Third quarter revenue rose 1% to €7.5bn (€7.8bn expected). Operating income also rose 1% to €2.5bn (€2.5bn expected) with a margin of 32.8%. New orders of €5.4bn were better than expected.

Free cash flow fell 54% to €244mn and there was net cash on the balance sheet of €2.4bn.

Management expects fourth quarter revenue to land between €9.2-9.8bn and operating income around €3.4bn (analysts had been expecting €9.4bn and €3.2bn respectively). Revenue for 2026 is no longer expected to drop from 2025 levels.

An interim dividend of €1.60 was announced, payable in November.

The shares 3.0% in early trading.

Our view

ASML delivered a decent quarter with strong new bookings and a subtle tweak to guidance helping lift shares on the day. The outlook has improved in the past few months, as the AI buildout continues to gather pace.

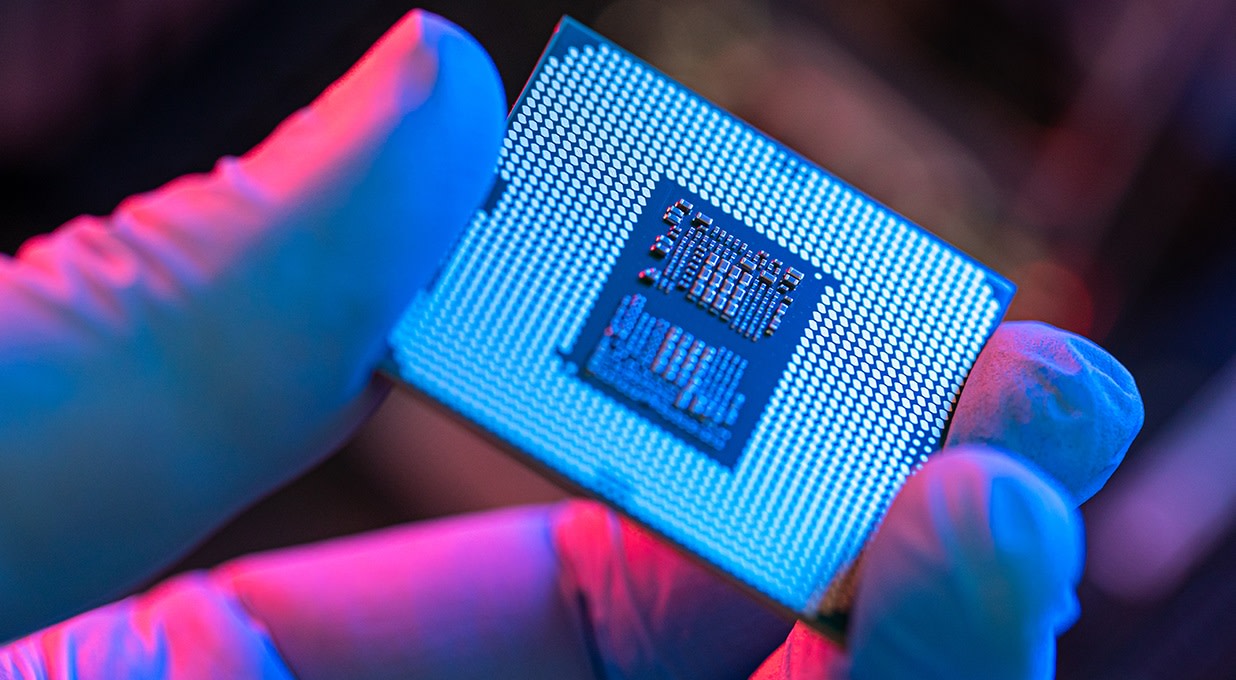

Netherlands-based ASML is the market leader in lithography machines used to make semiconductor chips. Without these, you wouldn't have the chips that power the latest phones, computers and AI data centres. It continues to push the boundaries of the most advanced tech and competitors look a long way off catching up.

Tariffs and broader economic uncertainty remain key challenges, and ASML’s customers have flagged similar concerns. ASML has some exposure to US manufacturing and imports/exports, but it’s relatively insulated to direct tariffs. ASML is far removed from the end consumer but will still feel an impact if spending drops.

Aside from tariff concerns, the market is mixed, with a slow recovery in consumer electronics and the reassessment of investment plans by some key chip manufacturers. Over the longer term, the company is well-placed to benefit from structural growth drivers such as artificial intelligence, increasing data volumes, and the energy transition.

The China story is also key. ASML’s latest tech is largely barred from being sold into China from both US and Dutch restrictions. Older versions have seen strong demand for the past few years but that’s expected to slow significantly in 2026. This is ASML’s largest region by sales, so it needs momentum elsewhere to help offset a decline in China – and it does seem to be getting that.

More broadly, the chip sector has a solid history of investing and innovating for the future, and current technological shifts could significantly accelerate that progress. ASML’s value lies in helping customers achieve higher returns on investment, and its economic moat doesn’t look like it’s under any real threat - but it needs to keep innovating to keep it that way.

ASML’s dominant position and technical expertise allow it to bank a sizeable chunk of revenue into profit. There’s room for profitability to improve further as services and upgrades for the installed base of machines become a bigger part of the business.

Overall, we think ASML's leading market position leaves it well-placed to benefit from long-term growth trends in the chip industry. However, the valuation now looks a little stretched and given the uncertain growth outlook over 2026, we think there are other names in the sector with more attractive return profiles.

Environmental, social and governance (ESG) risk

The semiconductor sector is medium-risk in terms of ESG. Overall, this risk is managed adequately in Europe and North America but has considerable room for improvement in the Asia-Pacific region. Its reliance on highly-specialised workers means labour relations is one of the key risk drivers. Other risks worth monitoring include resource use, business ethics, product governance, and carbon emissions.

According to Sustainalytics, ASML’s management of material ESG issues is strong.

It is targeting net zero emissions across the value chain by 2040 with credible near-term targets in place for direct and indirect emissions. Its manufacturing sites have received an internationally recognised certification, which suggests a strong environmental management system. There’s also a commitment to reducing hazardous waste.

ASML requires a highly skilled workforce and scores well on employee management, with turnover falling from 6% to 3.6% in 2023. Despite its dominant position it has not had any significant antitrust controversies, with its market position protected by innovation and complexity rather than anticompetitive practices.

ASML key facts

All ratios are sourced from LSEG Datastream, based on previous day’s closing values. Please remember yields are variable and not a reliable indicator of future income. Keep in mind key figures shouldn’t be looked at on their own – it’s important to understand the big picture.

This article is original Hargreaves Lansdown content, published by Hargreaves Lansdown. It was correct as at the date of publication, and our views may have changed since then. Unless otherwise stated estimates, including prospective yields, are a consensus of analyst forecasts provided by LSEG. These estimates are not a reliable indicator of future performance. Yields are variable and not guaranteed. Investments rise and fall in value so investors could make a loss.

This article is not advice or a recommendation to buy, sell or hold any investment. No view is given on the present or future value or price of any investment, and investors should form their own view on any proposed investment.