Junior SIPP charges

Annual account charges

The HL Junior SIPP is free to set up and low-cost to run. Our yearly charge for holding investments is never more than 0.45%. There's no charge for inactivity or for holding cash.

You can see the interest rates paid on any cash held in a Junior SIPP here.

Shares

0.45%

capped at £200 per year

Including UK and overseas shares, investment trusts, exchange-traded funds, VCTs, gilts and bonds.

Funds

| Value of funds (tiered) | Charge |

|---|---|

| On the first £250,000 | 0.45% |

| On the value between £250,000 - £1m | 0.25% |

| On the value between £1m - £2m | 0.1% |

| On the value over £2m | No charge |

What you pay is based on the value of your investments. Fund charges are calculated in bands: 0.45% each year on the first £250,000 of funds, 0.25% each year on the value of funds between £250,000 and £1m, 0.1% each year for funds between £1m and £2m, and no charge on the value of funds over £2m.

Important note about charges

The investments you choose may have their own charges, such as charges from a fund manager. These are in addition to our account charges. You can find these in each investment's key investor information. A bid/offer spread may also apply - see our Guide to Fund Prices for details.

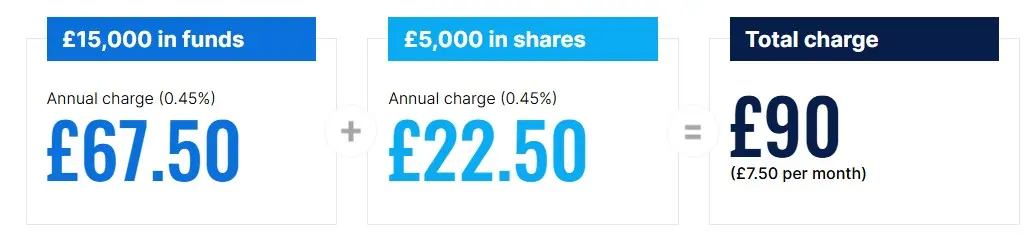

Example of HL account charges

If you invest £15,000 in funds and £5,000 in shares, your account charge would be £7.50 per month*.

*The monthly charge will depend on the exact value of your account each month. To keep things simple here, we didn't include any investment growth.

Dealing charges

Dealing charges are what you pay each time you buy or sell an investment.

Fund dealing

Includes unit trusts and open-ended investment companies (OEICs).

There’s no dealing charge for buying or selling funds.

Share dealing – online and mobile app

Just £5.95 per deal including UK and overseas shares*, investment trusts, exchange-traded funds, gilts and bonds.

*There's an added foreign exchange charge for overseas share deals, depending on deal size. See our overseas share dealing page for details.

Automatic reinvestment

If you’d like any share income automatically reinvested, we’ll reinvest your income when it reaches £10 per holding or the amount you choose. There’s no charge for this.

Other charges

| UK Stamp Duty Reserve Tax and Stamp Duty | 0.5% on purchases of UK shares. For shares that can't settle electronically, rounded up to the nearest £5 (for purchases worth more than £1,000) |

| PTM (Panel on Takeover and Mergers) | £1.50 on UK share deals over £10,000 |

| Irish Stamp Duty | 1% on purchases of Irish shares |

| French Financial Transactions Tax | 0.3% on purchases of certain French shares |

| Spanish Financial Transactions Tax | 0.2% on purchases of certain Spanish shares |

| Italian Financial Transactions Tax | 0.1% on purchases of certain Italian shares |

1% of the trade value, minimum charge £20, maximum £50.

You can set up a Direct Debit from £25 per month. There's no charge for a Direct Debit into funds, shares and selected investment trusts and exchange-traded funds (ETFs).

Made in addition to the charges above, where applicable.

Account closure fee - No charge

Automated sales to cover charges (selling fund units or shares to cover fees) - No charge

Quarterly statement and valuation (paperless) - No charge

Quarterly statement and valuation (paper) - No charge

Transfer out (as cash) - No charge.

Transfer out (as stock) - No charge.

Other charges may apply in specific circumstances - see the terms and conditions for details.

Charges FAQs

How are charges paid?

There's no need to remember to make any payments – we'll automatically take our charges each month. You'll need to keep cash in your account to pay any charges – there is a suggested minimum cash balance based on the size of your child's Junior SIPP, but you can hold as much cash as you like.

What happens if there's not enough cash to pay charges?

If you have fully contributed to your child's Junior SIPP and there is not enough cash to cover the outstanding charges, you can make a debit card payment directly into the Loyalty Bonus Account by calling our helpdesk on 0117 980 9897.

After that, and as a final resort, we’d sell holdings in your child's Junior SIPP to cover any charges and restore the suggested minimum cash balance. There is no additional charge for this. We will normally sell units of your largest fund holding first.

Important information

The charges above don’t include the cost of any advice you might need. If you need financial advice, our adviser would agree this cost with you separately.

We've won over 200 awards for our services

Best Buy Pension 5 years running

- Boring Money Best Buys 2025

Best for Customer Service

- Boring Money Best Buys 2025

Best UK Pension Provider

- Investing in the Web's Global Broker Awards 2024

Help and support

Take a look at our most frequently asked questions for quick answers.

If you need more assistance or have specific questions, please contact us.