Easy access savings

AER

Everything you need to know about easy access savings

What are easy access savings?

Easy access savings are a simple way to earn interest on your cash savings without having to lock them away in a fixed term product. You can add to your savings at any time and get to your money usually in one working day.

The benefits of easy access savings through an Active Savings Account

- Flexible savings - You can top-up or withdraw your money at any time. But withdrawals will usually take one working day to become available in your nominated bank account.

- Low minimum deposit - You can open an easy access product from as little as £1.

- More control - There’s no term length, so you can keep your product open for as long as you need.

- More choice - You’ll be able to choose from all the easy access products available as well as fixed term savings products, all in the same account. So you can mix and match different savings products from different banks and building societies to suit your needs.

- One login - You can get set up in minutes online with Active Savings with a single application form. Make sure you’ve read all the important information.

Easy access products pay a variable rate.

Finding easy access rates through Active Savings

You can shop around for the best rates on the savings market but this can be time consuming. That’s why we created Active Savings, so competitive rates from a range of bank and building societies are all in one place. Choosing the right easy access product depends on your savings goals and the rates that are available to you at the time.

Products are added and withdrawn all the time. So keep checking the latest rates. Occasionally, our banking partners offer savings products only available to existing Active Savings clients.

Market leading rates were last checked against Moneyfacts on 18 Sep 2025 at 9:24am.

Please note that one of Hargreaves Lansdown’s Non-Executive Directors holds the position of Senior Independent Director at Investec Bank.

It's so easy to have all my savings in one place, with multiple providers.MR VOISEY, South East Wales

I'm looking for

savings products

What do AER and Gross mean?

AER (Annual Equivalent Rate)

Shows what the interest rate/expected profit rate would be if it was paid and compounded

once each year. It helps you compare the rates on different savings products.

Gross

The interest rate without any tax removed. Interest/profits are paid gross. You are

responsible for paying any tax due on interest/profits that exceed your Personal Savings

Allowance to HM Revenue & Customs. Tax treatment can change.

What does expected profit rate mean?

Islamic banks offer an expected profit rate, rather than interest on their savings products, in order to comply with Sharia banking principles. They are authorised by the Prudential Regulation Authority, and regulated by the Financial Conduct Authority and Prudential Regulation Authority. Any eligible deposits up to £120,000 are covered under the FSCS. More about Sharia banking.

Easy access vs fixed rate savings

Easy access products allow you to deposit and withdraw your money whilst earning interest/profit at a variable rate. This means the rate can go up and down at any time. They often have fewer restrictions compared to fixed rate savings.

But fixed rate savings typically offer a higher rate for setting your money aside for a fixed period of time. You won't be able to withdraw it until the term ends, but you may be able to earn more from your savings at a higher interest rate.

Find out more about fixed rate savings

How quickly can I withdraw cash from easy access products?

With Active Savings, withdrawals from easy access typically take one working day.

This differs from instant access savings, offered by many high street banks and building societies where your money is available for you to withdraw immediately in branch, via ATM or via real-time transfer.

3

steps to

start saving

Step 1

Open an Active Savings Account

Or log into your HL account if you're already a client. Make sure you read the important information.

Step 2

Start with just £1

Add money with a debit card, or move across any uninvested cash in your Fund and Share Account.

Step 3

Choose your products

Select from the range of great rates available.

How do easy access savings work?

Easy access savings allow you to top-up your savings whenever you like.

It typically takes one working day to withdraw money from Active Savings easy access savings.

Some easy access products will have minimum opening amounts, and will typically pay interest monthly.

Can interest rates on easy access savings change?

Because easy access products have variable rates, it means that the rate can fluctuate up or down. If your rate does change, we’ll give you two weeks’ notice.

If you’re interested in opening a product that guarantees you a fixed rate for a set period of time, you might want to consider fixed rate savings but you can’t withdraw your savings until the term ends.

How is my money protected?

