an existing one

They provide a simple way to diversify across sectors

Over 400,000 investors already trust HL's expert fund management teams with more than £10bn of their money