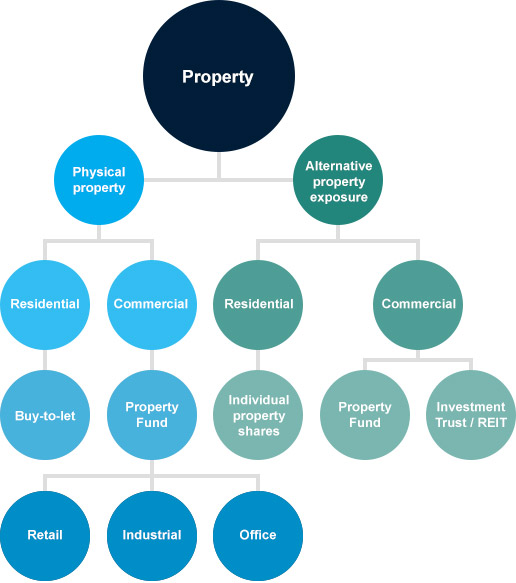

Investing in property is much more than just buy-to-let. While there aren’t many funds that invest in residential property, commercial property offers plenty of investment opportunities. It’s broadly divided into three areas: retail, industrial and office. Most investors access this part of the market through property funds or REITs (Real Estate Investment Trusts).

There are two IA (Investment Association) fund sectors devoted to property. The IA UK Direct Property sector contains funds that invest in bricks & mortar. The IA Property Other sector includes funds that invest elsewhere, such as overseas or in property company shares.

Scroll across to see the full image.

Our view on the Property sector

The performance of property funds usually depends on how the economy’s doing. In good times demand for property increases. This pushes up rents and property prices and encourages more construction. During slowdowns or recessions the opposite happens.

Commercial property is normally preferred by investors in need of an income. That’s because most of the returns come from rental income. As with any investment the value of property investments and the income they could provide can fall as well as rise.

Funds investing in physical property

Property funds that invest directly in bricks and mortar are popular with investors, but we don't think they're the best way to invest. This is because commercial property is illiquid so it’s not easily bought and sold. It’s time-consuming, labour-intensive, and expensive.

This creates problems for fund managers. Investors usually want to put a lot of money into their funds when performance is good, and the outlook is rosy. But because it can take months to find and buy suitable properties, the manager often ends up holding a lot of cash and missing out on rising property prices.

Similarly, when the outlook isn’t so good, or when performance has been poor, investors tend to sell property funds. This often forces the manager to sell properties in order to give investors their money back. The best properties are often quickest and easiest to sell, so remaining investors can be left with less attractive investments.

To help with this issue fund managers adjust the pricing of their funds and can stop investors trading them. These decisions are not taken lightly and only in extreme circumstances. It does mean you could receive less than you expect when selling a property fund, or not be able to sell at all for a period of time.

This can hurt the fund’s performance and means returns aren't solely down to the skill of the fund manager. The high costs associated with buying and selling property also eats into the income received by investors, more so than when buying and selling shares.

Funds investing in property company shares

These funds work in a similar way to funds that invest in company shares. The value of the fund is directly linked to the value of the shares the manager invests in.

They mostly invest in REITs. REITs own and operate a variety of properties and are looked after by an expert management team. This helps to spread risk and means they don't rely on a small number of properties.

You can also invest in REITs, and other property-related investment trusts, directly. These don’t have the same problems as unit trusts when large numbers of investors try to buy and sell at the same time. But it's possible for the shares in the REIT or investment trust to trade below (or above) the value of the properties they invest in. This is known as trading at a discount (or premium).

Investment trusts can also borrow money to invest, often called gearing. This can improve returns when markets are rising, but increases losses in falling markets, so it’s higher risk.

We think investors who want to invest in a specialist area should make sure it forms a small portion of a diversified portfolio.

Investment notes

Please remember past performance is not a guide to future returns. Where no data is shown, figures are not available. This information is provided to help you choose your own investments, remember they can fall as well as rise in value so you may not get back the original amount invested.

Property fund reviews

The fund ideas below are provided for your interest but are not a guide to how you should invest. These fund ideas are reviewed and updated periodically to ensure they match our latest views. For more information, please refer to the Key Investor Information for the specific fund. Remember all investments, and any income from them, can fall as well as rise in value so you could get back less than you invest. Past performance is not a guide to the future.

These funds invest in property. Valuations are subjective, and property is harder and more expensive to buy and sell than other assets. In exceptional circumstances, dealing in property funds may be suspended and you may be temporarily unable to sell your investment.

There is a tiered charge to hold funds on the HL platform - view our charges.

Source for performance figures: Financial Express.

This fund mainly invests in real estate investment trusts (REITs). It also invests in companies that don’t invest in property but make most of their money from the property industry.

The fund is mostly invested in companies that own, manage or develop UK properties. Some of them specialise in niche areas such as hotels, student accommodation or healthcare buildings. The portfolio also includes companies that don’t invest in property directly but that have a big link to the sector.

Part of the portfolio is invested in countries across Europe, like Germany, Sweden and Belgium. The fund can invest up to 20% overseas, which means it’s not solely reliant on UK-based businesses. The managers don’t invest in many companies. That means each one can have a big impact on performance, but it adds risk.

This fund was formally known as Global Property Securities Equity Index. Its name changed following a change in the index they want to track. It aims tracking the performance of the FTSE EPRA NAREIT Developed Green Low Carbon Target Index as closely as possible. It invests in hundreds of property companies worldwide.

More than half the fund is invested in North America, with the rest spread over Europe and developed Asian countries. Roughly 4% is invested in UK property companies. This could make it a good option to diversify a portfolio with more invested in UK property.

iShares is run by BlackRock, one of the largest providers of tracker funds on the market. They use their size and expertise to keep costs low, which helps them mirror the index. So far, we think they’ve done a good job – the fund's tracked its index closely and efficiently over the long term, although past performance is not a guide to the future.

The fund invests in some smaller companies. These could offer higher growth potential but they’re higher-risk than larger companies.

The manager invests directly in properties all around the UK, with over half the fund covering the South East, West Midlands and South West.

The fund’s investments are well-spread across the UK and it owns almost 70 properties. Around 45% of the fund invests in industrial property, with the rest invested in UK office and retail property. It can also invest in the shares of property companies as well as REITs.

High quality properties are preferred and the managers aim to improve their value by working closely with their tenants and building managers. They think this helps keep buildings fully occupied and improves long-term performance. The manager can use derivatives to invest, which adds risk.

The managers don’t invest in many companies. That means each one can have a big impact on performance, but it adds risk. The fund invests in assets which can be difficult to buy or sell quickly and the Managers may defer withdrawals or suspend dealing in times of market uncertainty.