Revenue is vanity, profit is sanity, but cash is king – or so the saying goes.

That’s because cash is what customers pay in, and what shareholders might get as a dividend.

Why is profit different to cash?

Profits can be sliced and diced in lots of different ways, but you can’t mess about with cash. It’s either there or it’s not.

For example, two key costs that affect profits, depreciation and amortisation, are not cash charges. They’re simply adjustments designed to smooth the cost of assets out over their usable lives.

Think about a company that invests £1mn in a new processing machine. Rather than take a one-off cost of £1mn against the income statement, it will depreciate the value of the asset over its useful life. If that’s 10 years, the company might choose to evenly depreciate the cost at a rate of £100,000 a year.how to

That smooths the cost base. But of course, the only cash outflow is the initial £1mn. Here’s an example.

Year | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

|---|---|---|---|---|---|---|---|---|---|---|

Cash flows (£) | -1mn | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

Depreciation (£) | -100k | -100k | -100k | -100k | -100k | -100k | -100k | -100k | -100k | -100k |

There are other ‘non-cash’ movements associated with an income statement too, like when a company is forced to write off the value of an asset through a write-down or impairment.

For example, a retailer might have a clothing line that it can’t sell. At some point, it must account for the fact that the inventory has little to no value – that would be a write-down or impairment.

There’s no cash changing hands, but the drop in accounting value passes through the income statement as a charge and weighs on profits.

This article isn’t personal advice. If you’re not sure an investment is right for you, seek advice. Investments and any income from them will rise and fall in value, so you could get back less than you invest.

Statements and ratios shouldn’t be looked at in isolation. Instead, use them to form a bigger picture of company health and prospects, which can help to inform your investment decisions.

