Baker Hughes’ fourth-quarter revenue was flat at $7.4bn, beating market expectations by over 4%. Growth of 9% in Industrial & Energy Technology (IET) was driven by demand for gas technology and services. That offset softness in Oilfield Services & Equipment.

Underlying cash profit (EBITDA) was up by 2% to $1.3bn.

Free cash flow leapt from $0.9bn to $1.3bn, driven by timing differences in receipts and payments. Net debt stood at $2.4bn.

At the midpoint of guidance, 2026 revenue is expected to fall slightly to $27.3bn (consensus $28.0bn), with underlying cash profit expected to rise marginally to $4.9bn (consensus: $5.0bn).

The shares were up 3.9% in pre-market trading.

Our view

Baker Hughes’ initial guidance for 2026 reflects a challenging backdrop for oil producers. However, an earnings beat in the fourth quarter of 2025, and signs of a further uplift in demand for Industrial Energy & Technology helped to lift the market mood on the day.

The positive outlook’s reflected by a record order-book for the division, which is well placed to benefit from rapidly expanding requirements for electricity. That’s coming from the electrification of transport, as well as the ongoing rollout of energy-intensive data centres behind the boom in Artificial Energy.

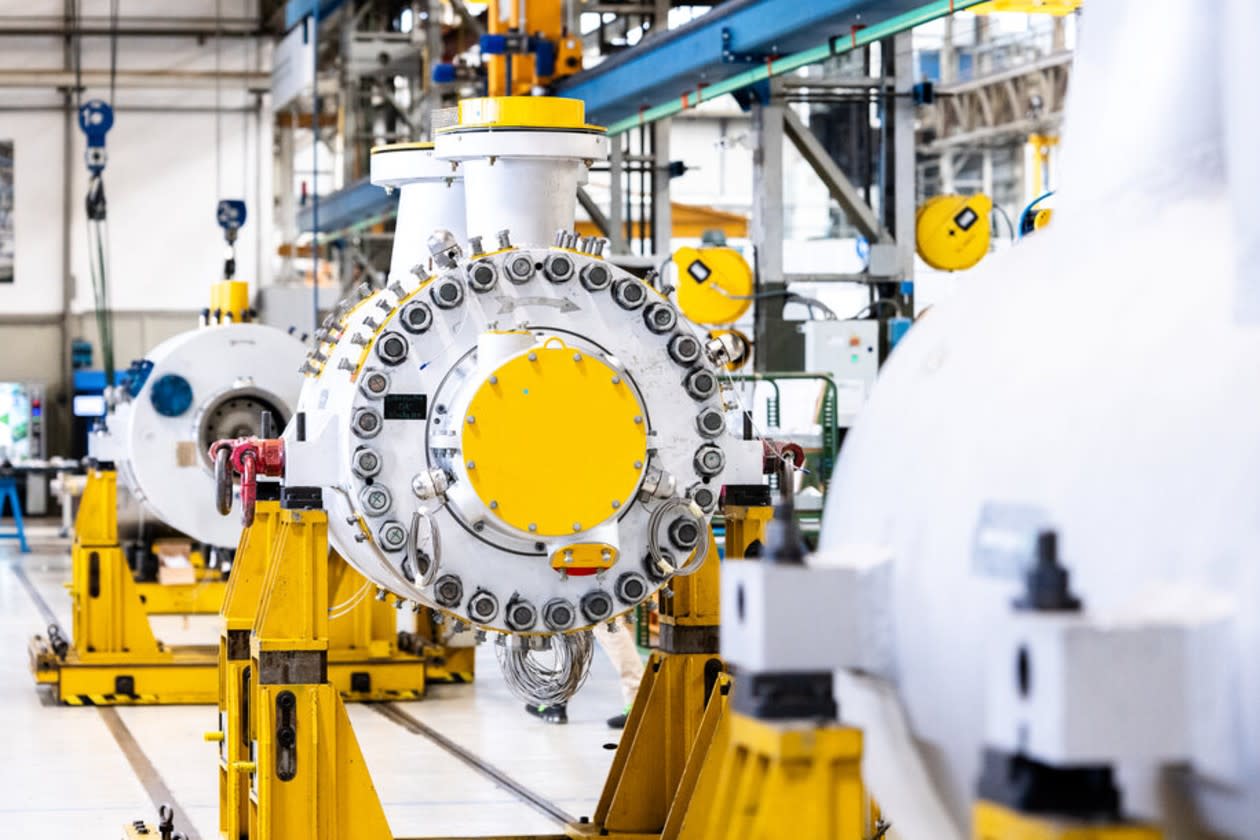

Baker Hughes provides power generation solutions, but it also has a leading position amongst suppliers of equipment that converts natural gas into liquid form (LNG) for storage and transportation. Gas is playing an ever more pivotal role in the global energy mix. The Group’s also seeing fast growth in its climate technology business, albeit from a low base.

We think the energy build-out is likely to have some peaks and troughs, but the group's order book has grown to $36bn. That revenue visibility, as well as continuing improvements in efficiency, can help deal with short-term lulls in commercial activity.

We think the proposed $13.6bn acquisition of Chart Industries, set to complete by mid-2026 is a complementary fit that expands the group’s capabilities in areas of the energy market with attractive growth credentials.

However, challenging conditions in the Oilfield Services & Equipment division are weighing on group performance. Concerns about oversupply of crude oil are riding high, so it may take some time for that part of the business to return to growth. As with all companies in the energy space, geopolitical risk is another key factor to monitor, and one where we currently see a heightened chance of volatility.

