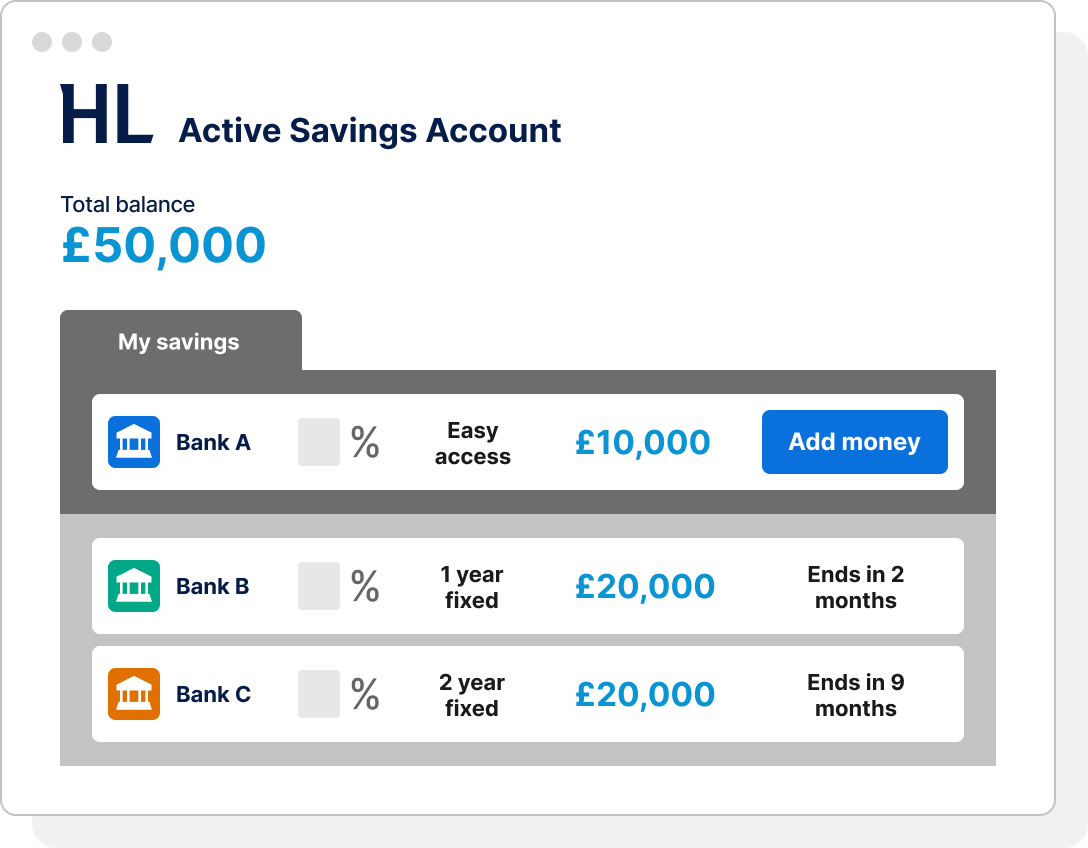

Active Savings Account

Access great savings rates from multiple banks.

All through one online account.

Revolutionise the way you save

Through one online account, you can hold savings from multiple banks and building societies.

Take the hassle out of earning interest

Forget the faff of multiple savings accounts and logins. Move cash between banks and savings products in minutes. All through a single login.

Options to keep your cash working

If your fixed rate is maturing, we'll keep you updated on your options to earn more interest. As well as the best rates on the platform.

Some of the best rates on offer

Easy access

Pays a variable interest rate. Withdraw money at any time - it usually takes 1 working day.

Limited access

Pays a variable interest rate. Limited number of money withdrawals without penalty.

Fixed rate

Pays a fixed interest rate for the length of the term. Withdraw money at the end of the term.

Up to

A E RUp to

A E RUp to

A E RUp to

A E RProducts pay interest gross and this rate can differ to the AER. Minimum deposits apply. Frequency of interest payments varies. Please note products can be added or withdrawn at any time.

AER (Annual Equivalent Rate) shows what the interest rate/expected profit rate would be if it was paid and compounded once each year. It helps you compare the rates on different savings products.

Log in to your Active Savings account

Open an Active Savings account

The Active Savings service is provided by Hargreaves Lansdown Savings Limited (company number 8355960). Hargreaves Lansdown Savings Limited is authorised and regulated by the Financial Conduct Authority (firm reference number 915119). Hargreaves Lansdown Savings Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 with firm reference 901007 for the issuing of electronic money.

