For many retail investors, the stock market is the primary focus when building a portfolio.

The ups and downs of shares (often referred to as stock and equities too), company earnings, and macroeconomic headlines tend to dominate the financial news cycle.

However, understanding the bond market, and its signals, can give share investors a powerful edge.

Bonds play a crucial role in shaping share valuations, influencing the cost of borrowing for businesses, and even acting as somewhat of a crystal ball for the broader economy.

Here's how stock market investors can use the bond market to their advantage.

This article isn’t personal advice. If you’re not sure an investment is right for you, seek advice. Investments rise and fall in value, so you could get back less than you invest. Yields are variable and no income is ever guaranteed. Ratios also shouldn’t be looked at on their own.

The bond market’s influence on stock valuations

While a stock’s price is tied to the fundamentals of the underlying business, it’s also shaped by the broader landscape across asset classes, including bonds.

At a basic level, stocks and bonds are rivals for investor capital.

When bond yields are low, investors often shift toward stocks in search of better returns, which can help drive share prices higher.

But when bond yields rise – especially yields on high-quality government bonds, which tend to be seen as essentially ‘risk-free’ – that dynamic can flip.

Higher yields make bonds more attractive by comparison, and that can put downward pressure on stock valuations.

Bond yields also play a central role in how investors calculate what a company is worth.

Many use discounted cash flow (DCF) models, which estimate the present value of a company’s future earnings.

Those future earnings are ‘discounted’ using a rate often linked to government bond yields. When yields rise, so does the discount rate – reducing the present value of those earnings and, in turn, the stock’s valuation.

This effect is especially pronounced for growth stocks, where much of the value is tied to profits expected years down the line. For these companies, even a modest increase in bond yields can have an outsized impact on share prices.

Higher bond yields = higher discount rates = lower equity valuations

The cost of borrowing for businesses

The bond market doesn’t just shape investor sentiment – it has a direct impact on how businesses operate, particularly when it comes to the cost of borrowing.

Companies often raise funds by issuing bonds, and the interest they’re required to pay is closely tied to broader bond market conditions.

When bond yields rise, borrowing becomes more expensive.

That added cost can ripple through a company’s decision-making – expansion plans could be put on hold, capital spending might be cut back, and hiring could slow.

Higher interest rates on debt (yields) can put serious pressure on profit margins for companies in debt-heavy sectors as interest costs rise.

Rising borrowing costs should act as a yellow warning sign for stock investors. A more expensive credit environment can squeeze earnings and weigh on future growth.

Paying attention to corporate bond spreads, the gap between corporate and government bond yields, can offer a window into investor sentiment around credit risk.

When spreads widen, it’s often a sign that lenders are becoming more cautious, and that can signal trouble ahead for business fundamentals and, by extension, stock markets.

Higher bond yields = higher borrowing costs

The yield curve as an economic barometer

Perhaps the most valuable insight the bond market offers share investors comes from the shape of the yield curve.

