The outlook for 2026 is mixed. Interest rates are expected to fall through 2026, with the market pricing in at least two cuts of 25 percentage points a piece on either side of the Pond. This should be supportive for equities – see the positive response in recent weeks to the prospect of the Federal Reserve (Fed) cutting rates in December.

But the macro picture is far from rosy. In both the US and the UK inflation is stubborn and economic growth looks weaker. There are glitches – or cockroaches as JPMorgan’s Jamie Dimon called them – in the financial system which could be early warning signs of an impending market downturn, and US equity valuations are very toppy compared to historical averages.

Despite these all-time-high prices, earnings continue to deliver, and in certain sectors there is market ebullience. So how do investors square these seemingly contrary data points?

This article isn’t personal advice. Unlike cash, investments can fall as well as rise in value, so you could get back less than you invest. If you're not sure what's right for you, ask for financial advice.

Macroeconomics and politics

Let’s start with the backdrop. In the UK, recent forecasts from the Office of Budget Responsibility (OBR) upgraded inflation expectations for 2026 from 2.1% to 2.5% thanks to higher wages and services. This is still a downward trend however, and as such, we should expect interest rates to also come down through the year – though not at the velocity that households might hope. The Bank of England has taken a slow and steady approach to rates so far and we expect this to continue with two-three cuts through 2026. This is supported by growth expectations for the UK, which – while recently downgraded by the OBR to 1.4% – is positive for the year ahead, negating the need for drastic cuts.

In the US, there are more complex factors at play. Inflation continues to moderate, but US policies risk overstimulating an already growing economy.

President Donald Trump has mooted the idea of tariff cheques on social media, echoing the covid cheques that helped boost GDP during the pandemic. The so-called One Big Beautiful Bill also drip-feeds tax cuts and spending into the system, adding more debt to a country already running a record deficit.

Add to that, the President is looking to replace outgoing Federal Reserve Chair Jerome Powell with a candidate that is more dovish (and sympathetic to the White House). Consensus is for two cuts in the US through 2026, following the December 2025 cut. But Trump may push for more.

The US economy is not going gangbusters. The jobs market is weakening, adding to expansion concerns heading into 2026. But Trump is keen for it to do better as he heads into mid-term elections next year. If you pump too much stimulus into the system, and stoke too much demand, inflation will re-ignite. This in turn could mean the Fed is forced back into a hiking cycle, which equity markets will not like. It is a difficult balance to get right – and it will create volatility in the bond market, which in turn creates opportunities for the tactical investor.

We are bullish on neither the pound nor the dollar as we move into 2026, though for different reasons. The recent UK Budget saw the pound initially rally as the Chancellor delivered her speech, but as the market digested the OBR’s lower growth forecasts, and the lack of near-term economy-boosting policies in the days that followed, sterling gave up its gains. We do not see enough evidence to contradict the market. A weaker pound is good news for the FTSE 100, as three quarters of the companies’ earnings are ex-UK.

We are similarly lacklustre on the dollar. The world’s reserve currency has had stiff competition over the past year as the preferred store of wealth. Global central banks have instead been buying up gold – stoking the record highs. Gold’s shine is relative. Trump’s erratic approach to tariffs and global diplomacy, and the threat of Russia having its assets seized by global players supportive of Ukraine has made the metal a more attractive neutral reserve.

Dollar weakness can create investment opportunities however – it is good for US-based firms with global revenues, and good for emerging markets.

On gold – Goldman Sachs estimates that central banks will target around 20% of reserves in the precious metal, and China is currently at around 8%, which – alongside continued geopolitical uncertainty – should prop up the gold price, though we do not expect the returns of this year, or last, to follow in 2026.

