Thank you for downloading your guide to Self-Invested Personal Pensions

Your download should start automatically. If it doesn't, download your copy here.

Important information - SIPP investors need to be happy to make their own investment decisions, and understand that all investments can rise and fall in value. It’s possible to get back less than you pay in. You’ll usually need to be at least 55 (rising to 57 from 2028) before you can access the money in your pension. Pension and tax rules can change and any benefits will depend on your circumstances. Before transferring a pension you should always check the costs involved first and whether you’d lose any valuable benefits. If you’re not sure what’s best for your situation, you should ask for financial advice.

What is a SIPP?

A Self-Invested Personal Pension (SIPP) is a type of account that allows you to take charge of your retirement savings. You have the freedom to invest exactly where you want to and control how much money goes in and when.

You have all the same tax advantages as a traditional pension, and the government will still give you a boost of up to 45% (or 48% if you're a Scottish rate tax payer) on top of anything you pay in as tax relief.

You can even use a SIPP to combine all your old pensions into one easy-to-use online account. And take money out from age 55 (rising to 57 from 2028).

Pension and tax rules can change and any benefits will depend on your circumstances.

Join over 500,000 clients already using the HL SIPP

Flexible payments - Monthly direct debits from as little as £25 a month, with the ability to pause or cancel payments if you ever need to.

Invest where and how you want to - You can pick your own investments, select one of our ready-made portfolios, or pay a financial adviser to choose investments for you.

Freedom at retirement - With the HL SIPP, you're free to choose from all the main retirement options, including taking a flexible income.

SIPP charges

The HL SIPP is free to set up and low cost to run. Our yearly charge for holding investments is never more than 0.45%. Some investments will have their own annual charges, so please check these first before you invest.

It’s free to buy and sell funds. Other dealing charges depend on the type of investment and how often you trade.

Two simple ways to open a SIPP

Start with a bank payment

Set up monthly payments from as little as £25, or make one-off payments of £100 or more.

You can change your pension contributions whenever you like.

Transfer your old pensions

Transferring pensions from another provider, including old workplace pensions, can help you to take control of your retirement savings.

The fastest way to transfer is online.

How much can you pay into a SIPP?

If you're a UK resident under 75, you can usually pay in as much as you earn each year, up to £60,000 across all your pensions, and get tax relief. You may be able to pay in more or less than this amount if you have unused allowance from previous tax years, you're a high earner or have flexibly accessed your pension.

What can I invest in with a SIPP?

With a SIPP, you’re in control of how and where you invest.

To build your own portfolio, choose from over 2,500 funds, UK and overseas shares, investment trusts and more. Or, you can choose from a range of ready-made options where our team of experts will take care of the day-to-day investment decisions for you.

Switch your pension on

Helping people save and invest for over 40 years

Trusted by over 2 million clients

We’re a financially secure company, authorised by the Financial Conduct Authority. And have won over 200 awards.

Expert knowledge and guidance

Get the latest investment news, research and insight. Plus tools to help you make decisions with confidence.

Ongoing support

Help from our UK-based client support team. Or personal financial advice from our highly qualified experts.

Taking money from a SIPP

Money in your pension is usually locked away until you’re 55 (57 from 2028). But any time after that, you can start to withdraw money, even if you’re still working.

Use your SIPP to buy a guaranteed income for life, or keep it invested and make withdrawals as and when you need to. Plus, get up to 25% tax-free (all other income withdrawals are taxable).

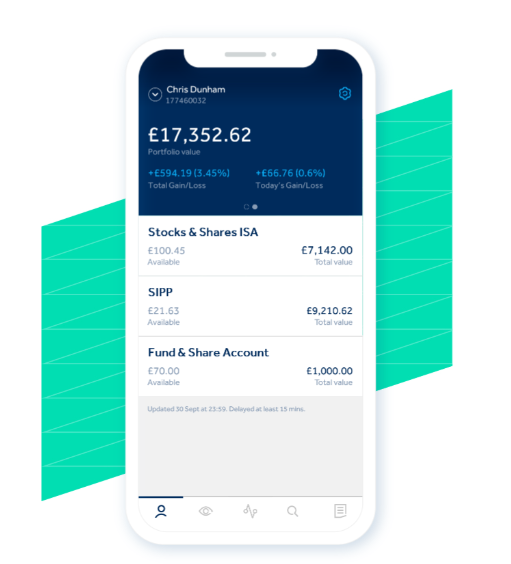

YOUR PENSION IN YOUR POCKET

The HL app

Fast, secure account access

Log in to your account securely using fingerprint login and Face ID on iPhone.

Your investments at a glance

It's easier than ever to see your investment performance and if your pension's on track.

Place deals on the go

Buy and sell investments, even on the move.

Apple, the Apple logo, Face ID and iPhone are trademarks of Apple Inc., registered in the U.S. and other countries.

SIPP FAQs

Anyone under the age of 75 who is a UK resident or a Crown employee, or their spouse or civil partner who is working overseas, can open and pay into a SIPP.

Yes, you can have both a SIPP and your existing workplace pension, and this can be a flexible way to top up your retirement savings tax-efficiently. If you have access to a workplace pension, make sure you’re maximising any employer contributions before deciding whether to pay into a SIPP. You’ll also need to make sure the money put in across all your pensions each year (including any basic rate tax relief added by the government) doesn't go over the total pension annual allowance of £60,000.

You can set up an HL SIPP from as little as £25 a month, or by making a one-off contribution of £100 or more. All you need to hand is your National Insurance number and either your bank details or debit card.

You can also open an HL SIPP by transferring a pension. The fastest way to transfer is online. You'll need your pension name and type (e.g. Aviva personal pension), policy number and pension value (this doesn't have to be exact) to get started. You should be able to find these details on your annual statement or can ask your current provider when you’re checking what exit fees apply or if you’ll lose any valuable benefits.

You can have as many SIPPs as you like, but you just need to make sure the money you put in across all your SIPPs each year doesn't go over the total pension annual allowance.

No, SIPPs are not subject to Inheritance Tax (IHT). So, it could be more tax-efficient for clients to withdraw other investments at retirement and leave their pension intact.

Best Buy Pension

Boring Money Awards 2026

Best For Investment Research

Boring Money Awards 2026

Best For Customer Service

Boring Money Awards 2026

Help and support

If you have any questions about pensions, you can speak to one of our UK-based client support experts.

Call us on 0117 980 9926