Important information - What you do with your pension is an important decision that you might not be able to change. You should check you're making the right decision for your circumstances and that you understand all your options and their risks. The government's free and impartial Pension Wise service can help you and we can offer you advice if you’d like it. The information on our website isn’t personal advice.

What is an Uncrystallised Funds Pension Lump Sum (UFPLS)?

An UFPLS is a flexible way to take money from your pension. You can withdraw your entire pension in one go, or a bit at a time. An UFPLS withdrawal shouldn’t be confused for a tax-free cash pension lump sum, where the entire payment is tax free.

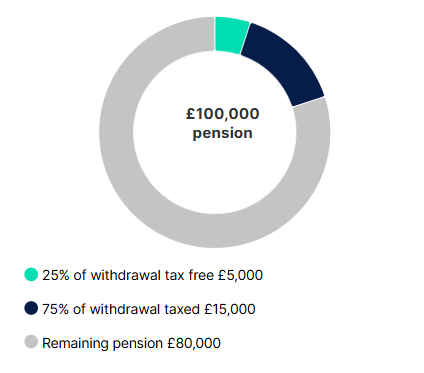

With an UFPLS, usually 25% of each withdrawal will be tax free (up to a maximum of £268,275) and the rest taxed as income. Anything you don’t withdraw stays invested as you choose.

For example, if you had a £100,000 pension and made a £20,000 UFPLS withdrawal, usually £5,000 of that withdrawal would be tax free. The rest (£15,000) would be taxed as income. The remaining £80,000 stays invested as you choose and more lump sums can be taken in future.

Read our Guide to Lump Sums to find out more about the risks and benefits and compare other options like annuities and drawdown.

Remember, pension and tax rules can change, and any benefits depend on your circumstances. It’s not possible to take an UFPLS from defined benefit pensions (such as final salary pensions).

What are the risks of UFPLS?

There’s a risk of withdrawing too much from your pension savings too soon. Unlike some other options (like an annuity, which provides a guaranteed income for life), you’re responsible for making sure your pension lasts as long as you need it to. If your withdrawals aren’t sustainable, you could find yourself short of income later on. Taking large withdrawals could also affect your tax situation.

Unless you decide to withdraw the whole pension in one go, you’re choosing to keep what’s left invested. This means you need to be aware of investment risk and review your choices regularly. Though there’s the potential to grow the value of your pension, you need to be mindful that all investments can fall and rise in value, so it’s possible to get back less than you originally invest. This means lump sum withdrawals won’t be right for everyone.

Does an UFPLS trigger the Money Purchase Annual Allowance (MPAA)?

Once you've flexibly accessed your pension, which includes taking an UFPLS payment, you’ll have triggered the MPAA. This means your annual allowance of £60,000 will be reduced to £10,000 per tax year for future contributions into money purchase pension schemes such as the HL SIPP.

Contributions above the annual allowance, or the MPAA, will be taxed as income.

Lump sums and tax

Your pension provider will organise for any tax to be taken and paid to HMRC before paying out your lump sum. Pension income is usually taxed at your marginal rate, but it’s likely an emergency tax code will be applied to your first UFPLS withdrawal. This will apply to future withdrawals until HMRC send your correct tax code directly to your pension provider.

Remember all taxable pension income is added to any other income you receive in the same tax year, so taking large withdrawals could push you into a higher tax bracket. Tax rules can change, and more or less tax may be taken than you owe, which will need to be resolved with HMRC directly.

Investing the rest of your pension

For lots of people, one of the biggest attractions of keeping a pension invested is the potential for its value to continue growing throughout retirement. But there are no guarantees. Investments carry risk. The value of all investments, including the income they produce, can rise and fall in value so you could get back less than you invest. Your financial goals and plans for making withdrawals are likely to have an impact on what pension investments you choose.

In the HL Self-Invested Personal Pension (SIPP), you can choose from over 3,000 funds, shares, investment trusts and more to build your own portfolio. You’re in control of what you buy and sell. You can also pick from ready-made portfolios or pay an adviser to choose investments for you.

How much does a pension lump sum cost?

Not all pension providers offer lump sums, and those that do may have set up and withdrawal charges as well as annual management and investment fees. Check this first before transferring or applying, and make sure you won’t give up any valuable benefits in the process.

In the HL Self-Invested Personal Pension (SIPP), there is no set up, transfer or withdrawal charge. Our yearly charge for holding investments is never more than 0.35%. Some investments will have their own annual charges, so please check these first before you invest.

Dealing charges depend on the type of investment and how often you trade.

What happens when you die

If you die before 75, anything left in your pension can be paid to your beneficiaries, tax free in most cases. If you die at or after 75 anything paid out will be taxed as your beneficiary's income. It is worth noting that, from April 2027, the government is proposing that most pensions will form part of someone’s estate and so could be subject to inheritance tax.

How to apply

Usually, you need to be at least 55 (rising to 57 from 2028) to make a lump sum withdrawal. You can apply to do this with your current pension provider, if they offer it, or transfer to a different provider of your choice, like Hargreaves Lansdown.

Before you apply, make sure you fully understand all your options. If you’re not sure what’s right for your situation, we suggest you seek free guidance from Pension Wise or contact us for personal advice.

1. Get your personal illustration

Your UFPLS illustration will show how charges and different growth rates could affect what’s left in your pension over time. It’ll also give you an idea of when your money might run out (or what might be left over). Even if you’re just researching your options, this is a good first step.

2. Complete a risk questionnaire

If you’re happy with your UFPLS illustration, and you’re confident you understand the risks, call us on 0117 980 9926 to complete a risk questionnaire. You can also return your risk questions by post.

3. Complete and return your application

Once we have your completed risk questions, we can send your application (which you can use to transfer your pension at the same time, if that’s what you plan on doing). We can send your application in the post, or by email.

Why choose HL?

Invest where and how you want to - You can pick your own investments, select one of our ready-made portfolios, or pay a financial adviser to choose investments for you.

24-hour online access - Monitor your account around the clock and place investment instructions with a click, or the swipe of a finger on our mobile app.

Great value for money - Free research, the latest investment news, tools and insight from our team of experts.

Award winning - We've won over 200 awards, including Best Buy Pension 2025 from the Boring Money Awards.

Peace of mind that you’re in safe hands - We're the UK’s no.1 platform for investments and savings, trusted by over 1.9 million clients and regulated by the FCA. We take account security seriously.

Support on hand when you need it - Get ongoing support from our UK-based helpdesk and the answers to your pension questions no matter how big or small.

Guidance, help and advice

Guidance from Pension Wise

Pension Wise is a free, impartial government service for anyone aged 50 or over, with a UK based personal or workplace pension.

It can help you understand what type of pension you have, how you can access your savings and the potential tax implications of each option. But it isn’t financial advice.

Have a question?

Our UK-based helpdesk are here for you six days a week. Our friendly and knowledgeable team are ready to answer your questions no matter how big or small.

Call us on 0117 980 9926.

Opening hours

Monday - Friday: 8am - 5pm

Saturday: 9.30am - 12.30pm

Alternatively, you can email us.

Retirement advice from HL

Not sure if an UFPLS is right for you? Our financial advisers can give advice on your pension options and work with you to:

Feel confident about when and how to take your pension

Match all your investments to your personal goals and income strategy

Help you plan for later life and Inheritance Tax