Equity valuations

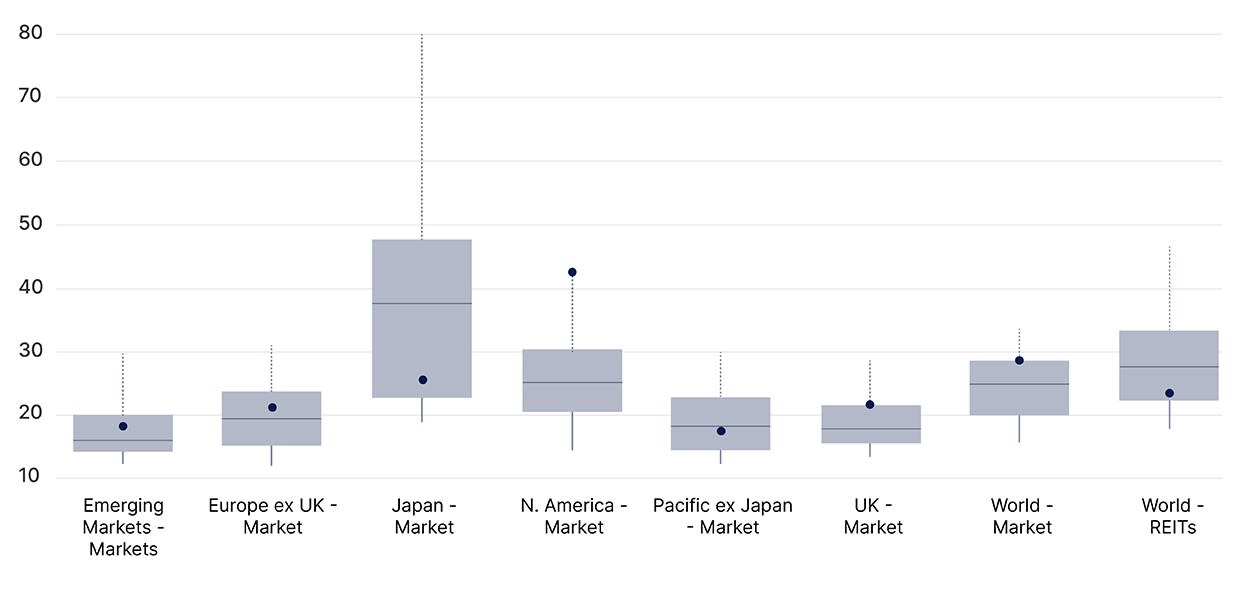

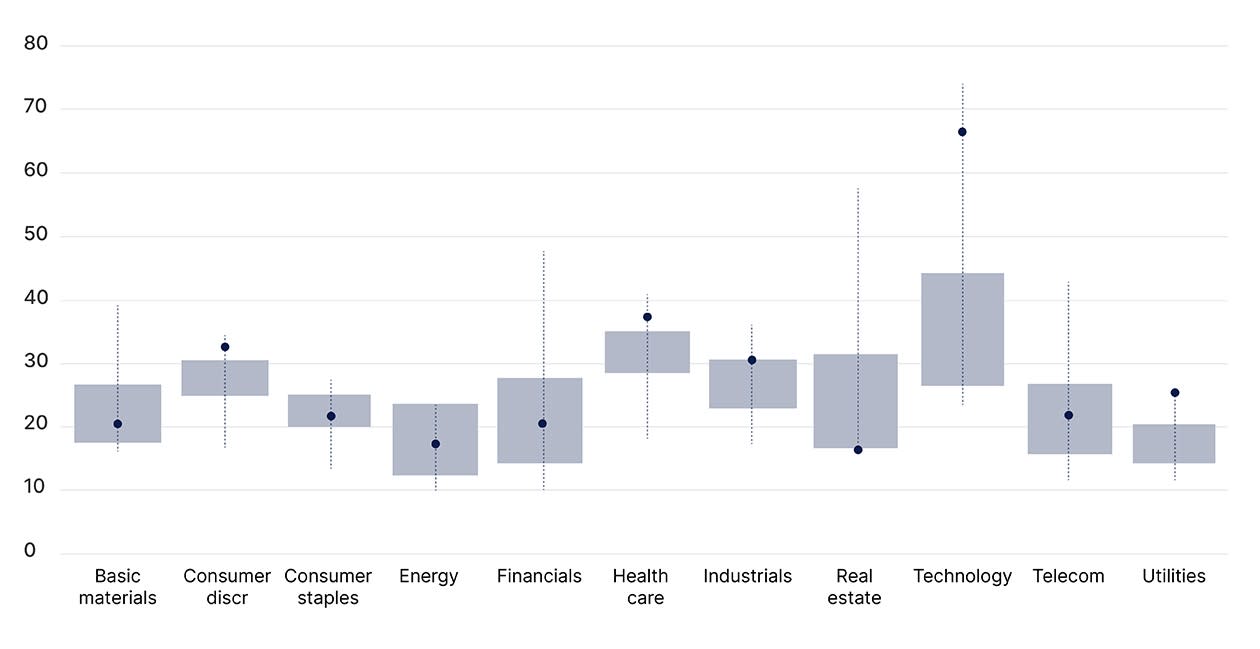

We close 2025 having seen strong stock market returns across the globe. Market valuations for the US are far above historical averages. The graphs below use the cyclically adjusted price earnings ratio, a measure of a company or market’s value, to compare current market values – the dot – to valuations since each sector was formed, ranging from 20 to 60 years of data – the box. As you can see, both the N America and the global tech sector, driven higher by fantastical returns from AI companies are at historically very high valuations.