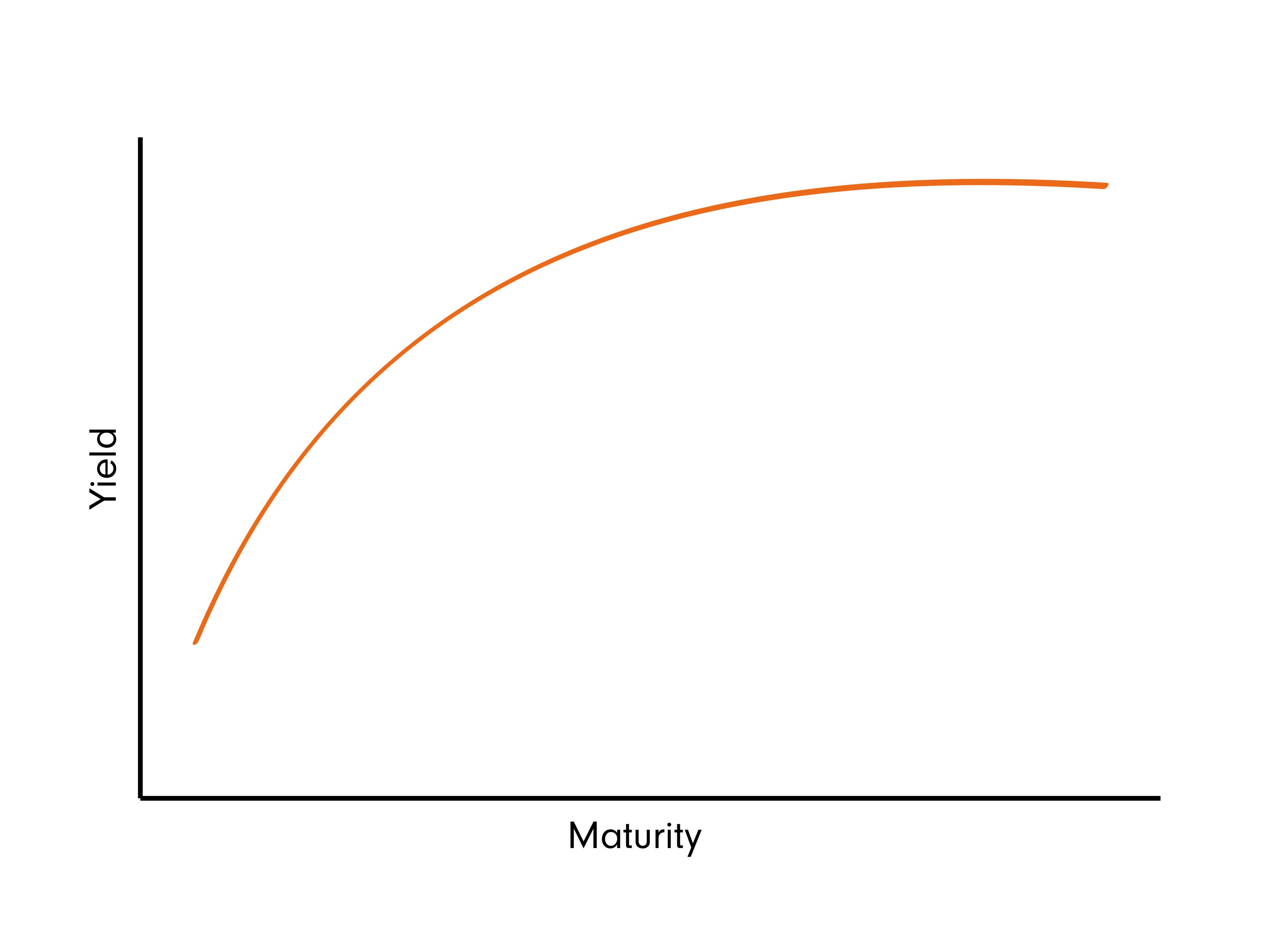

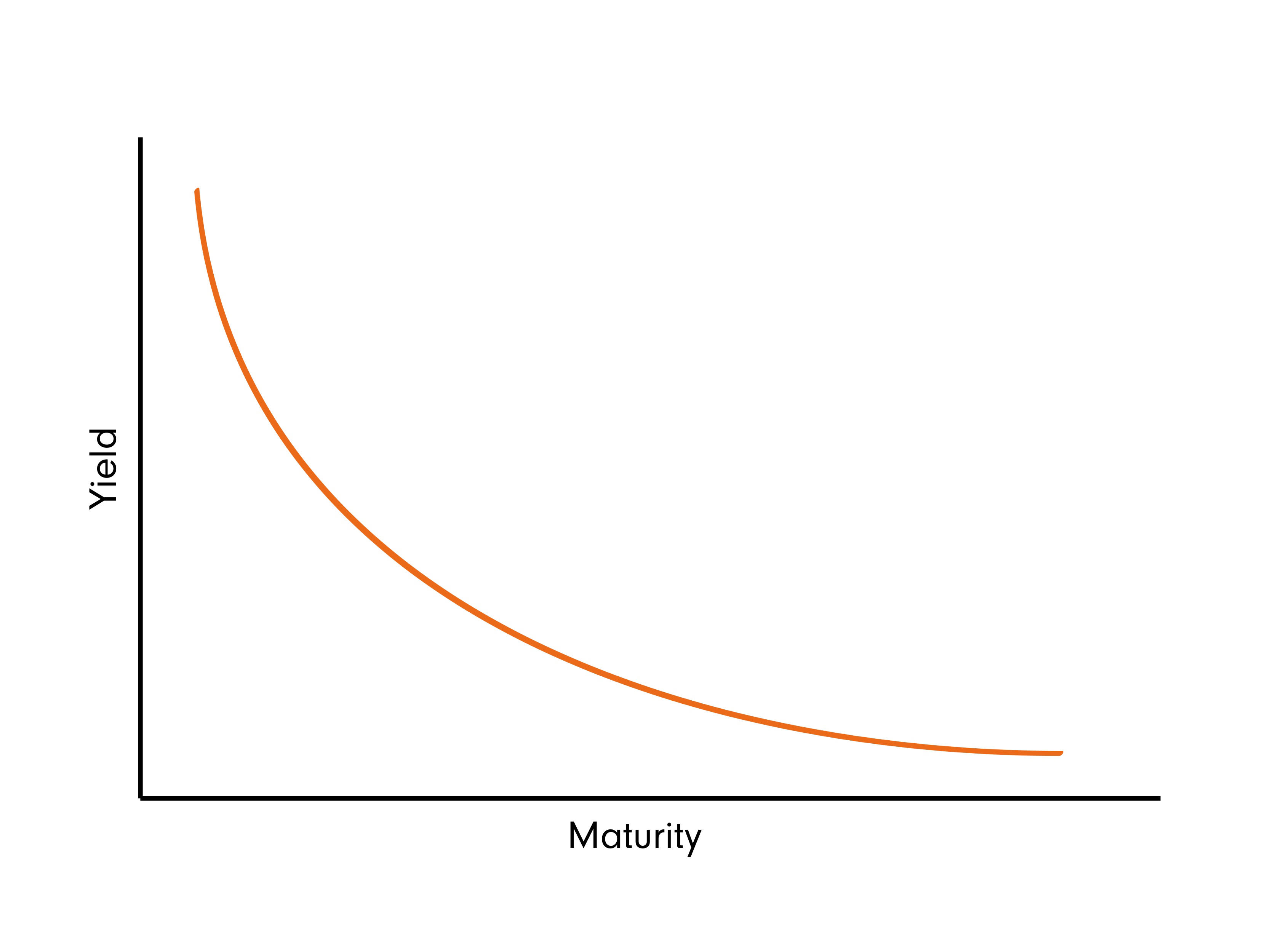

The yield curve plots the yields of government bonds across different maturities, typically from short-term (like 3-month or 2-year bonds) to long-term (like 10-year or 30-year bonds).

A ‘normal’ yield curve slopes upward, meaning longer-term bonds yield more than shorter-term ones, reflecting expectations of future economic growth. Investors need to be paid more to lock their cash away for longer periods.

However, when short-term yields rise above long-term yields – an inverted yield curve – it has historically signalled tricky times ahead.

Yield spreads offer insight into expected economic conditions

The UK yield curve

If we compare the current UK yield curve to where it was a year ago, we can see some interesting developments.

UK gilt yield curve

You’ll notice the curve is generally upward sloping, which suggests some future growth is expected, and the lack of any inversion is generally a good sign.

Over the last year, however, there have been some shifts.

Yields at the shorter end have come down, a reflection of weakening conditions and the expectation that short-term interest rates might be cut by the Bank of England.

But at the same time, longer-term yields have risen. That tends to be a bad sign for businesses whose borrowing costs are likely to have risen as a result. This suggests markets are concerned about future inflation and perhaps the UK’s growing debt burden, which tracks with what we’ve seen in recent months.

The US government’s tariff policies have stoked global inflation fears. Plus, we’ve heard from the UK government that there’s little to no wiggle room in the country's finances, meaning it could need to borrow more (issue more debt) if things don’t go as planned.

All in, it’s not bad, but there are signs that the economic outlook is getting more challenging.

Putting it all together

The bond market is vast and actually bigger than the stock market.

The collective actions of bond investors – reflected in bond yields, spreads, and curve shapes – can offer timely, valuable clues about future economic and market conditions.

For the retail investor, you don’t need to become a fixed-income expert. But keeping an eye on key metrics – like the 10-year government bond yields, the spread between corporate and government bonds, and the slope of the yield curve – can offer some critical context when investing in stocks.