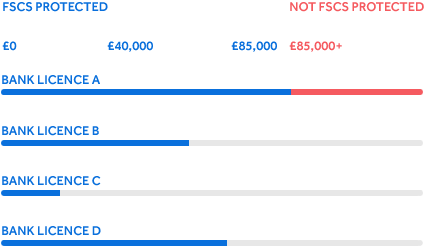

When you add money to a savings product, it’s held by that bank or building society. Eligible deposits are protected up to £120,000 per banking licence. Any deposits over £120,000 with the same provider are not likely to be covered. All our banking partners are authorised by the Prudential Regulation Authority, regulated by the Financial Conduct Authority and Prudential Regulation Authority, and are covered by the Financial Services Compensation Scheme (FSCS). Money in the cash hub is covered under Barclays' licence.

Money with Active Savings which isn’t in a savings product is held in the cash hub. As we are not a bank, it’s either protected through the FCA’s safeguarding rules if we (Hargreaves Lansdown Savings Ltd) were to fail, or the FSCS, if Barclays were to fail.

We don't charge you

We don’t charge you directly, instead we charge our banking partners. This means the same or similar products offered directly by the banks and building societies may have different rates to those available on Active Savings.

Savings Essentials

All the information you need for cash savings

Tips to help you save

If you’re looking for an easy way to improve your cash returns, here are our five top tips.

2m read

What affects savings rates?

There are a number of things that affect the interest rate that you’ll receive on your savings.

4m read

Discover better ways to save with Active Savings

Cash ISA

You can now save up to £20,000 each tax year free from UK income tax through Active Savings, with our new Cash ISA. Tax rules can change and benefits depend on personal circumstances.

Fixed Rate Savings

Fixed rate savings products typically offer a higher rate for setting your money aside for a fixed period of time. Remember inflation reduces the future spending power of money.

Transform your savings today

You can get started with Active Savings online in minutes.

I chose Active Savings because of better interest rates than my usual high street bank. Not only that, but I don’t have to open any new accounts with other banks as it’s all done through HL.MISS BALSA, London

An easy way to access a variety of saving accounts.

MR CRADDOCK, Dorset

HL Awards

BEST FOR CUSTOMER SERVICE 2022

Boring Money

GOLD FOR CUSTOMER EXPERIENCE 2022

Times Money Mentor

Help and support

If you have any questions about Active Savings, you can speak to one of our client support experts.

AER (Annual Equivalent Rate) shows what the interest rate/expected profit rate would be if it was paid and compounded once each year. It helps you compare the rates on different savings products.

Gross means the rate without any tax removed. Interest/profits are paid gross. You are responsible for paying any tax due on interest/profits that exceed your Personal Savings Allowance to HM Revenue & Customs.

AER (Annual Equivalent Rate) shows what the interest rate/expected profit rate would be if it was paid and compounded once each year. It helps you compare the rates on different savings products. Once you have opened a fixed term product the rate won't change, but rates on easy access products can vary.

Gross means the rate without any tax removed. Interest/profits are paid gross. You are responsible for paying any tax due on interest/profits that exceed your Personal Savings Allowance to HM Revenue & Customs. Tax treatment can change. Once you have opened a fixed term product the rate won't change, but rates on easy access products can vary.

If you are considering adding money to this savings product, please ensure you have opened an Active Savings Account and given us your instructions before the application deadline.

The savings of private individuals held with authorised banks and building societies are covered under FSCS. All of our partner banks are authorised by the Prudential Regulation Authority (PRA) and covered under FSCS.

AER (Annual Equivalent Rate) shows what the interest rate/expected profit rate would be if it was paid and compounded once each year. It helps you compare the rates on different savings products. Once you have opened a fixed term product the rate won't change, but rates on easy access products can vary.

Gross means the rate without any tax removed. Interest/profits are paid gross. You are responsible for paying any tax due on interest/profits that exceed your Personal Savings Allowance to HM Revenue & Customs. Tax treatment can change.

This website is issued by Hargreaves Lansdown Asset Management Limited (company number 1896481), which is authorised and regulated by the Financial Conduct Authority with firm reference 115248.

The Active Savings service is provided by Hargreaves Lansdown Savings Limited (company number 8355960). Hargreaves Lansdown Savings Limited is authorised and regulated by the Financial Conduct Authority (firm reference number 915119). Hargreaves Lansdown Savings Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 with firm reference 901007 for the issuing of electronic money.