HL SELECT UK GROWTH SHARES

Stock market surprise offers opportunity to invest

Managers' thoughts

HL SELECT UK GROWTH SHARES

Managers' thoughts

Steve Clayton - Fund Manager

27 March 2017

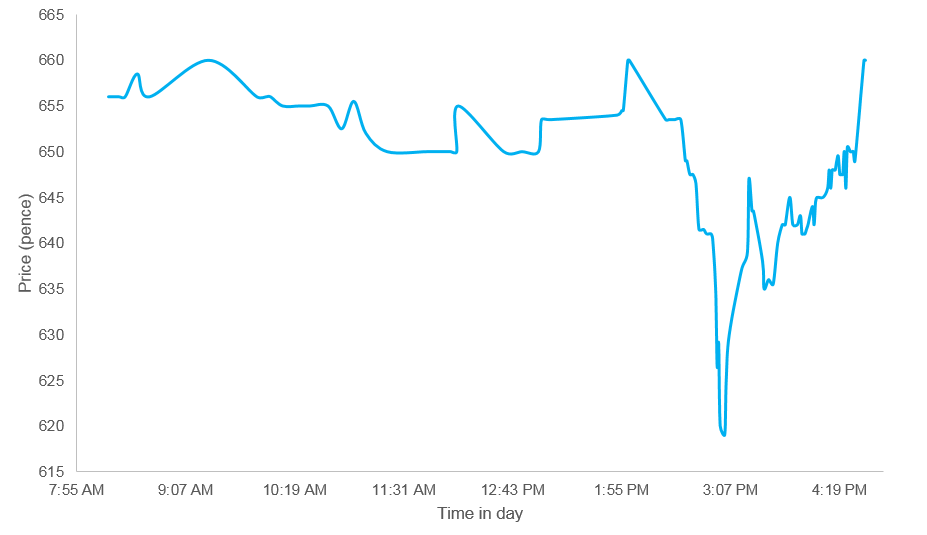

It’s been fairly quiet in the portfolio with only a few companies reporting but recently we were able to take advantage of one of the stock market’s occasional funny turns to add to our position in Sanne Group, a fund administration business that we have high hopes for. Sanne is not the most frequently traded stock and we were rather surprised one afternoon to see its share price suddenly tumble like a stone. In a matter of a few minutes, the price dived from 655p to as little as 620p, with no news appearing on the screens to justify the move.

Source: Bloomberg 17/03/2017 – this is a snapshot of Sanne’s price movements on the day described above.

Our dealer, Lennie, quickly made some calls and came back with the news that Sanne was being promoted from the Small Cap to the Mid Cap index, and there was a fund out there with a mandate that said it should not hold Mid Cap stocks and so was looking to sell its position. We don’t care whether a stock is a member of one index or another, just whether the business is worth investing in. So we quickly gave Lennie orders to buy and he was able to find 300,000 shares for the fund at 636p, before the price quickly bounced back. Please remember, past performance is not a guide to the future.

Normally, we try to be purposefully long term in the way we think and act. But in an instance like this, when opportunity knocks, it’s silly not to take advantage. We’re waiting on news as to how their recent acquisitions have performed before deciding how far we ultimately take this position, with our exposure now at 2.9% of the fund.

Close Brothers (which is also held by our sister fund, the HL Select UK Income Shares) put out a pretty decent set of interim results, covering the half year to the end of January. Profits were up 21% and the dividend rose by 5% (variable and not a reliable indicator of future income). All divisions contributed, with the Winterflood market-making arm more than doubling its profit, whilst Banking and Asset Management delivered perfectly respectable, if unspectacular gains of their own.

The dividend increase is far behind the profit increase for the simple reason that Winterflood is a volatile business, and so the dividend is driven more by the banking division’s progress. The attractions of Close Brothers remain unchanged; the core bank lends warily at strong margins, which protects returns during downturns. Winterflood is a business that on average, earns a good return on capital, but market-making is volatile. Whilst Asset Management is another high returning activity within the group, even if it is far outweighed by the scale of the banking division.

Close Brothers has an excellent record of delivery over many years with profits having steadily quadrupled over the last twenty-odd years and dividends having climbed steadily throughout. The business remained profitable right through the financial crisis, albeit at much reduced levels. It rarely hits the headlines, and like any bank, it’s not immune to recession, but people who’ve owned it for a fair while are likely to be found smiling.

Burford Capital is the fund’s strongest performer so far. We first bought stock at 460p on day 1 of the fund’s life, following up at 465p shortly thereafter. Today they are nudging through 800p. Please remember that past performance is not a guide to the future. Newsflow has been plentiful, with a major acquisition, news of a core case being valued at a big premium by investors and now 2016 results that were strongly ahead.

As a reminder, Burford funds other people’s litigation. Corporate lawsuits, not your neighbour’s PPI claim. Burford don’t fight the cases themselves, they fund the client’s legal expenses in return for a pre-agreed share of the proceeds. The results showed income up 59% and profit after tax up 75% with margins of 76% and a return on equity of 21%.

All looks good, although given that commercial law suits depend on either the parties agreeing to settle, or a judge ruling in your favour, looking good is not necessarily the same as actually turning out good in future. But what does encourage us hugely is that Burford have so far demonstrated great consistency in achieving strong returns from year to year. Also, with the company having financed a rising number of cases in the last year or two, there is a lot of capital tied up in cases that have yet to settle and where no return has yet been recognised. As those cases do mature and hopefully go Burford’s way, there is scope for returns to accelerate further.

More about HL Select UK Shares

Please read the Key Investor Information Document before you invest.

Important information: Investments can go down in value as well as up, so you might get back less than you invest. If you are unsure of the suitability of any investment for your circumstances please contact us for advice. Once held in a SIPP money is not usually accessible until age 55 (rising to 57 in 2028).

The maximum you can invest into an ISA in this tax year 2025/2026 is £20,000. Tax rules can change and the value of any benefits depends on individual circumstances.

Invest in an ISAYou can place a deal online now or top up an existing account first, using your debit card.