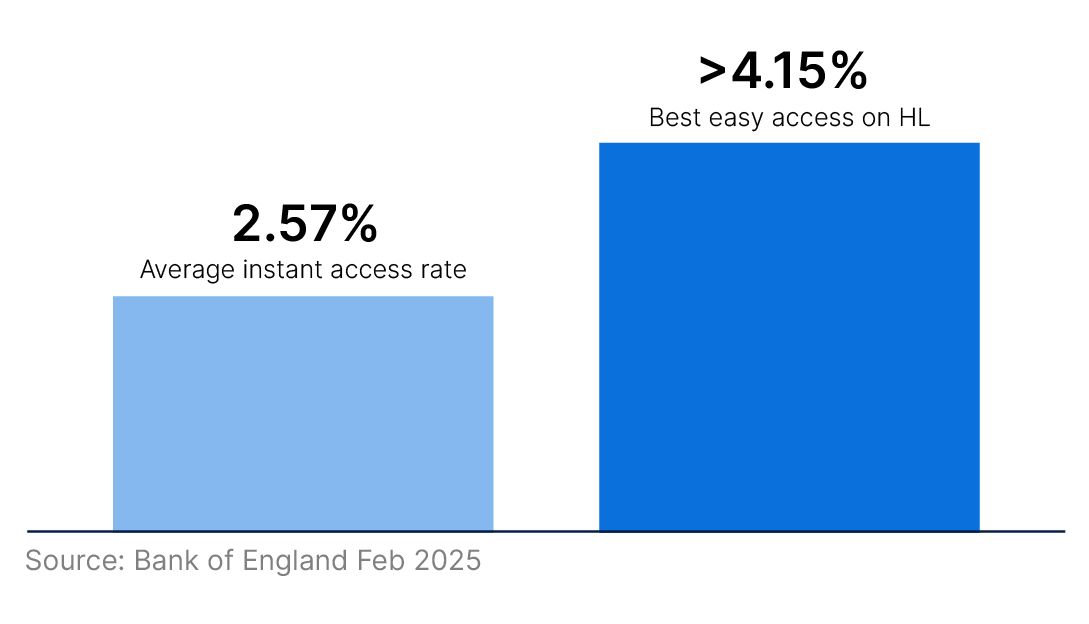

Never settle for average

Last month, the best easy access rate through Active Savings was always 4.15% or better – far ahead of the average instant access rate available.

In fact, the best easy access rate has always beaten the instant access market average.

Start earning more interest in minutes. Then easily switch between banks when your needs change.

Rates are variable. Easy access withdrawals usually take one working day.

Fixed rates for every occasion

We give you more fixed rates than any bank.

That means great rates from one month up to five years.

And with FSCS coverage through each banking licence, save knowing your cash is protected.

Boost your money with an

award-winning savings platform

Join 150,000 clients who trust us with over £10bn of their cash savings.

Great rates

Great rates

Pick and mix between consistently competitive easy access and fixed rate savings.

Multiple banks

Multiple banks

Choose rates from our wealth of banking partners and spend less time shopping around.

Cashback

Cashback

Cashback offer. Act by 11 September 2025 and you could get £10 - £150 cashback. Terms apply.

Tax and your Personal Savings Allowance

You could earn up to £1,000 of interest tax free, depending on which income tax band you're in. This is known as your Personal Savings Allowance.

Interest you earn over your allowance could be subject to income tax. Benefits depend on individual circumstances and rules can change.

All interest paid into your Active Savings account is paid without tax deducted, and counts towards your Personal Savings Allowance.

Grow your savings free of charge

We do not charge any set-up, annual, or exit fees for Active Savings Accounts.

Instead, we charge our banking partners who pay us a percentage fee for every product they may have on our platform.

This means the same or similar products offered directly by the banks and building societies may have different rates to those available on Active Savings.

Our banking partners

Active

Savings

Cashback

To qualify, you must register for the offer and open a new Active Savings account by 11 September 2025. From the day you open your account, you have up to 60 days to add at least £5,000 by debit card or Pay by Bank and deposit this into one or more savings products. If you qualify, cashback will be paid into your Active Savings cash hub by 16 November 2025.

Active

Savings

CashBack

To qualify, you must register for the offer and open a new Active Savings account by 11 September 2025. From the day you open your account, you have up to 60 days to add at least £5,000 by debit card or Pay by Bank and deposit this into one or more savings products. If you qualify, cashback will be paid into your Active Savings cash hub by 16 November 2025.

Existing HL clients with an investment account still need to register for this offer.

You will not be eligible for the offer if you already have an Active Savings account - this includes accounts with no money in them.

.

| You save | Your cashback |

|---|---|

| £5,000 - £9,999 | £10 |

| £10,000 - £19,999 | £20 |

| £20,000 - £29,999 | £40 |

| £30,000 - £49,999 | £60 |

| £50,000 - £74,999 | £100 |

| £75,000 or more | £150 |

Important - Please use the same full name and email address on the registration when you open your Active Savings Account. If the details on your account do not match the details on your registration, your cashback payment may not be made automatically.

