Important information - What you do with your pension is an important decision that you might not be able to change. You should check you're making the right decision for your circumstances and that you understand all your options and their risks. The government's free and impartial Pension Wise service can help you and we can offer you financial advice if you’d like it. The information on our website isn’t personal advice.

The best annuity rates from the UK's leading annuity providers

To help you get an idea of what an annuity pays, we compile the best annuity rates available for a £100,000 pension each week and month. Annuity rates change regularly, and quotes are only guaranteed for a limited time, so they could be higher or lower in the future.

The exact income you could receive will depend on the value of your pension, your personal details and the options you choose. Remember, your annuity income is taxable and you normally can't swap your pension for an annuity until age 55 (rising to 57 in 2028).

Make sure you confirm health and lifestyle details when you get a quote as you could be entitled to an enhanced annuity.

This week's best annuity rates (26 February 2026)

Annual income from a £100,000 pension used to buy an annuity

| Annuity type | Age 55 | Age 60 | Age 65 | Age 65 (smoker*) | Age 70 | Age 75 |

| Single life, level, no guarantee | £6,566 | £6,876 | £7,770 | £8,079 | £8,399 | £9,462 |

| Single life, level, 5 year guarantee | £6,438 | £6,852 | £7,713 | £8,031 | £8,291 | £9,222 |

| Single life, RPI, 5 year guarantee | £4,063 | £4,481 | £5,402 | £5,797 | £6,190 | £7,202 |

| Single life, 3% escalation, 5 year guarantee | £4,443 | £4,859 | £5,792 | £6,177 | £6,518 | £7,468 |

| Joint life 50%, level, no guarantee | £6,214 | £6,564 | £7,170 | £7,424 | £7,804 | £8,536 |

| Joint life 50%, 3% escalation, no guarantee | £4,111 | £4,578 | £5,178 | £5,543 | £5,906 | £6,761 |

These quotes were generated on 26 February 2026 using our online annuity quote tool, which compares the rates available from the UK's leading annuity providers. All quotes are based on an average postcode and paid monthly in advance. The joint life quotes assume the spouse is three years younger than the person buying the annuity.

*Smoker annuity based on a 65 year old who has smoked 10 cigarettes a day for the last 20 years and drinks 15 units of alcohol a week.

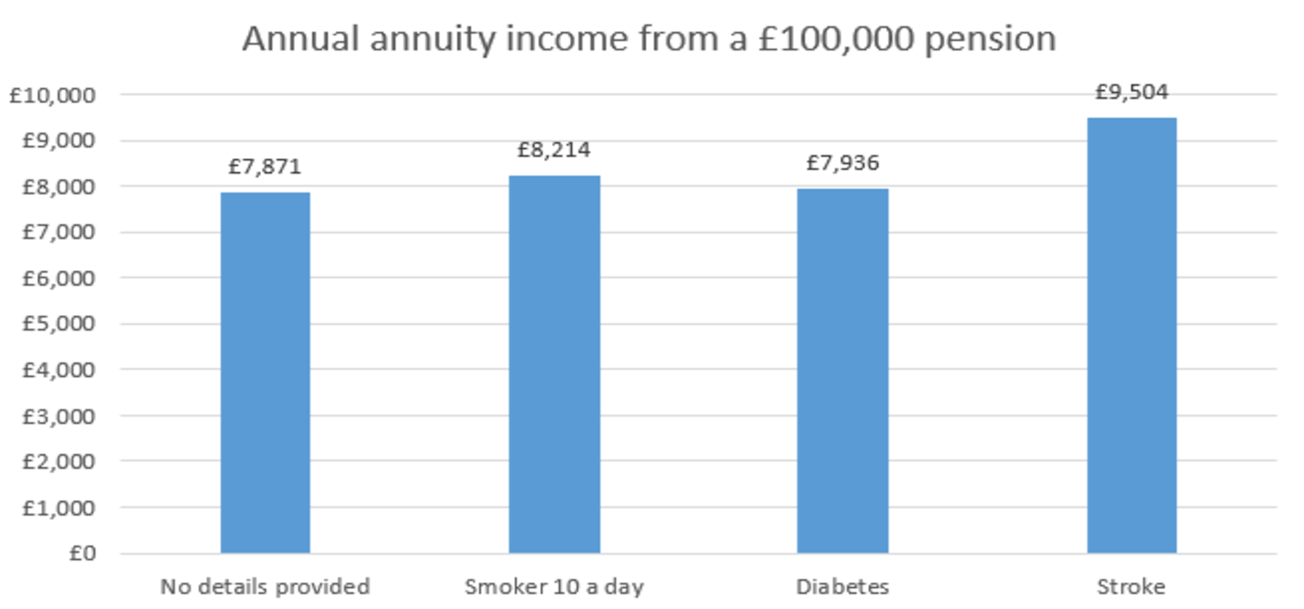

This month's best enhanced annuity rates

Take a look at the chart below to see how much extra income people receive when they confirm health and lifestyle information.

We generated these quotes using our online annuity quote tool on 18 February 2026. All quotes are for a single life annuity, paid monthly in advance, with no escalation or guarantees built in. Quotes are for a married man aged 65 with a wife 3 years younger, who lives in an area which has an average life expectancy. When health details have been added, we've also said they drink 7 units of alcohol a week and have a Body Mass Index of 27. Annuity rates change all the time, so they could be higher or lower in the future.

