Diversification

How variety can pay over the long term

Important information - This page is designed as guidance, not personal advice. Learn more about the differences between the two. If you’re still not sure what’s right for you, you should ask for advice. All investments and any income they produce can fall as well as rise in value so you could get back less than you invest, especially over the short term. Past performance is not a guide to the future.

What is diversification?

At a glance

- Diversification is an investment strategy to manage risk and smooth returns.

- It helps you prepare for stock market ups and down by holding a variety of investments.

- There are different ways to diversify – through geographies, types of investment and sectors.

How different investments help you diversify

At a glance

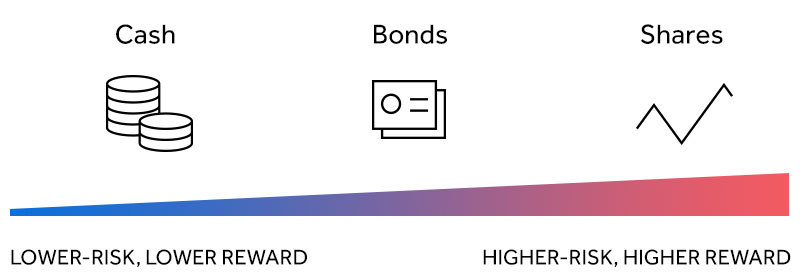

- Choosing different kinds of investments across a range of markets means they rely on different factors to do well.

- Make sure you know the investments you’re picking and how they work, while taking a long-term view.

- Think about different sectors and how they can slot into your portfolio.

Strategies for a diversified portfolio

At a glance

- You can compare your investments against the global stock market to help diversify your portfolio.

- Consider how long you’re investing for. Different goals will need different lengths of time to stay invested.

- There are different types of funds to help you diversify.

3 tips to manage the diversification of your portfolio

At a glance

- Avoid over-diversification by holding too many different investments.

- Know the costs of your investments so you’re not paying more than you need to.

- Review and rebalance your investments once or twice a year.

Investment ideas for each account

If you’re not sure where to get started, our experts have chosen some investment ideas for our different accounts. But remember, it’s not personal advice. All investments can fall as well as rise in value, so you could get back less than you put in. If you’re not sure what to do, seek advice.