The group boasts a robust balance sheet and impressive cash flows. That helps support a prospective dividend yield of 1.8%%. But future shareholder returns can’t be guaranteed, and share buybacks are taking a back seat in order to free up funds for the acquisition of Chart Industries.

Baker Hughes’ attractive business mix is reflected by a valuation towards the top of the peer group. It’s well deserved in our opinion, but that premium has been widening, suggesting that investors are hopeful of more growth to come. The long-term dynamics are positive, and we see scope for upside to guidance as the year goes on. However, it feels like the market may expect the same, meaning there’s little room for any disappointments.

Environmental, social and governance (ESG) risk

The ESG risk to oil and gas service providers runs parallel to those impacting producers. Environmental concerns are the primary driver of ESG risk for this group, with carbon emissions and waste disposal being the main issues. Health and safety, community relations and ethical governance are also contributors to ESG risk.

According to Sustainalytics, Baker Hughes's management of material ESG issues is strong, as are its ESG reporting practices. Based on available evidence, a part of executive remuneration is explicitly linked to sustainability performance targets. Similarly, the environmental policy is very strong. The company also has a strong whistleblower programme in place. It does not appear to be implicated in any significant controversies. It has a stated goal of reducing scope 1 and 2 emissions by 50% by 2030, and an overall reduction in scope 3 by 2033, although emissions from the products it sells, which account for almost all of its emissions have been moving in the wrong direction.

Baker Hughes key facts

All ratios are sourced from LSEG Datastream, based on previous day’s closing values. Please remember yields are variable and not a reliable indicator of future income. Keep in mind key figures shouldn’t be looked at on their own – it’s important to understand the big picture.

This article is original Hargreaves Lansdown content, published by Hargreaves Lansdown. It was correct as at the date of publication, and our views may have changed since then. Unless otherwise stated estimates, including prospective yields, are a consensus of analyst forecasts provided by LSEG. These estimates are not a reliable indicator of future performance. Yields are variable and not guaranteed. Investments rise and fall in value so investors could make a loss.

This article is not advice or a recommendation to buy, sell or hold any investment. No view is given on the present or future value or price of any investment, and investors should form their own view on any proposed investment.