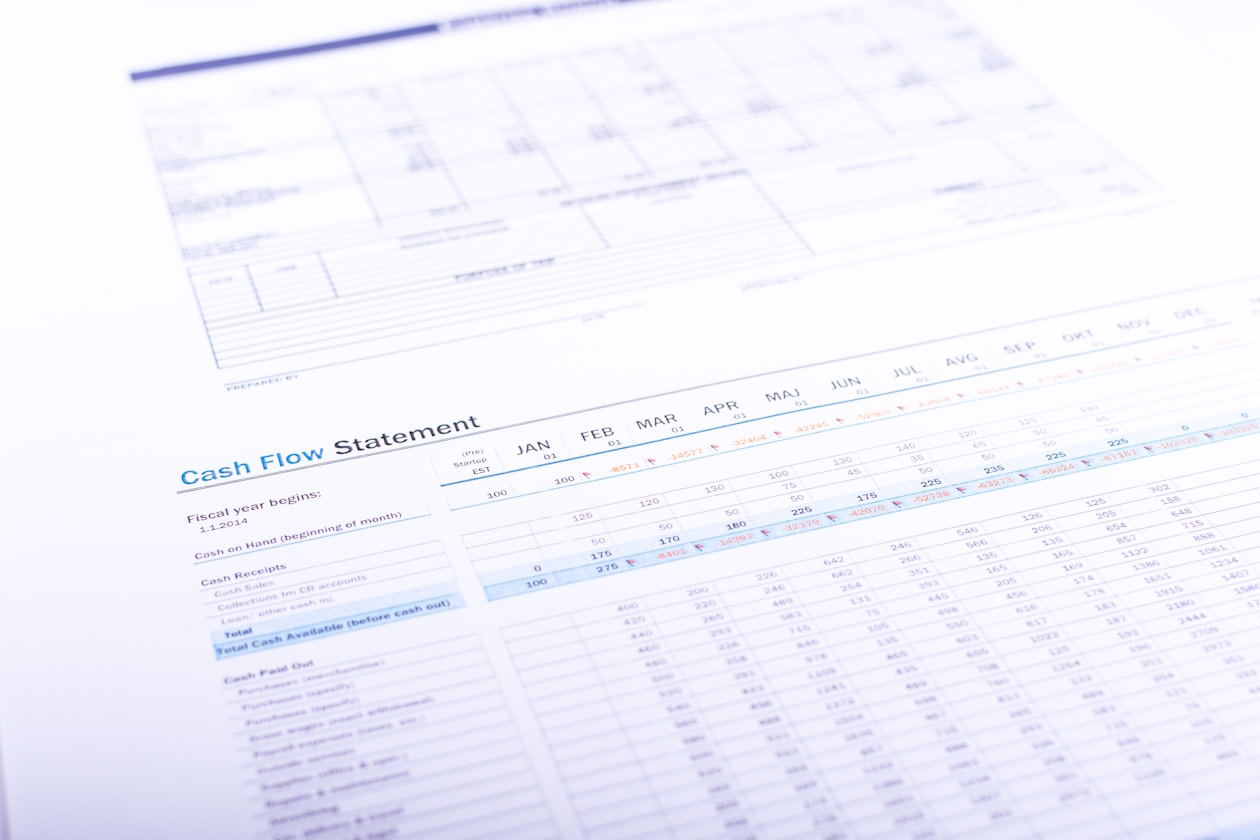

What goes on a cash flow statement?

Cash flow statements are divided up into three sections – operating cash flows, financing cash flows and investing cash flows.

They do pretty much what they say on the tin.

For example, operating cash flows reflect the day-to-day operations of the business. Think the money coming in from product sales minus the costs of doing business.

So how do we get to cash?

If you remember, profit figures can have non-cash items included. So, to get cash, we start with net income and adjust for differences between accounting items and actual cash flows.

Here’s a simplified example:

Net income | £5,000,000 | Start |

|---|---|---|

Depreciation | £500,000 | Add |

Amortisation | £275,000 | Add |

Gain on the sale of land | (£100,000) | Deduct |

Increase in payables | £50,000 | Add |

Increase in receivables | (£75,000) | Deduct |

Operating cash flow | £5,650,000 | End |

Starting with net income, the first step is to adjust for non-cash items like the depreciation and amortisation expenses we discussed earlier.

We can then look at non-operating items.

For example, gains or losses made on the sale of assets would pass through the income statement, but typically these proceeds aren’t part of a company’s standard operations.

That means they’re likely to fall under cash flow from investing, not operations. We therefore need to deduct any gains and add back in any losses.

Then we can move to balance sheet items.

Companies can book revenue before the cash has turned up, and record costs before a payment has actually been paid. Think about when you buy something on a credit card. The transaction happens, but the bank won’t take any cash from your account on the day.

Two key items to keep an eye on are receivables and payables, both of which are recorded on the balance sheet.

Receivables appear as assets because they reflect money owed from customers. Payables are liabilities, for example money owed to suppliers.

We’re interested in the change in the numbers from year to year.

If the company’s payables rise and receivables fall, that means it’s deferred payments to suppliers or improved collections from customers – both of which are good news for cash flows.

Alternatively, falling payables and rising receivables are bad news for cash flow.

You end up with operating cash flow, sometimes referred to as cash from operations (CFO). This reflects the cash that’s come into the company’s coffers from operating activities.

What do financing and investing cash flows tell us?

For a complete picture, we need to think about financing and investing activities too.

By looking at the financing and investing cash flow sections, we can find out about a company’s longer-term investments in property and equipment.

We can also find out about its financial comings and goings – think loan repayments, investments in other companies, proceeds from rights issues and share buybacks.

In investing cash flows, you’ll find ‘purchase of property, plant and equipment’. Again, the meaning is straightforward, it’s the cash the company has spent on new sites and equipment. If this is deducted from operating cash flow, we get a useful metric called free cash flow.

It shows what’s left over from operating cash after expansion and upkeep costs.

A positive free cash flow suggests the business has cash left over to give back to shareholders, pay off debts, invest in research & development (R&D) or use to acquire other companies.

It can be useful to determine if a company’s free cash flow is, and has consistently been, greater than the dividend paid. That’s another figure you’ll be able to find on the cash flow statement, under financing cash flows.

If you don’t fancy doing all the number crunching yourself, our team of equity analysts provide research on some of the UK’s biggest listed companies. We can help complement your own research.

If you’d like to receive our analysis, it can be sent straight to your inbox.