These companies are “priced for perfection” – forecasts that are perpetually beat, competitive spending that only increases. Past performance is absolutely no guarantee of future returns. The AI adoption gap remains a risk. There is significant scope for productivity enhancements across all sectors, and AI will be additive to GDP, but it is unclear whether current valuations flow through to benefits seamlessly.

While we think there are some star players within the sector that will be crucial to charging global growth, there is risk that the wider sector is overvalued and in “bubble” territory. If this happens and sentiment shifts – whether for macro reasons or company specific concerns emerge, all companies – even those with strong fundamentals – will be impacted. Goldman Sachs and Morgan Stanley have both stated this sector is “fully valued” in recent months, and we expect the AI story to continue to drive returns, and volatility, through 2026.

How global markets are currently valued compared to historical averages

How global equity sectors are currently valued compared to historical averages

Rout risks?

Is an AI bubble, a too-bullish President, soaring government debt and a wobbly jobs market enough to cause a stock market crash?

Potentially not imminently – momentum could continue if key companies’ results deliver, though there is growing concern about valuations. But it would be remiss not to mention the more esoteric indicators that have flashed red in returns months. The bankruptcy of US sub-prime auto-lender Tricolor was one such indicator. It was sub-prime unwinding that caused the global financial crisis, and the failure of this firm is down to borrowers defaulting on their loans, hardly a sign of a robust consumption-driven economy.

Indeed, it was the failure of Tricolor that caused JPMorgan Chase CEO Jamie Dimon to remark “When you see one cockroach, there are probably more”. A few weeks later, five US regional banks revealed they had made a series of bad loans linked to the troubled California real estate market, sending share prices down and lawsuits up.

The good news is these look like isolated incidents. US bankruptcy rates are at pre-pandemic levels, and we will be watching this closely. But investors should note even if the data is reassuring, when markets are frothy, negative news flow creates volatility.

3 themes for 2026

For all the reasons above, a well-diversified and tactical investment approach is increasingly important, across both equities and fixed income. Investors who may not wish, or have the capacity, to do this themselves should look for fund selections that have breadth and flexibility, such as volatility managed multi-asset solutions, or seek professional financial advice.

Take the time to understand a potential investment before investing. When making decisions, investors should consider their goals and attitude to risk as the themes below may not be right for everyone. Bear in mind that while these themes are ones we consider of interest for 2026, investing should be for the long term and that investment values and income can rise and fall.

Nimble Bonds

Bond markets offer opportunities for income now and the potential for total return as yields come down.

For investors looking to take advantage of the market volatility an active approach is best. Pick fund managers with a proven track record trading across the market, as changing rhetoric through the year is likely to create opportunities.

Actively managed funds can take advantage of the market volatility and we think the potential for opportunity here outweighs the additional cost of an active approach. Look for funds that can invest in government and corporate bonds, across different geographies.

Emerging Markets

Emerging markets offer ongoing opportunities, shaped by shifting tariff policies as emerging economies move away from US supply chains to inter-Asia and inter-emerging market trade routes.

Valuations are attractive on a relative basis and emerging markets offer some much needed diversification alongside the crowded US megacap trade.

There is potential for the India market to rally following weakness in 2025. We expect the dollar weakness to benefit the broader sector. Emerging markets can be more volatile than developed markets, so investors should be comfortable with this risk.

Quality

The “quality” style of investing means companies that have characteristics which should do well regardless of economic backdrop. This is typically because they have stable and predictable cashflows and little to no debt. This often includes companies in sectors such as utilities, consumer staples, healthcare and industrials. This has been out of favour in recent years as either high-growth tech firms, or value-biased companies have led returns.

We think this has created a potential buying opportunity to rebalance portfolios, and should markets take a down-leg these companies are likely to hold up better.

Find out what else we’re thinking about in 2026 with our 5 Funds to watch in 2026.

Pick your own investments or choose from ready-made options.