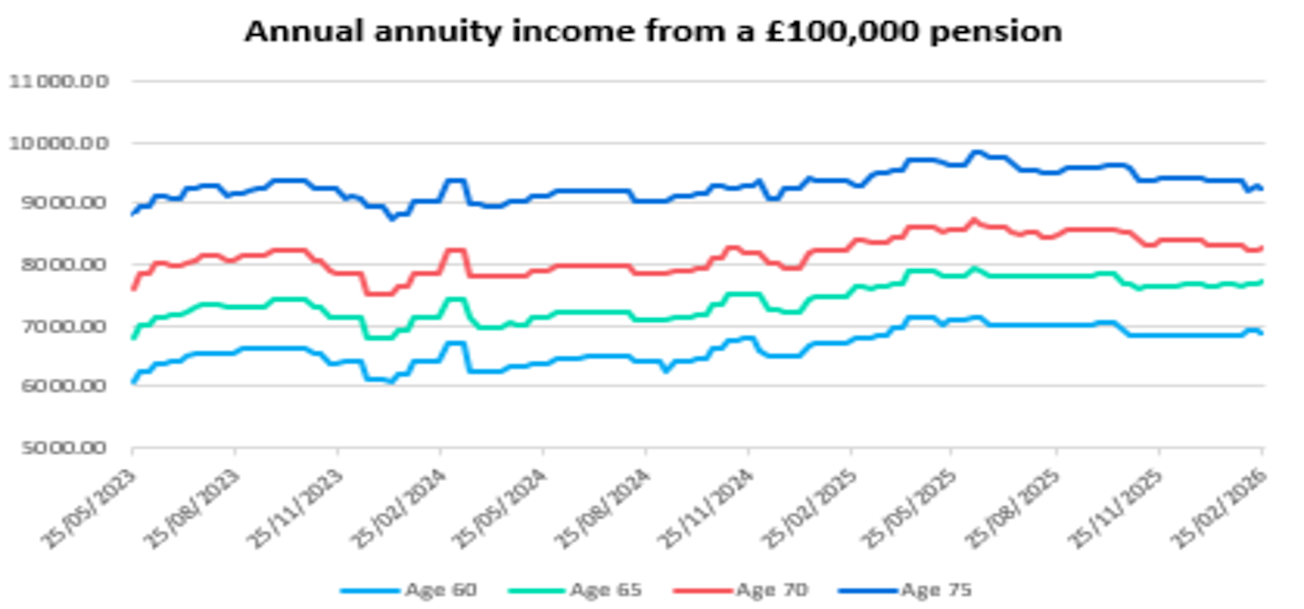

Best annuity rates in the last 3 years by age

We generated these quotes using our online annuity quote tool between 20 April 2023 and 26 February 2026. All the quotes in the graph are based on a £100,000 single life level annuity with a five year guarantee built in, and paid monthly in advance.

Trusted annuity broker for 20+ years

Compare quotes in minutes from the UK's leading providers in one go.

Choose from a range of options tailored to your specific financial goals and retirement plans.

Access dedicated support six days a week, with financial advice available if you need it.

What impacts annuity rates?

Annuity rates change regularly, and they’re calculated based on several factors such as your age and life expectancy, the value of your pension, health and lifestyle, gilt yields and interest rates and the annuity options you choose.

High interest rates positively impact pension annuities and how much secure income you could get. This is because annuity providers typically buy government bonds to generate returns. Rising interest rates push these returns up - so a rise in interest rates should push annuity rates up as a result. There is no way of knowing if interest rates could go up or down in future and therefore the impact it could have on annuity rates.

The potential cost of delay

It might be tempting to put off buying your annuity in the hope that rates rise, but the cost of delaying could be significant. You can estimate the potential costs or benefits of delaying your annuity by using our annuity delay calculator.

Annuity FAQs

Annuities give you a secure income for life that isn’t reliant on the stock market. It could be a wise option if you couldn’t cope with a drop in income or don’t feel confident managing investments.

It’s also worth looking into whether you might qualify for an enhanced annuity if you suffer from a health condition.

If you’re not sure what to do with your pension, you should seek free guidance from Pension Wise about your options. If you’re still unsure, get personal advice.

Yes. Annuities are provided by insurance companies and offer a secure income for the rest of your life. Once set up, the amount you receive won’t normally change unless you’ve opted for an annuity that increases by a certain amount each year.

Providers may offer a short cooling-off period where you can cancel. But after that, once you have purchased an annuity you cannot normally cancel it, change to a different provider or get your money back.

You can choose for your annuity to track inflation. It will move in line with the Retail Price Index (RPI). This means your income will retain its buying power overtime.

If you choose a single life annuity, it will pay you an income for the rest of your life, but it will stop when you die.

A joint life annuity will continue to pay an income to your beneficiary (usually your spouse or partner) if you pass away first.

You can choose for your annuity income to increase each year by a certain percentage. Typically, this is by 3% or 5%, but other options may be available.

A level annuity will pay you the same amount of income each year. This could mean the buying power of your income is reduced over time because of inflation.

Expert support and advice

Guidance from Pension Wise

Pension Wise is a free government service for people getting ready to receive a UK defined contribution pension (this could be a personal or workplace pension).

It offers impartial guidance on pension types, how to access savings, and the tax implications of each option.

Helpdesk support

Our Bristol-based helpdesk are here for you six days a week. Our friendly and knowledgeable team are ready to answer your questions no matter how big or small.

Please contact us or schedule a callback at your convenience.

Advice on your retirement plans

Our financial advisers can help you develop a retirement income strategy, ensuring your investments align with your goals.

They'll advise you on the best time and methods for accessing your pension.