All emails relating to this initiative are classed as general marketing. By filling out this form, you are signing up for emails relating to the cashback offer and other relevant marketing we believe might be of interest to you. We explain how we use your data in our Privacy Policy.

If you would like to amend your marketing preferences or unsubscribe, you can do so by clicking ‘unsubscribe’ on any of our emails, once logged in to your account, or by calling our helpdesk on 0117 900 9000.

Important - Please use the same full name and email address on the registration when you open your Active Savings Account. If the details on your account do not match the details on your registration, your cashback payment may not be made automatically.

All emails relating to this initiative are classed as general marketing. By filling out this form, you are signing up for emails relating to the cashback offer and other relevant marketing we believe might be of interest to you. We explain how we use your data in our Privacy Policy.

If you would like to amend your marketing preferences or unsubscribe, you can do so by clicking ‘unsubscribe’ on any of our emails, once logged in to your account, or by calling our helpdesk on 0117 900 9000.

Protecting your money

FSCS protected

Money held with one of our banking partners is covered by the Financial Services Compensation Scheme (FSCS). The FSCS will protect your deposits up to £85,000 if the banking partner fails. This limit is per banking licence.

Safeguarding

Money not in a savings product is held by Barclays Bank. Your money is protected under Financial Conduct Authority (FCA) safeguarding rules if HL were to fail and under the FSCS if Barclays were to fail.

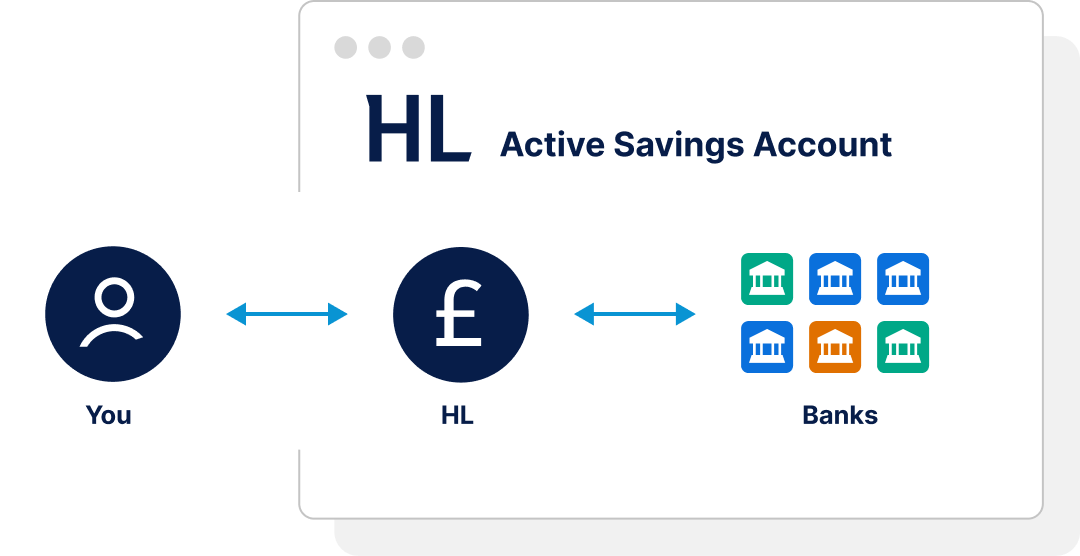

How it works

- Add your money to the Active Savings Account.

- Choose as many products as you like from our different banking partners.

- Spread your money across the products.

- Withdraw your money or select a new product to save into.

Hear why Nick chose Active Savings

Nick talks about his experience with Active Savings.

Ready to get started?

Open an Active Savings Account. Deposit your cash and watch your savings grow.

Active Savings Account or Cash ISA?

Not sure what's right for you? Read more about our accounts and learn about differences in tax treatments, contribution limits and access to cash.

Insights

Guides and Tools

We've pulled together everything you need to know to make the most from your savings.

Frequently asked questions

If you've got a more detailed question that hasn't been answered in our pages, take a look through our FAQs.

Sign up for alerts

Be the first to hear when transfers into the HL Cash ISA are available and when we welcome new banking partners.

This website is issued by Hargreaves Lansdown Asset Management Limited (company number 1896481), which is authorised and regulated by the Financial Conduct Authority with firm reference 115248.

The Active Savings service is provided by Hargreaves Lansdown Savings Limited (company number 8355960). Hargreaves Lansdown Savings Limited is authorised and regulated by the Financial Conduct Authority (firm reference number 915119). Hargreaves Lansdown Savings Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 with firm reference 901007 for the issuing of electronic money.