Shopify reported a 32% rise in third-quarter revenue to $2.8bn (as expected). Growth was broad, driven by a 32% increase in the value of orders processed through the platform to $92bn.

Operating profit rose 21% to $343mn, driven by the top line growth.

Free cash flow rose 20% to $507mn. Net cash, including leases, was $5.2bn at quarter-end.

Third-quarter guidance points to revenue growth in the “mid-to-high twenties”.

The shares fell 3.8% in pre-market trading.

Our view

We continue to be impressed with the execution at Shopify. Top line growth is strong and that’s feeding through to rising cash flows at the bottom of the funnel. Sentiment has improved significantly over the past 6 months, so there’s extra pressure now to keep raising the bar.

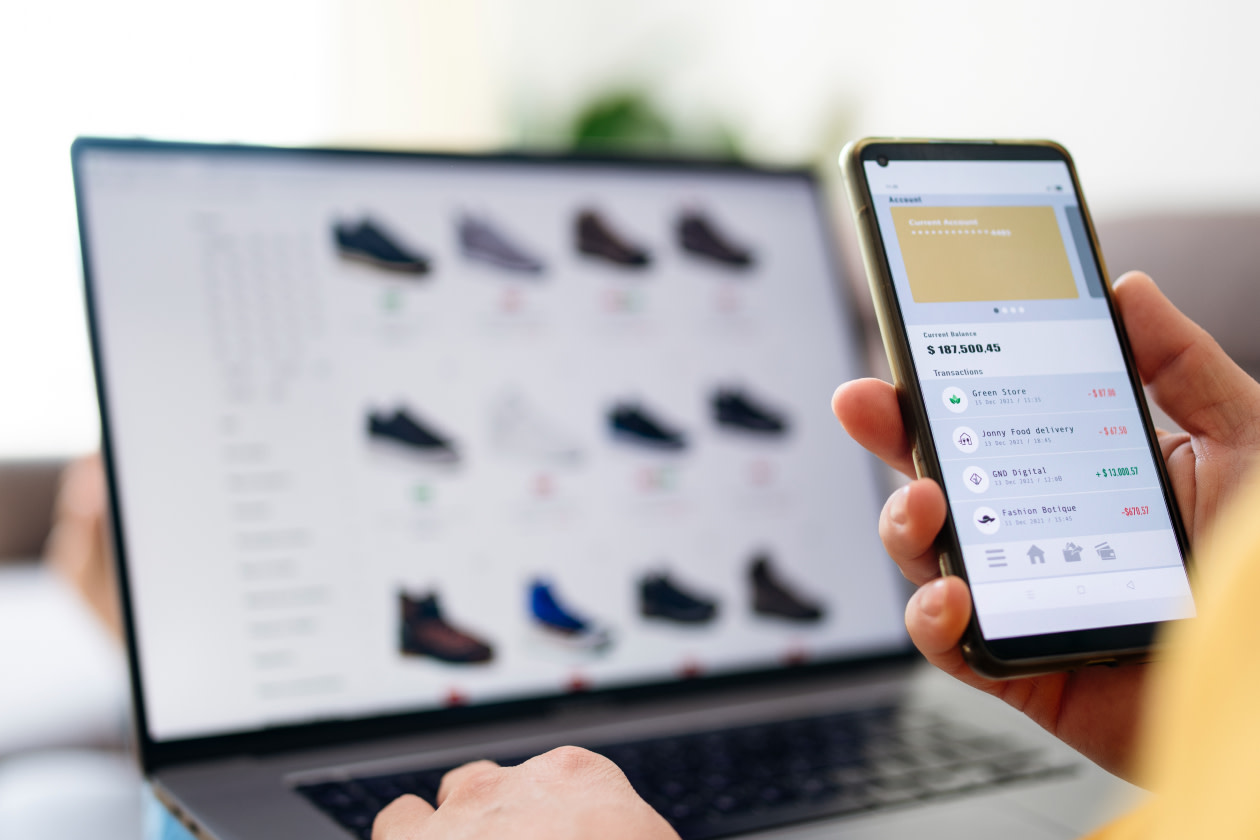

Shopify is a commerce powerhouse. But rather than selling products itself, it provides the internet infrastructure for businesses to operate online. Its platform simplifies the complex world of online retail, offering a range of tools for businesses of all sizes to create and manage their online shops. This covers website templates to payment processes, and everything in between.

Perhaps unsurprisingly, the shift towards digital shopping has been a major growth driver for Shopify. AI adds another angle, and the digital first platform is well placed to adapt and evolve as new ways to shop take hold.

The recent announcement of Shopify within ChatGPT is a perfect example of where AI can add value. ChatGPT users will soon be able to buy from Shopify’s merchants within ChatGPT, giving Shopify first mover advantage in what we think will be a major shift in how we shop. We’re also excited about the improved journeys on social media platforms, as another avenue where younger shoppers are spending more time.

We share some of the market’s enthusiasm, particularly for the group’s subscription-based revenue, which it collects from sellers to use its platform. While these make up a smaller portion of overall revenue, it’s still a more resilient and profitable source of income than the slice it collects on each sale.

Investments are being made to expand the range of solutions clients can subscribe to. But for now, the merchant solutions segment, including transaction fees, still contributes around two-thirds of group revenue, tying Shopify’s success closely to that of its customers.

Aside from investing in the business, the group’s been keeping a tight grip on costs and making sure the headcount remains stable is a real focus. Coupled with shedding the burden of its unsuccessful logistics company last year, the underlying financial profile has significantly improved in recent years.

Overall, we’re impressed by Shopify’s leading proposition and ability to integrate itself into merchant’s operations. There are several potential growth levers; from expanding beyond the US, a new generation of AI and social media shoppers, to the adoption of its services from larger players.

But with the sharp move higher in recent months, a lot of those strengths are already built into the valuation.

Environment, social and governance risk

The technology sector is generally medium/low risk in terms of ESG, though some segments are more exposed, like Electronic Components (environmental risks) and data monetisers (social risks). Business ethics tend to be a material risk within the tech sector, ranging from anti-competitive practices to intellectual property rights. Other key risks include labour relations, data privacy, product governance and resource use.

According to Sustainalytics, Shopify’s management of material ESG issues is average.

ESG reporting is in place and the board is responsible for overseeing ESG issues, but reporting does not align with leading best practices. Data privacy is an important risk, and it’s being managed well but with room for improvement. There haven’t been any major controversies from a data or cybersecurity standpoint, but it could do with improving regular risk assessments.

Shopify key facts

All ratios are sourced from LSEG Datastream, based on previous day’s closing values. Please remember yields are variable and not a reliable indicator of future income. Keep in mind key figures shouldn’t be looked at on their own – it’s important to understand the big picture.

This article is original Hargreaves Lansdown content, published by Hargreaves Lansdown. It was correct as at the date of publication, and our views may have changed since then. Unless otherwise stated estimates, including prospective yields, are a consensus of analyst forecasts provided by LSEG. These estimates are not a reliable indicator of future performance. Yields are variable and not guaranteed. Investments rise and fall in value so investors could make a loss.

This article is not advice or a recommendation to buy, sell or hold any investment. No view is given on the present or future value or price of any investment, and investors should form their own view on any proposed investment.