Our aim is to help you make the most of your money

Our free expert guides and interactive calculators will help you make your own informed decisions.Investment and retirement guides

Investment guides

Beginner's guides

Pensions & retirement

- Self-Invested Personal Pensions

- Your Options at Retirement

- Guide to Drawdown

- Annuity guide

- Guide to Pensions for Business Owners

- Guide to Pension Tax Relief

- 10 Costly Pension Mistakes

- Guide to flexible pension income: Drawdown vs lump sums

- What Happens to Your Pension When You Die Factsheet

- How to Save Tax in Retirement Guide

- Lifetime Allowance Factsheet

International payments

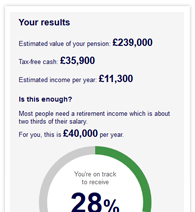

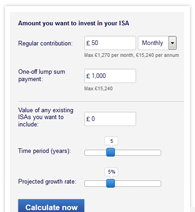

Tools and calculators - helping you plan for your future

-

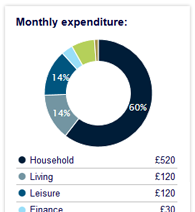

Household budget planner

Calculate your income against your expenditure to work out the difference.

Calculate expenditure

-

-

Inflation calculator

How inflation affects the real value of your savings and their growth rate.

Calculate inflation

New to investing?

Watch our videos to get to grips with the basics, and see how to get started.

Download a Guide to investing in the stock market to learn more.