Investing in funds

Find out what funds are and how to invest

Important information - Our service is designed for investors who want to make their own investment decisions without personal advice. If you are unsure of the suitability of an investment for your circumstances please contact us for investment advice. Investments will fall as well as rise in value so you could get back less than you invest. Tax rules can change and benefits depend on individual circumstances. Once held in a pension money is not usually accessible until age 55 (57 from 2028).

What is a fund?

A fund is an investment that pools together money from lots of individuals. The fund manager then invests the money in a wide range of assets e.g. UK shares, overseas shares, bonds etc. Each investor is issued units, which represent a portion of the holdings of a fund.

Different funds specialise in different sectors - for example, if you're interested in Europe you could invest in a fund that focuses on Europe.

Example

fund

Example

fund

Why invest in funds?

Fund managers choose and manage underlying investments

Benefit from the expertise, knowledge and time spent by the fund manager and their team researching and picking the best opportunities in a chosen sector.

With an active fund, a fund manager uses their skill to try and do better than a benchmark to fit an investment goal. Passive funds try to closely track the performance of a stated index, so are also known as tracker funds.

Diversifying

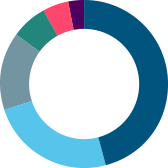

Investing in funds means your money is spread across multiple assets. As some investments will perform better and some worse over time, diversifying will, in theory, help spread the risk and smooth returns over time.

Investing for the long term

We always recommend investing for at least 5 years - you have a better chance of riding out short-term volatility and benefitting from greater returns.

Want to get started by don't know how?

Let us ask you a few questions and we'll help you find the right approach

Investment advice from HL

If you don’t want to choose investments yourself, an adviser could save you time and effort by building an investment portfolio for you.

A financial adviser can:

- Pick investments that are suitable for your goals

- Create a well-balanced and diversified portfolio

- Make sure your portfolio is cost and tax-efficient

If you’d like a professional to make your investment decisions for you, you can choose a financial adviser to help.

Investment advice from HL

If you don’t want to choose investments yourself, an adviser could save you time and effort by building an investment portfolio for you.

A financial adviser can:

- Pick investments that are suitable for your goals

- Create a well-balanced and diversified portfolio

- Make sure your portfolio is cost and tax-efficient

If you’d like a professional to make your investment decisions for you, you can choose a financial adviser to help.

Why hold funds with Hargreaves Lansdown?

-

Choose from over 3,000 funds

Whether you're an experienced investor, just starting or want to leave it to an expert, you'll be able to find the right funds, with over 3,000 funds to choose from.

-

Expert fund research

Our experienced research team's knowledge and insight is available to you with regular research updates. Sign up to alerts to keep you up-to-date with the latest insight.

-

No charge to buy or sell funds

Most fund trades cost absolutely nothing and are usually confirmed by the next working day. We also have an automated low-cost income reinvestment service.

-

Invest from £100 or just £25 per month

Pay in on a monthly basis from £25 a month. You can choose to invest in funds, FTSE 350 shares or eligible investment trusts, or hold the money as cash until you choose what to do with it.